Infrastructure Financing through Islamic

Finance in the Islamic Countries

145

The Five-Year Program for Economic Reform (2015-2019) includes strategies for the

development of PPP arrangements in different sectors. The Program’s purpose is to expand

production and exports; and to increase living standards, giving an essential role to the private

sector. Total private sector investments as per the program are expected to account for 83.4%

of total investment requirements. The Program has identified different socioeconomic pillars,

and among them are infrastructure development and the PPP framework (GPFEDC, 2016).

4.5.4.

Legal and Regulatory Framework for Infrastructure Investments

The Sudan Land Settlement and Registration Act 1925 (LSRA 1925) set up a land registry and

outlines the terms of the acquisition of privately or publicly owned land. Based on this law,

land can be leased devoid of any limitations on the leasing value and the maturity of the leasing

contract (ALN, 2015). Based on the LSRA 1925, foreign investors are allowed to get lands

through the National Investment Authority (NIA) for their investment project or through

approval by the Council of Ministers (UN, 2015). The Investment Encouragement Law 2013

makes state governments liable for confining, registering, planning, mapping, and issuing

information defining the existing lands for agricultural, industrial and service projects.

Since the government plays a key role in the development of the infrastructure in Sudan, the

legal framework for private sector participation has not developed. Although there is no

codified Public Private Partnership (PPP) law, there have been a few infrastructure projects

that have been implemented using PPP. Examples of infrastructure projects structured as PPP

are shown in Table 4.5.3. Three projects, namely the Juba Port Franchise, Omdurman Water

Treatment Plant and Kanartel were initiated in the 2000s with investments worth USD 310

million (PPPLRC, 2017).

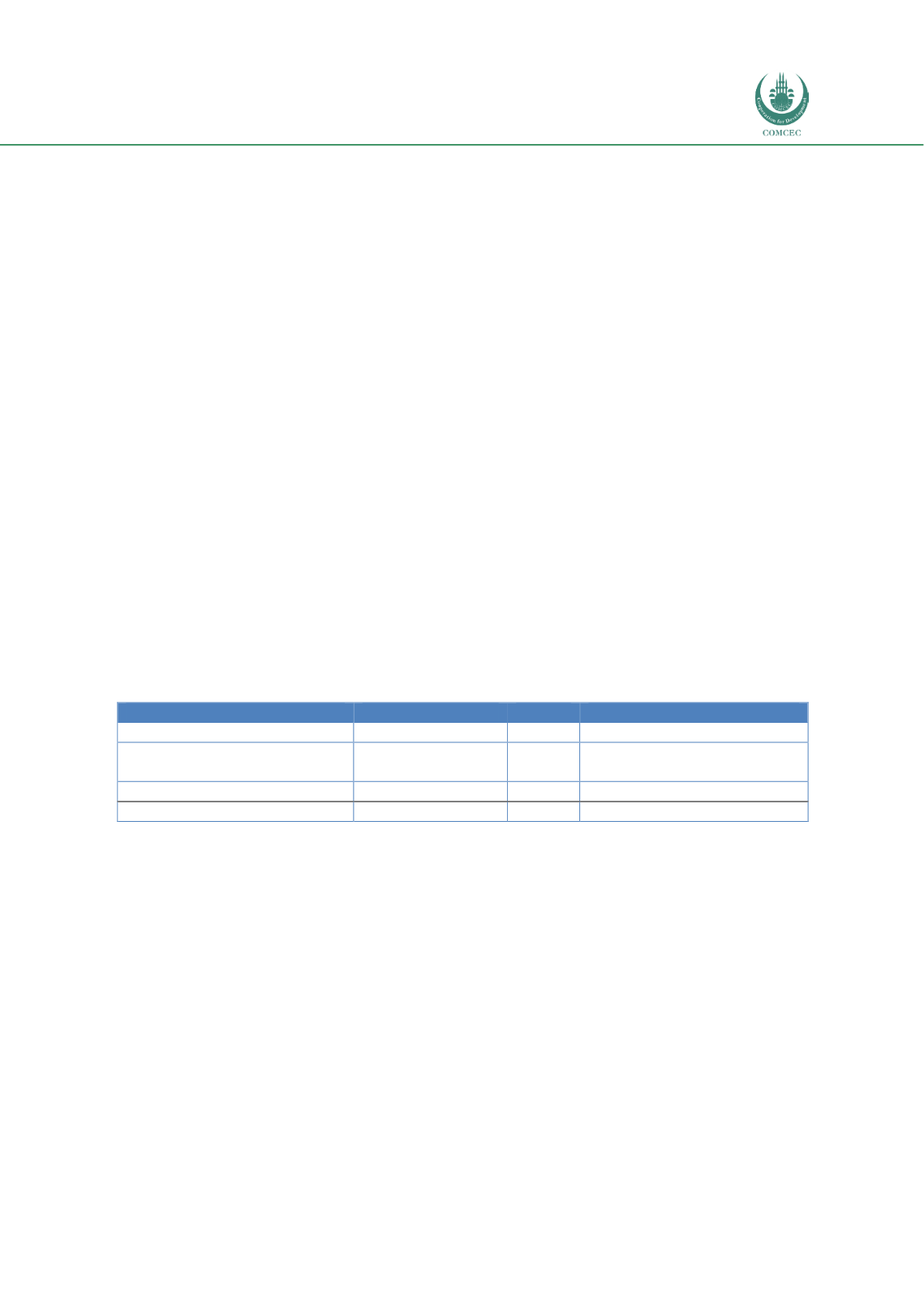

Table 4.5. 2: PPP Projects in Infrastructure

Project Name

Sector

Year

Investment (USD million)

Kanartel

ICT

2004

159.00

Omdurman Water Treatment

Plant

Water and

sewerage

2007

120.70

Juba port concessionPorts

2006

30.0

Total

309.70

Source: World Bank (2018), available at

https://pppknowledgelab.org/countries/sudanSudan has recently formed a PPP unit (World Bank 2018) and has launched its first PPP

initiative with the World Bank in January 2017. A grant from the Public-Private Infrastructure

Advisory Facility (PPIAF) will be used for the PPP Support Program to reinforce the policy and

regulatory environment and framework for PPPs in Sudan (World Bank 2017).

The status of the procurement regime in Sudan relative to other income groupings and the

Sub-Saharan African region is shown in Chart 4.5.3. The chart shows that Sudan has an overall

weak procurement regime with all stages of preparation, procurement and contract

management even when compared to low income groups and the Sub-Saharan region. Since

the stage of preparation is the most important part of any procurement process, a low score of

17 is indicative of the weakest part that can prevent the initiation of infrastructure projects.

The scores of all the stages of the procurement regime in Sudan are lower than the averages of

OIC member countries.