Infrastructure Financing through Islamic

Finance in the Islamic Countries

148

4.5.5.2.

Islamic Financial Institutions

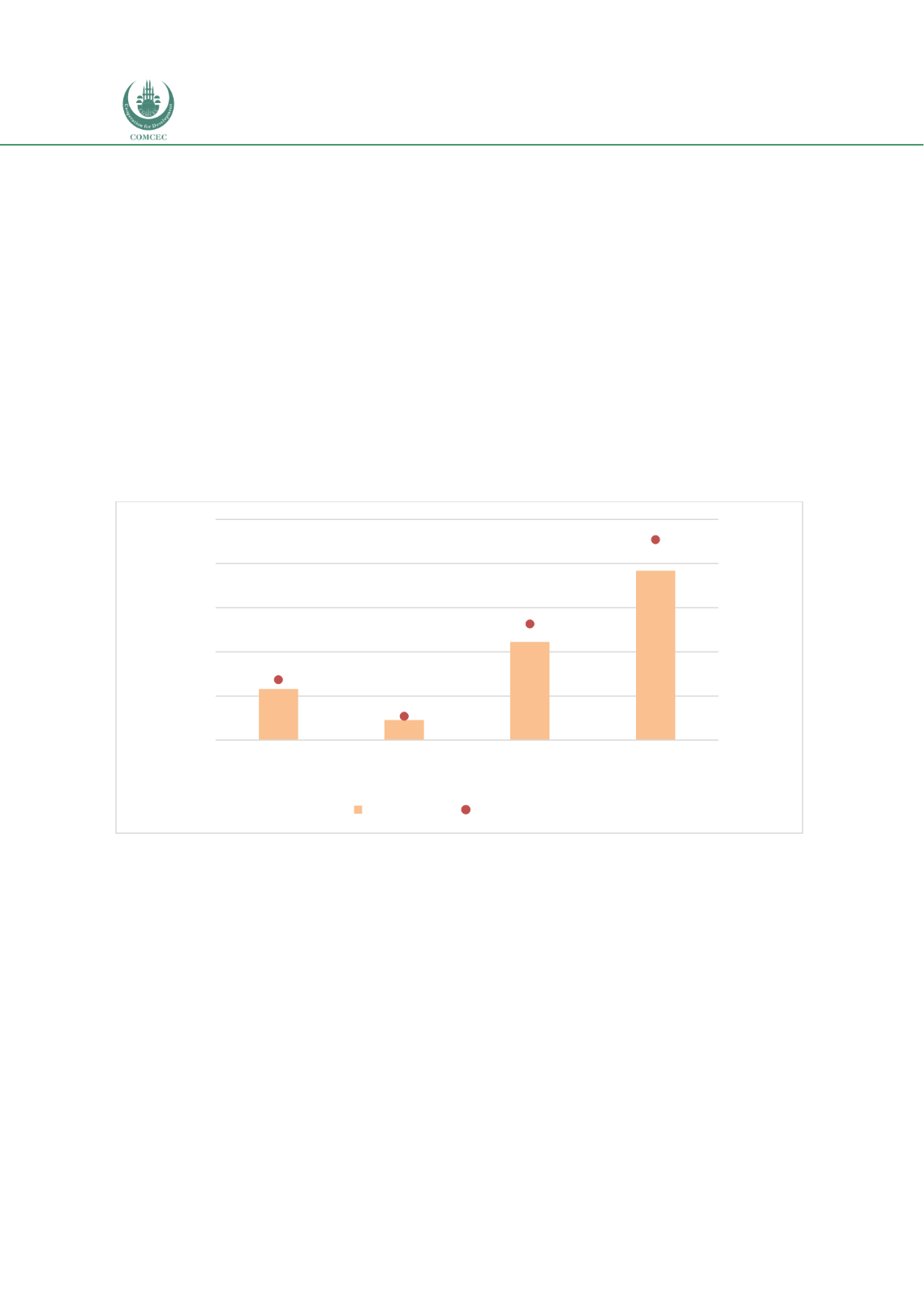

Chart 4.5.4 shows the banks’ direct and indirect financing for the infrastructure sector in

Sudan. Out of a total assets of SDG 211.246 billion, an investment of SDG 5.795 billion (2.7% of

the total) was made in the transportation and storage sector and an SDG 2.279 (1.1% of the

total) investment was made in the mining and energy sector. The banks held government

sukuk and GICs worth SDG 11.126 billion, constituting 5.3% of total banking assets. The issuer

of government sukuk and GICs, the Sudan Financial Services Company (SFSC), claims that the

funds raised are invested in infrastructure and development project financing such as health

projects, hostel construction, river transportation, railways, and other infrastructure projects

in Sudan's regional States (SFSC, 2018). Thus, the bulk of the banks’ infrastructure funding is

done indirectly through sukuk and GICs, which represent 58% of the total bank infrastructure

financing. It should be noted that while the direct financing by banks in the infrastructure

sector is illiquid, the indirect financing through sukuk and GICs makes the investments liquid

since these instruments can be sold on the stock exchange.

Chart 4.5. 4: Bank Infrastructure Financing: Sudan (2017) (SDG million)

Source: CBOS Annual Reports (2017)

The direct investments in the infrastructure sector by Sudanese banks in Q1 2018 are shown

in Table 4.5.3. The results in the table confirm those reported in Chart 4.5.4, showing that only

3.59% of the total assets are invested in the infrastructure sector.

5,785.3

2,279.9

11,126.1

19,191.3

2.7%

1.1%

5.3%

9.1%

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

0

5,000

10,000

15,000

20,000

25,000

Transportation &

Storage

Mining & Energy

Sukuk & GICs Total Infrastructure

Financing

% of total assets

SDG (Million)

SDG (million)

% of total assets