Infrastructure Financing through Islamic

Finance in the Islamic Countries

152

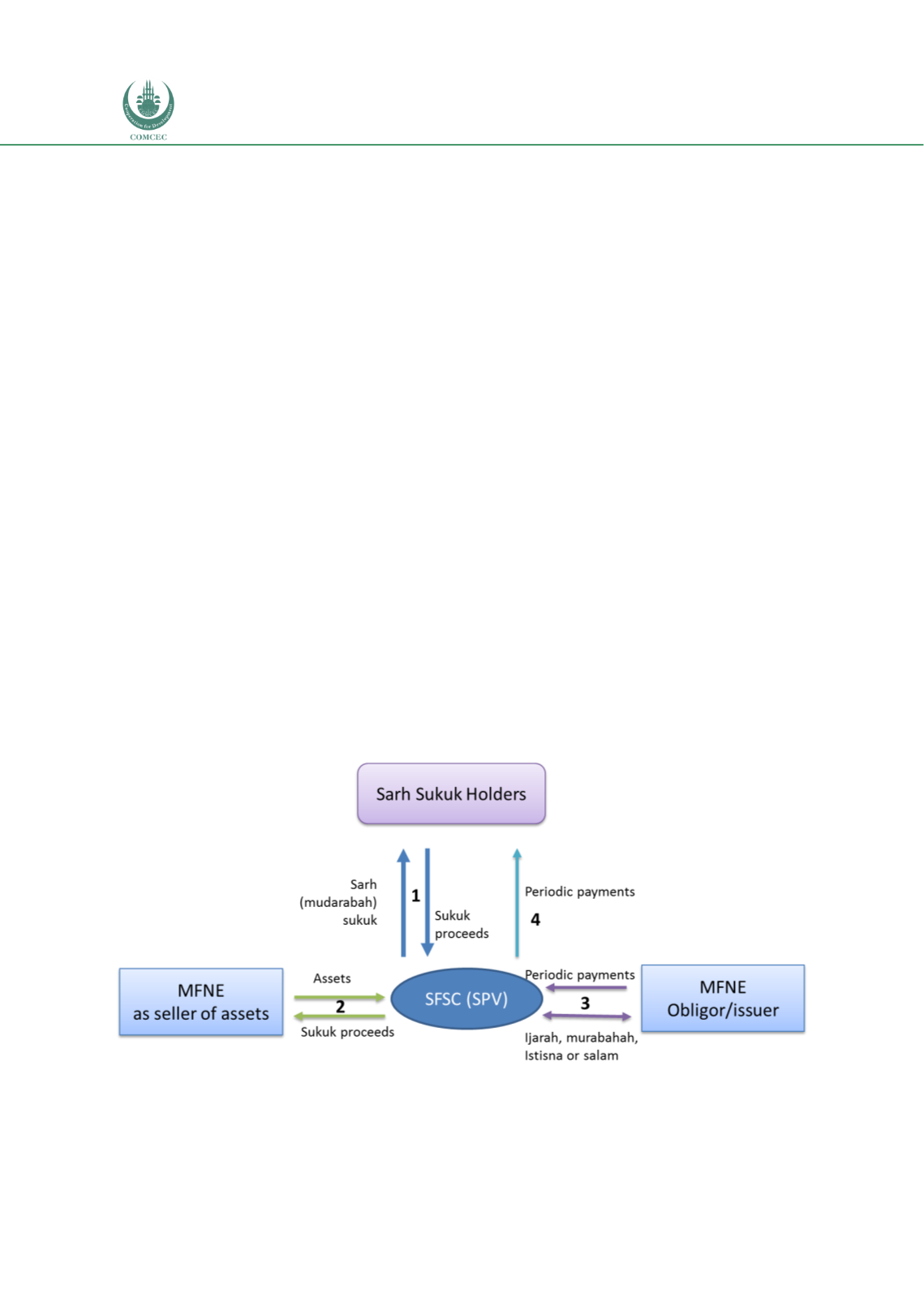

Case Study: The Government Investment Sukuk (GISs) Sarh

The Government Investment Sukuk (Sarh) is a Shari'ah-based financial instrument issued by

the Ministry of Finance and National Economy (MFNE) on behalf of the Sudan Government. It

is managed and marketed on the KSE through the SFSC. The proceeds of these Sukuk are used

for financing the infrastructure of the various states of Sudan. The main objectives of Sarh are

to gather national and regional savings, encourage investment, manage liquidity at the

macroeconomic level across open market operations, develop the local capital markets,

employ savings in the development and infrastructure projects, and reduce inflationary effects

by providing financing to the state government supported by real assets (Yousif, 2015).

The Sarh Sukuk structure comprises three parties: Sukuk holders (investors), SFSC (

mudarib

),

and the MFNE (applicant of finance). Sarh represents real assets under various contracts

(ijarah, murabahah, istisna, and salam). The relationship between sukuk holders and SFSC is

based on mudarabah contract where the investors are rab al-mal and SFSC is the mudarib. The

contract between the Ministry and the SFSC is based on various legal contracts identified in

Chart 4.5.9. The profit of the invested funds is determined by the total returns of the

investment contracts and the profit shares of the mudarabah contract distributed every three

months based on a share of 92% going to the rab al-mal (the investor) and 8% to the mudarib

(SFSC). Sarh can be easily liquidated on the KSE and is considered by banks to be a liquid

security (Yousif, 2015).

In 2017, 8.1 million Sarh Sukuk were sold on the KSE with total value

of

SDG 819.5 million compared to 9.2 million Sukuk with a total value of SDG 8.2 million in

2016 (CBOS, 2017).

Out of the 14,314 million actual deficit in the government budget in 2017, Sarh financed SDG

163 million, representing only a 1.13% contribution percentage compared to 2% in 2016 with

a total amount of SDG 206 million out of the net actual budget deficit of (SDG 10,918 million)

(CBOS, 2017).

Chart 4.5. 9: Structure of the Government Investment Sukuk (GISs) Sarh

Source: Authors own.