Infrastructure Financing through Islamic

Finance in the Islamic Countries

155

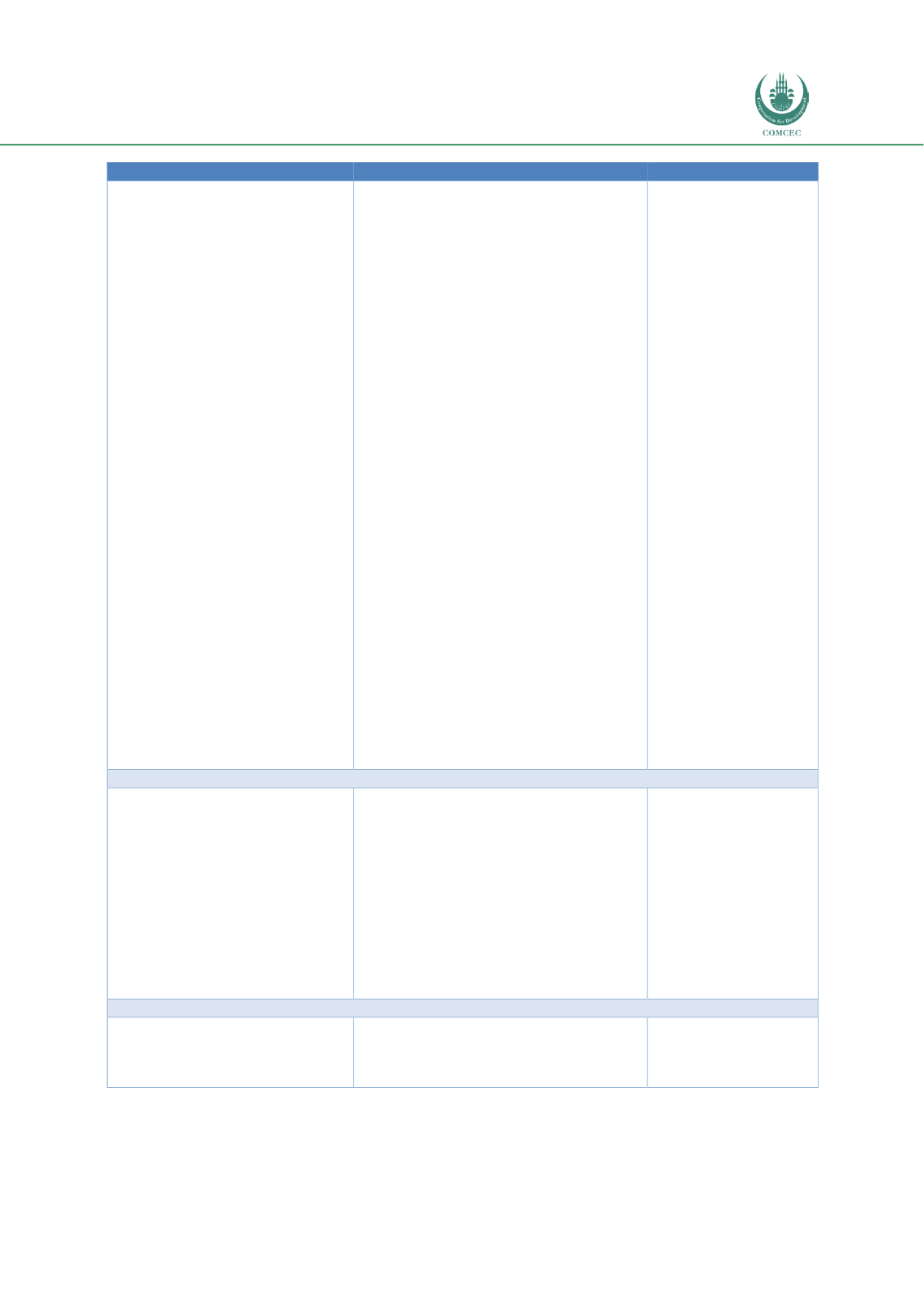

Issues

Recommendations

Implemented by

these accounts bear the risks of

the investments and Islamic banks

are not required to hold much

capital for investments made from

these accounts.

While Sudan has a cooperative

framework in the form of the

Liquidity Management Fund from

which banks can access liquidity

in case they need it (COMCEC

2016), a well-functioning money

market is lacking.

Although the balance sheet

structures of nonbank institutions

such as insurance companies are

more compatible for investments

in long-term projects, the takaful

industry in Sudan parks a large

percentage of its assets in banks.

The overall nonbank financial

institution sector in Sudan is

underdeveloped. Since the balance

sheet structures of these

institutions support investment in

long-term investments, these

institutions have the potential to

increase funding to the

infrastructure sector.

Develop a well-functioning Islamic

money market through which banks can

access liquidity which would further

resolve the problems of liquidity.

Increase the share of investments in

project sukuk by takaful companies to

enhance their contribution to the

infrastructure sector.

Establish other nonbank financial

institutions such as pension funds and

sovereign wealth funds that can invest in

the infrastructure sector.

Establish a specialized infrastructure

financial institution/bank to increase

investments in infrastructure projects.

With the anticipated increased in the role

of the private sector in infrastructure

investment, this institution can also

provide information and advisory

services on Islamic project financing.

Central bank

Islamic banks

Regulatory authorities

Takaful companies

Regulatory authorities

Islamic nonbank

financial institutions

Islamic Capital Markets

The key player in capital markets

is the government that issues

various types of Islamic securities.

Sources of funds for infrastructure

development can be diversified by

issuing retail sukuk.

Develop the market infrastructure for

capital markets. This would also be

required for the further participation of

both retail and institutional investors and

increase the size of the overall capital

market in the country.

Issue retail sukuk

Introduce financial literacy programs to

increase literacy in Islamic finance

Introduce an efficient mechanism for the

delivery and redemption of sukuk issues.

Capital markets

regulatory authority

Issuers (sovereign

and corporate)

Capital markets

regulatory authority

Issuers (sovereign

and corporate)

Financial institutions

Islamic Social Sector

Developing innovative models of

zakat and waqf which can

potentially

provide

social

infrastructure services.

Revive the institutions of zakat and waqf

beyond their traditional roles and develop

innovative models to provide some of the

social infrastructure services.

Public and private

sector zakat and waqf

institutions