Infrastructure Financing through Islamic

Finance in the Islamic Countries

153

Case Study: Sudan Financial Services Company Ltd.

67

The Sudan Financial Services Company Ltd. (SFSC) was established by the Central Bank of

Sudan (CBOS) and the Ministry of Finance and National Economy (MFNE) in 1998 with an

ownership of 99% and 1% of shares respectively. The vision of the SFSC is to work towards

achieving sustainable economic and social development through the provision of Islamic

financial services, stable and distinguished and satisfies the desires of the society. The

objectives of SFSC include the ‘promotion and diversification of financial services and financial

products in accordance with Shariah rules; design and execute a marketing policy that can

absorb the requirements of present as well as potential clients; promotion and training of staff

on recent developments regionally and internationally in the area of financial services and

related technology; and adoption of modern systems and technology and achieve the adequacy

and efficiency of the financial and administrative performance of the company with discipline

and speed.’

The key functions of SFSC are to provide ‘financial services related to management, dealing in

the shares and allocation owned by the government of the Sudan, its corporations and

institutions through the issue of sukuk in accordance with Shariah’. The SFSC has developed

sukuk and Government Investment Certificates (GICs) that have raised funds of more than SDG

1 billion that has helped finance development projects including infrastructure in the country.

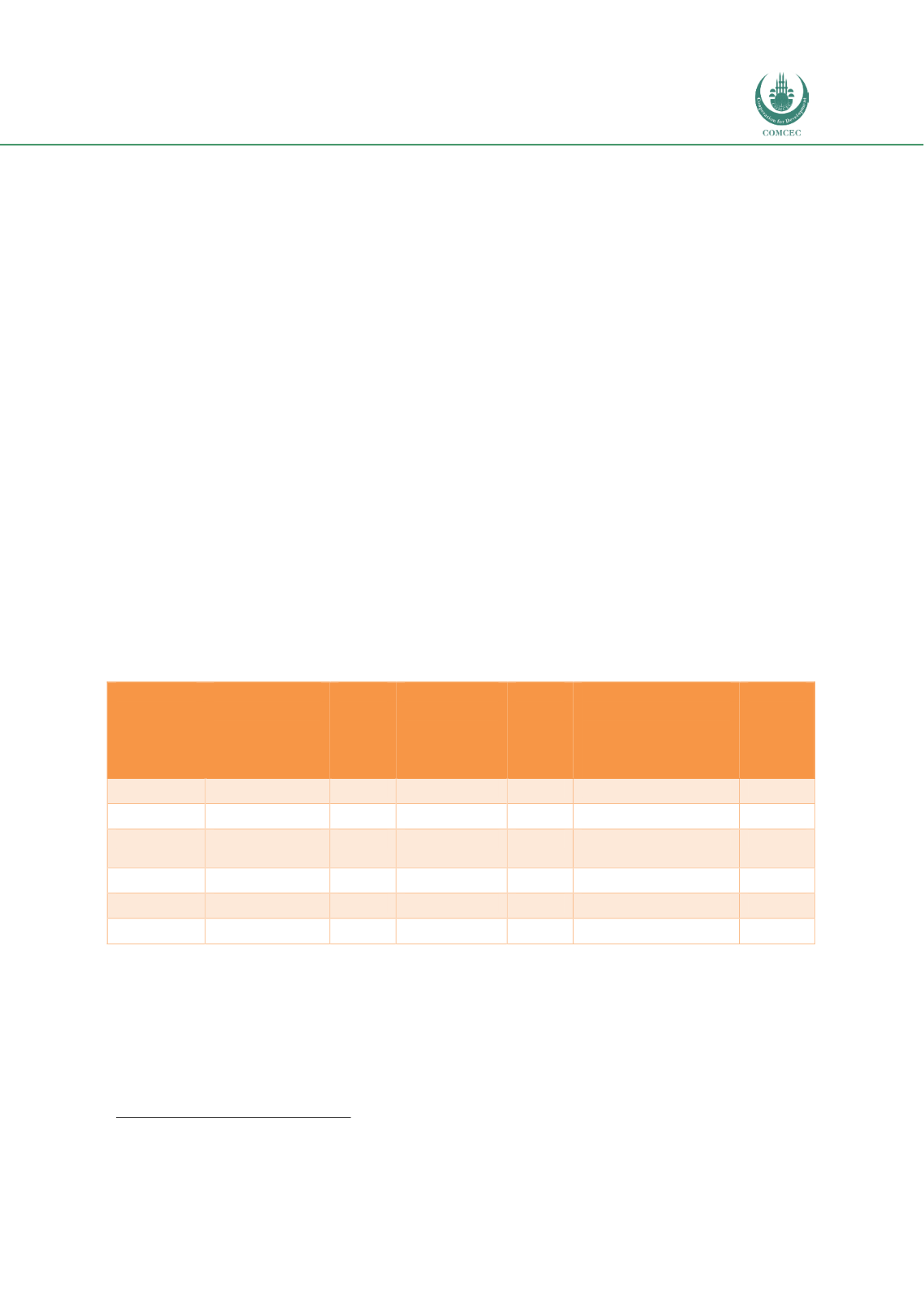

The Shariah-compliant certificates issued by SFSC on behalf of different stakeholders is shown

in Table 4.5.4. As can be seen, during 2016, SFSC helped with the issuance of SDG 23.631

billion of certificates with SDG 20.559 billion of GMCs, SDG 2.242 billion of Shasha, and SDG

829 million of Sarh.

Table 4.5. 4: Issuance of Shariah Compliant Certificates by SFSC (2016) (SDG million and %)

Investors

Government

Musharakah

Certificate

(GMCs)

SDG Million

% of

total

Government

Investment

Certificates

(GIC/Sarh)

SDG Million

% of

total

Sudan Company for

Electricity

Distribution Ijarah

Certificate (Shasha)

SDG Million

% of

total

CBOS

2,197.2

10.7%

327.3

39.5%

46.9

2.09%

Banks

9,805.5

47.7%

219.9

26.5%

1,352.1

60.29%

Companies

and Funds

6,363.1

30.9%

199.9

24.1%

416.7

18.58%

Public

2,193.8

10.7%

82.1

9.9%

0.4

0.02%

426.5

19.02%

Total

20,559.6

829.2

2,242.6

Source: Central Bank of Sudan Annual Report 2016.

(https://cbos.gov.sd/sites/default/files/Annual%20report%202016.pdf)4.5.6.

Conclusion and Recommendations

Sudan has passed through a turbulent time with the adverse influence of the economic slump

caused by oil shocks following the separation of South Sudan. Infrastructure weaknesses in the

country have also been due to the lack of economic diversification during and following the oil

67

http://www.shahama-sd.com/en/content/about-company