Infrastructure Financing through Islamic

Finance in the Islamic Countries

149

Table 4.5.

3

: Islamic Banks Asset Structure and Financing of the Infrastructure Sector in

Sudan (Q1 2018)

(SDG million)

Total Islamic Banking Assets

Asset Composition

SDG

(Million)

% of

total

Total Shariah-compliant

financing (excluding

interbank financing)

119,122.0

40.5%

Sukūk holdings

20,467.0

7.0%

Other Sharī`ah-

compliant securities

0

0.0%

Interbank financing

0

0.0%

All other assets

154,315.0

52.5%

Total assets

293,904.0

100%

Infrastructure Financing by Islamic Banks

Financing going to

infrastructure

SDG

(million)

% of

total

Electricity, gas, steam and

air-conditioning supply

1,788.0

0.61%

Water supply; sewerage

and waste management

0

0.00%

Transportation and

storage

8,765.0

2.98%

Information and

communication

0

0.00%

Education

0

0.00%

Human health and social

work activities

0

0.00%

Total infrastructure

10,553.0 3.59%

Source: IFSB Prudential and Structural Islamic Financial Indicators

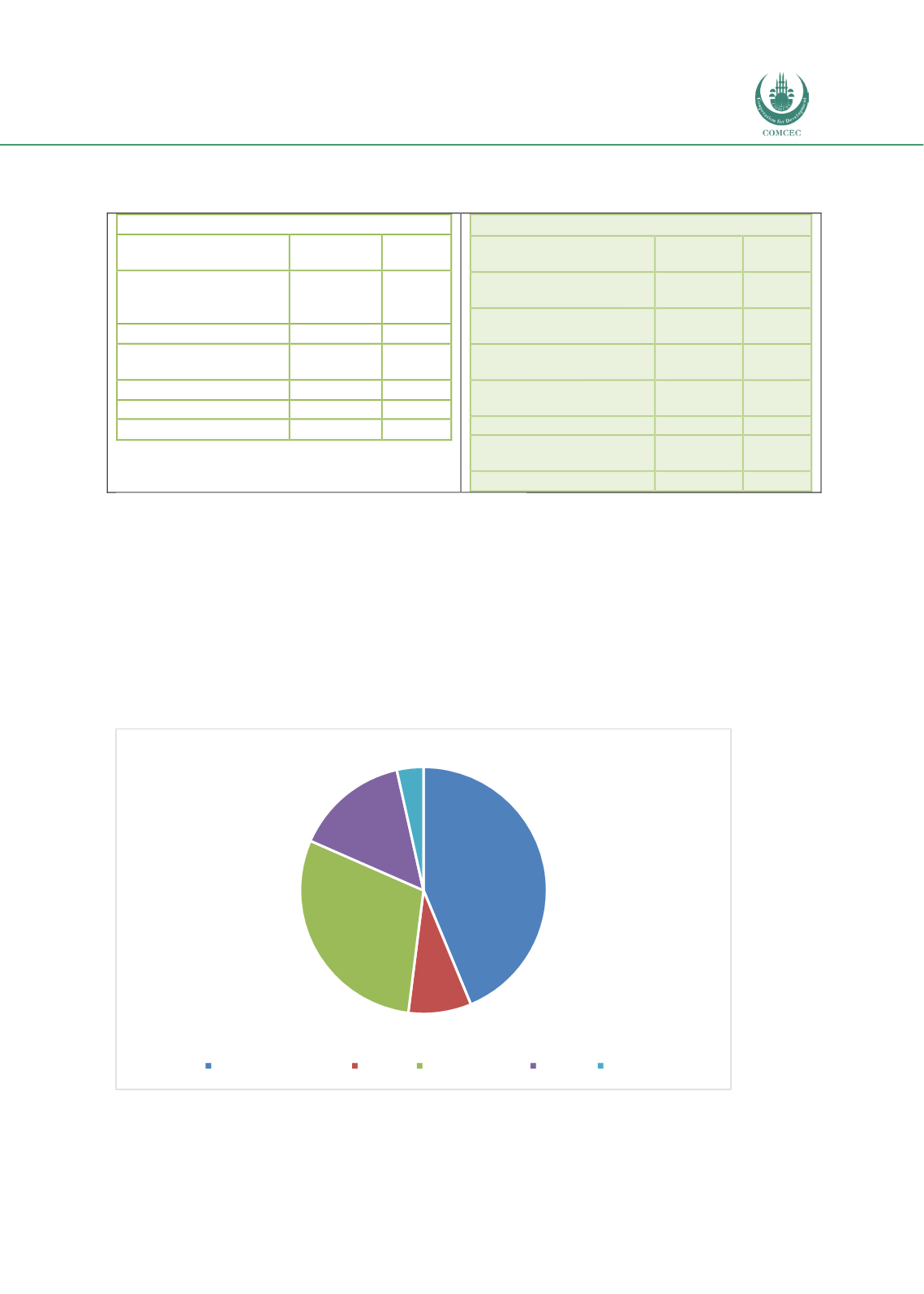

Chart 4.5.5 shows the distribution of assets for the insurance sector in Sudan. Lands and real

estate investments represent 43.7% out of the total insurance sector investment portfolio in

2017 while stocks, Sukuk, and bank deposits represent 14.9%, 8.2%, and 29.6% respectively in

the same year. This means that 96.4% of the insurance investment portfolio is invested in

liquid assets. Although this kind of investment diversification is healthier for the insurance

sector and strengthens its consolidated balance sheet, freezing this huge fund in liquid assets

rather than employing it in reshaping the distribution of general insurance to serve the real

economic sector lessens the contribution of the insurance sector to the national economy.

Chart 4.5. 5: Distribution of Insurance Sector Investments in Sudan (2017) (%)

Source: Insurance Supervisory Authority (ISA), Annual Report 2017

43.7%

8.2%

29.6%

14.9%

3.5%

Lands & Real estate Sukuk Bank Deposits

Stocks

Others