Infrastructure Financing through Islamic

Finance in the Islamic Countries

146

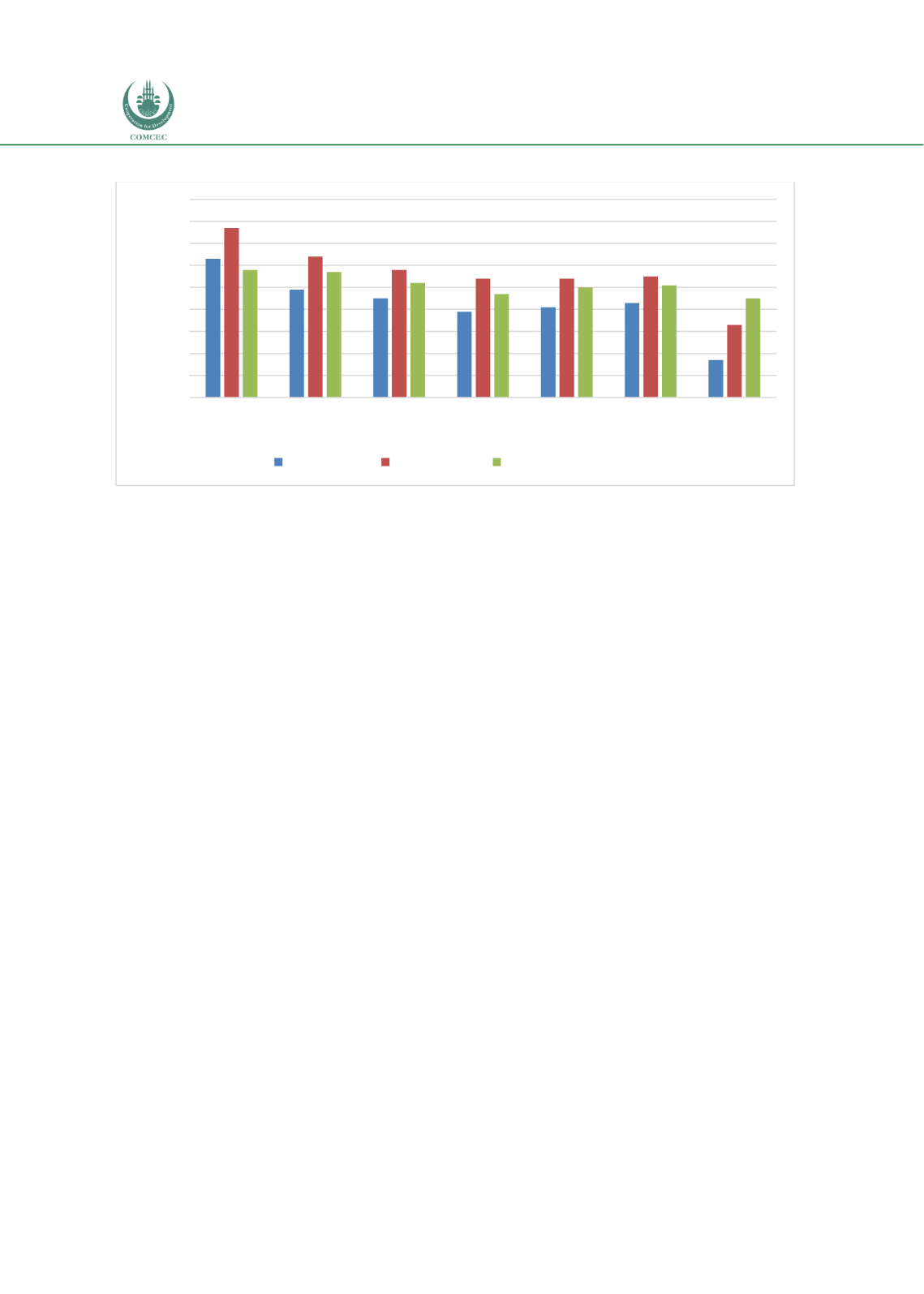

Chart 4.5. 3: Procurement Regime of PPPs: Sudan (0-100 Highest)

Source: World Bank (2018f)

4.5.4.1.

Laws and Regulation Supporting Islamic Finance

The whole financial sector of Sudan is Islamic. Thus, the legal and regulatory framework is

highly supportive of Islamic finance and the banking industry. Different laws have been

codified to support the Islamic financial industry. The bank of Sudan Act 2002 amended 2002

and 2006 define the main role and objectives of CBOS as being to regulate and supervise banks

with full adherence to Islamic Shari'ah principles (BOS Act, 2012). The Banking Business Act

2003 (BBA 2003) stipulates the rules and bank licenses, and it states the minimum capital,

reserves, provisions, etc. It defines the accounting and disclosure. It authorizes CBOS to inspect

banks and financial institutions. The BBA 2003 founded the Higher Shari’ah Supervisory Board

(HSSB) as the higher body that monitors the implementation of Shari’ah Standards.

While the insurance system in Sudan was completely transformed to the Islamic system in

1992, the legal framework was formalized for the sector with the enactment of the Insurance

and Takaful Act 2003 (IT Act 2003). In the IT Act 2003, Takaful distinguishes between life

insurance and general insurance, (IMF, TWB, 2005). There are other laws indirectly

supporting insurance and the Takaful system. The Road Traffic Act of 1983, the Civil

Transactions Act of 1984, and the Money Laundering and Terrorism Financing Act 2014 (ML &

TF Act) also indirectly related to the Insurance and Takaful system in Sudan. Insurance and

Reinsurance Companies in Sudan are regulated by the Insurance Regulatory Authority (ISA)

which, in turn, are supervised by the Minister of Finance and National Economy. One of the

main roles of the ISA is to issue Insurance or Reinsurance licenses. It is also prohibited to

register any business firm in the Commercial Registrar General (CRG) before obtaining the

interim approval of the Board of Directors of the ISA.

Capital markets are governed by the Khartoum Stock Exchange Act of 1994 (KSE ACT 1994)

and are regulated by the Financial Markets Regulation Authority Act of 2015 (FMRA Act 2015).

KSE operates on the basis of Islamic Shariah. It organizes and supervises the issuance of

securities; raises capital; and encourages savings and investment in securities, Sukuk, and the

government investment certificates (GICs). The legal framework of the capital markets is also

63

49

45

39

41

43

17

77

64

58

54

54

55

33

58

57

52

47

50

51

45

0

10

20

30

40

50

60

70

80

90

High income Upper-middle

income

Lower-middle

income

Low income Sub-Saharan

Africa

OIC Members

(40)

Sudan

Index (0-100 Highest)

Preparation Procurement

Contract management