Infrastructure Financing through Islamic

Finance in the Islamic Countries

143

The insurance sector is the lowest with a total asset value of SDG 5.2 billion representing 2.3%

of the total financial sector value. Fifteen insurance companies operating under the

supervision of the Insurance Supervisory Authority (ISA) in the country comprise nine, general

non-life insurance companies, four composite (general and life) insurance companies, and two

reinsurance companies (BOK, 2016).

4.5.2.

Current Status and Projected Investments in Infrastructure Sectors

The World Bank (WB) in its global rankings 2018 ranked Sudan number 121 out of 160

countries based on the Logistics Performance Indicator 2018 (LPI). Based on the LPI criteria,

Sudan had a moderate rate of only 2.2 in infrastructure compared to Germany, which had the

highest rate in the world of 4.2 (TWB, 2018). Based on the index system and evaluation model

of the Chinese Economic Report Series 2014, Sudan ranks 92 out of 133 countries (Jianping et

al. 2014).

Sudan has invested in infrastructure during the last few decades. Power generation capacity

has tripled from 1,000 MW in 2005 to 4,000 MW in 2012. Sudan has the capacity to be a major

exporter of hydropower if additional facilities are improved and links to other Nile Basin

countries are established. Sudan has made progress in liberalizing the Information

Communication Technology (ICT) sector and has succeeded in attracting substantial amounts

of domestic and foreign private capital (AfDB, 2016). However, Sudan’s most pressing

infrastructure challenges remain in the water and transportation sectors as most of Sudan

suffers from insufficient access to clean sources of water and access to sanitation

(Ranganathan, Garmendia, 2011).

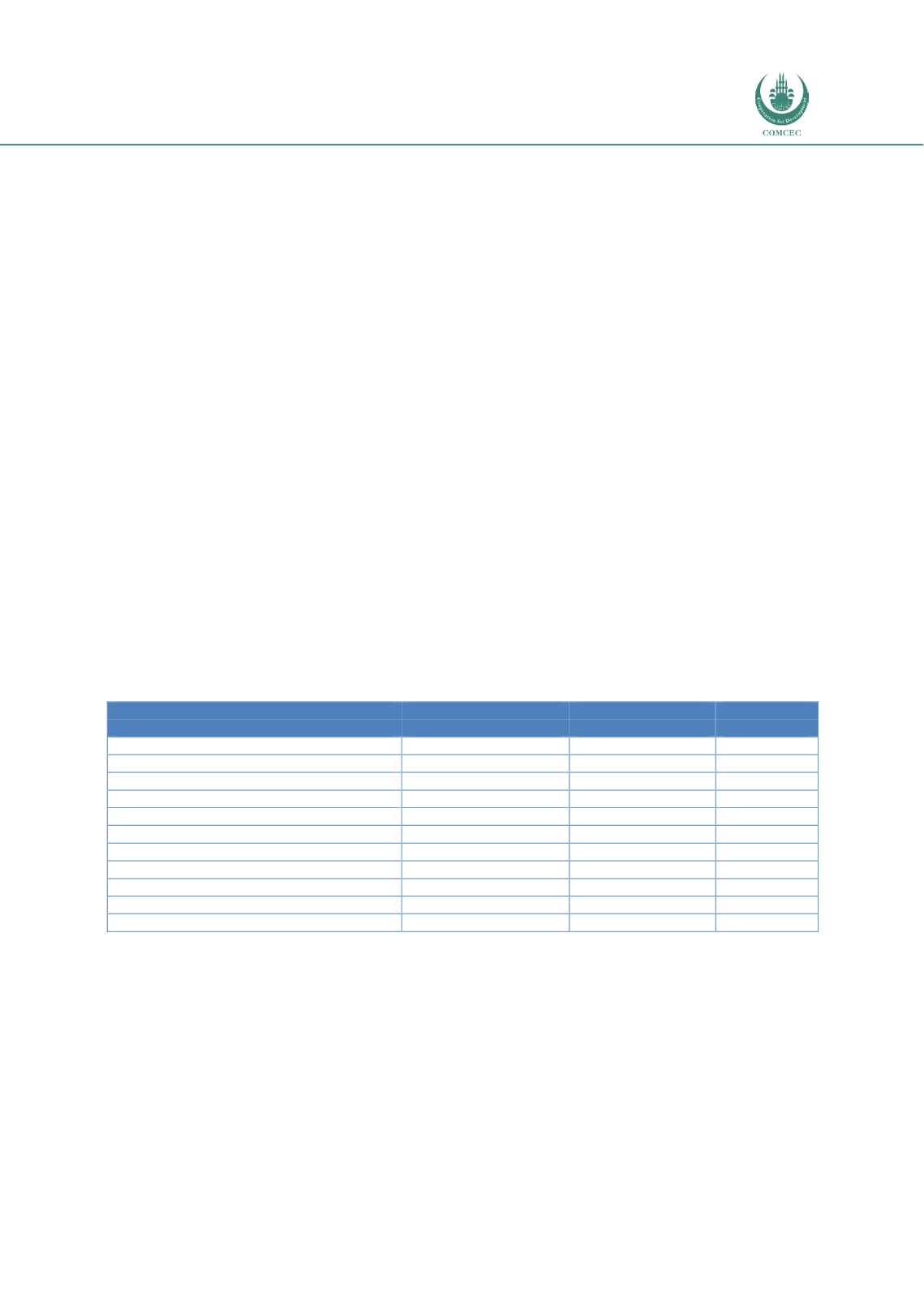

Table 4.5. 1: Development Expenditures for Proposed Infrastructure Programs 2014-2030

(In USD million at 2012 prices)

Program

Medium-term

Long-term

Total

2014-2020

2021-2030

Roads

3,346

5,985

9,330

Railways

1,945

1,698

3,643

Ports

410

611

1,020

Civil aviation

153

297

450

Transport Sub-total

5,853

8,590

14,444

Power

6,380

8,043

14,423

Water resource supply

600

1,400

2,000

Domestic water and sanitation

5,160

11,317

16,477

Irrigation

800

2,200

3,000

ICT

324

300

624

Total

19,117

31,851

50,967

Source: AfDB (2016: 169)

Table 4.5.1 shows the total investment needed for the achievement of the proposed program of

development for the infrastructure sectors in the medium term (2014-2020) and long-term

(2021- 2030). The total estimated funding requirements over the period is close to USD 51

billion. USD 14.4 billion of it is for transportation and the power sector needs USD 14.4 billion.

The water and sanitation services need USD 16.5 billion and water resource supplies and

irrigation development need USD 2.0 billion and USD3 billion respectively.

The average annual expenditure on infrastructure development is expected to be USD 2.7

billion per year for the 2014-2020 period, and USD 3.2 billion per year for the 2021-2030 long-