Infrastructure Financing through Islamic

Finance in the Islamic Countries

140

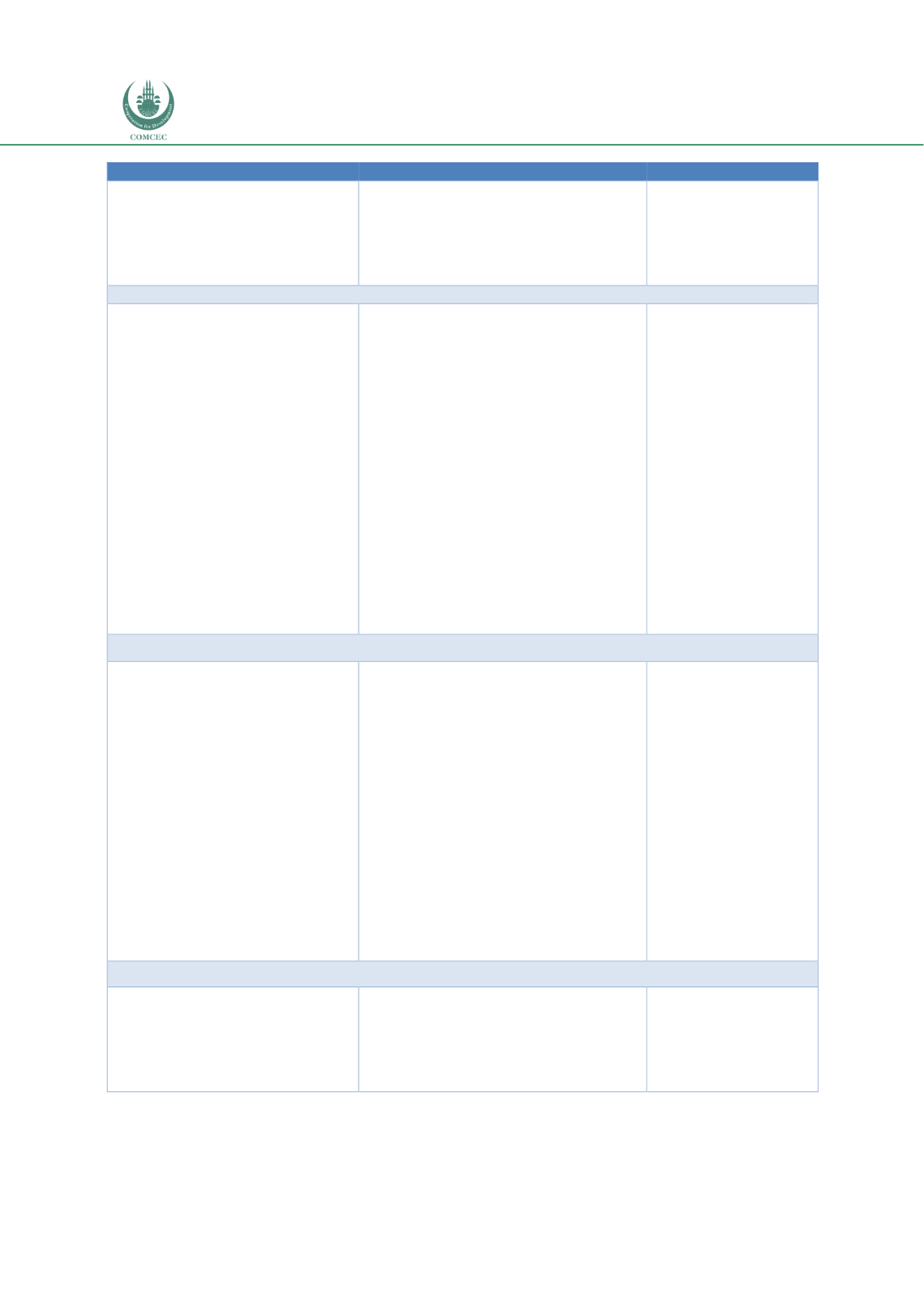

Issues

Recommendations

Implemented by

Islamic banks contribution to

infrastructure development can

also be increased by jointly funding

the projects with other banks

through syndicated financing.

Create a sound legal and contractual

framework for syndication to increase

the participation of Islamic banks in

infrastructure projects along with other

banks.

Relevant government

ministries

Islamic Financial Institutions

One reason for the small direct

investments in infrastructure

sector by Islamic banks is likely

due to their liquid and short-term

liabilities structure.

The contribution of the Islamic

nonbank financial institutions in

Saudi Arabia can be enhanced by

increasing the share of investments

in the infrastructure sector.

Introduce and expand the size of

restricted investment accounts which

can be used for longer-term investments.

Increase the takaful companies’

investments in infrastructure projects.

Enhance the Shariah-compliant share of

the pension funds and sovereign wealth

to expand the contribution of Islamic

finance in infrastructure development.

Develop Islamic funds/ banks for

infrastructure investments to further

increase the share of Islamic finance in

infrastructure investments. The national

level institution will be able to pool

funds from different sources for

investments in infrastructure projects.

Banking regulators

Islamic banks

Islamic nonbank

financial institutions

Relevant public bodies

Islamic investment

banks

Islamic Capital Markets

Infrastructure financing and sukuk

structures are complex.

Issuing sukuk for projects instead

of bonds has the potential to

increase the investor base as both

Islamic and conventional financial

institutions can invest in these

securities.

To expand the investor base, retail

sukuk can also be issued in Saudi

Arabia.

Establish an advisory GLC that can

advise on the issuance of sukuk and

develop templates for issuing sukuk for

infrastructure projects.

Develop market and infrastructure for an

efficient Islamic capital market/sukuk.

Issue more sukuk by both public and

private sector entities for infrastructure

projects.

Issue retail sukuk

Introduce financial literacy programs to

increase the literacy of Islamic finance

Introduce efficient mechanisms for the

delivery and redemption of sukuk issues.

Capital markets

authority.

National Centre for

Privatization (NCP)

Capital Markets

Authority

Issuers (sovereign and

corporates)

Financial institutions

Capital markets

authority

Issuers (sovereign and

corporates)

Financial institutions

Islamic Social Sector

Vision 2030 emphasises the role of

the non-profit sector in achieving

developmental goals.

Increase the role of the social sector in

providing infrastructure services such as

health and education by providing a

supportive legal framework under which

innovative models of zakat and waqf can

develop.

Relevant government

ministries