Infrastructure Financing through Islamic

Finance in the Islamic Countries

135

While no specific information on the proportion of the funds raised by sukuk issues going to

the infrastructure sector is available, a part of the funds raised by the government is expected

to be spent on the infrastructure sector on a pro-rata basis. Furthermore, a few of the

government-linked companies have raised funds by issuing sukuk in the recent past. For

example, in 2012, the Saudi Electricity Company raised USD 1.75 billion and the General

Authority of Civil Aviation raised USD 4 billion by issuing sukuk (IIFM 2018: 34).

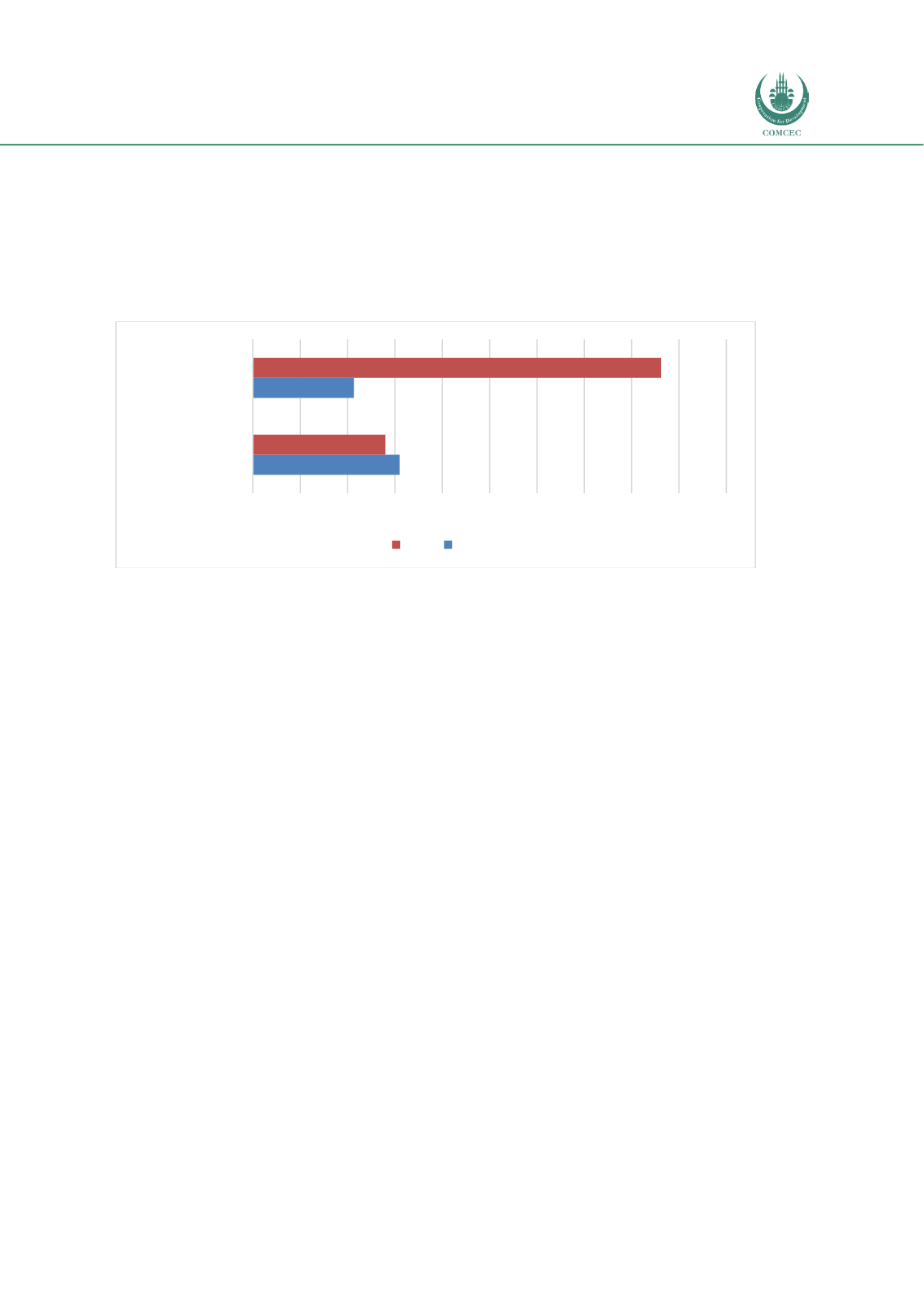

Chart 4.4. 9: Offered Sukuk & Debt Instruments Listed in CMA (SAR billion)

Source: CMA (2017: 110)

4.4.5.4. Social Sector

Zakat collection and distribution is the responsibility of the government and is managed by the

Department of Zakat and Income Tax (Allami 2015). Zakat is disbursed through the Social

Insurance Agency of the Ministry of Social Affairs but no data on the heads of disbursement is

available. The legal regime for waqf in Saudi Arabia is not well developed (Tahir 2015). While

there are less than 1,000 non-profit and charitable foundations or waqf in Saudi Arabia

contributing only 0.3 % of the GDP, this figure is much less than the global average of 6 percent

(Vision2030: 77). Currently, only 7 percent of projects have goals of generating a social impact

that is aligned with the long-term national priorities of the country. The short-term goal of

Vision 2030 plans to increase the percentage of non-profit organizations that can have a

measurable and deep social impact to one third by 2020. The government is planning to

provide the right regulatory environment to increase the role of the non-profit sector in

promoting social welfare. The case study of a health facility Centre in Alkharj, Riyadh initiated

by Al Rajhi is an example of providing social services through the non-profit sector

4.4.5.5. International Sources

As indicated, the Islamic Development Bank is the only source of Shariah-compliant financing

from multilateral development institutions. Chart 4.4.10 shows that while 86 projects worth

USD 1.93 billion were financed in Saudi Arabia during 1975-2016, since 2016 only three

projects worth USD 119.5 million were funded by the IDB. The small number of projects are

indicative of the relatively smaller quantity of funds that IDB has at its disposal to fund 57

member countries.

31

21.35

28

86.25

0 10 20 30 40 50 60 70 80 90 100

Number

Value (SAR Billion)

2017 2016