Infrastructure Financing through Islamic

Finance in the Islamic Countries

142

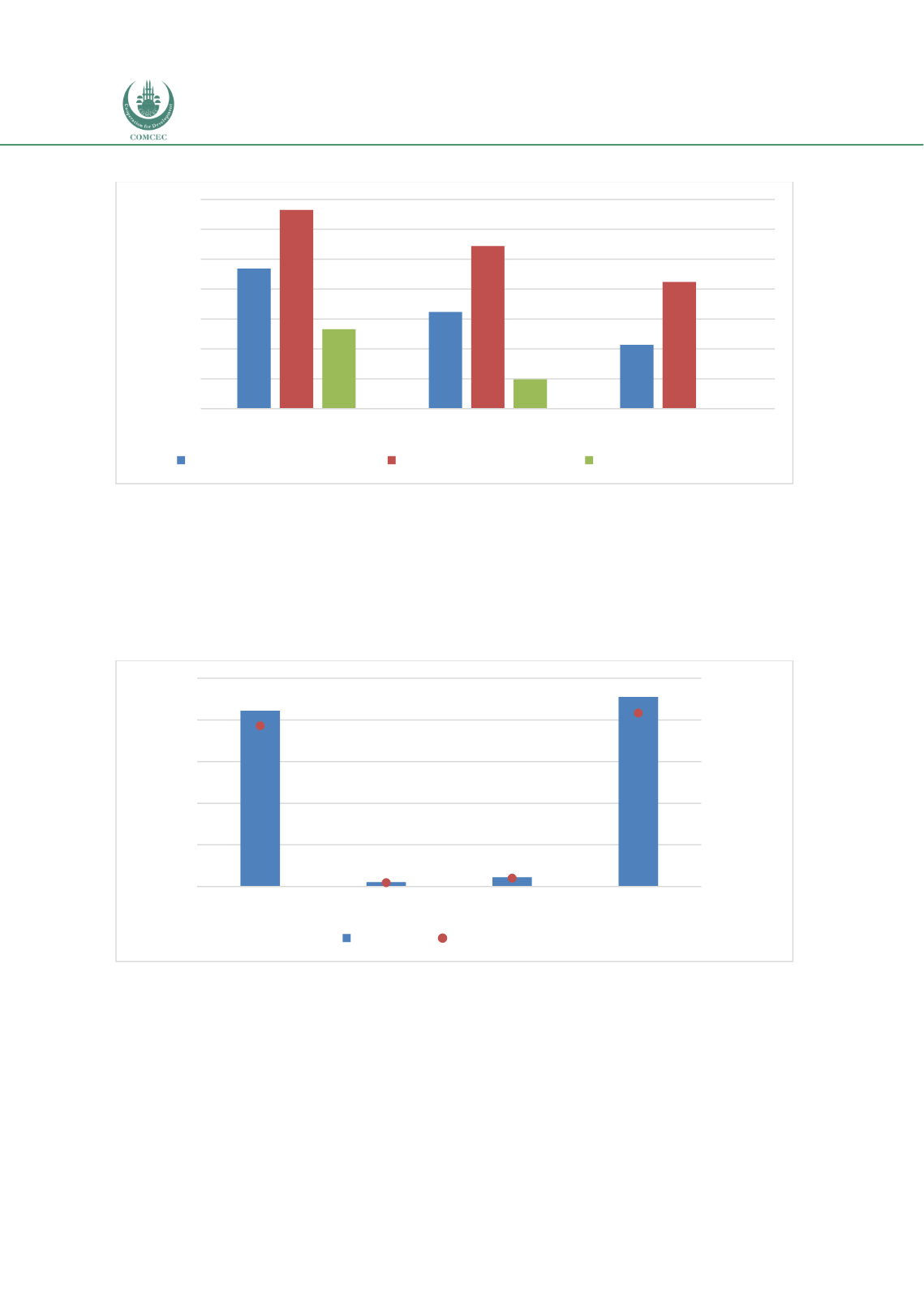

Chart 4.5. 1: Relative Financial Sector Development in Sudan (2016) (0-1 Highest)

Source: IMF Financial Sector Development Database

Chart 4.5.2 shows the composition of the Sudanese financial sector including banks, insurance

companies and capital market value. The financial sector is dominated by banks with assets

worth SDG 211.2 billion (USD 11.765 billion), representing 92.8% of the total size of Sudan’s

financial sector. The total Islamic banking assets of 37 specialized, commercial, banks in Sudan

increased by 10.5% from USD 10.651 in 2014 to USD 11.765 billion in 2017 (CBOS, 2017).

Chart 4.5. 2: Islamic Financial Sector Composition Sudan (2017) (SDG billion)

Source: (CBOS, 2017) & (KSE, 2017 & (Insurance Companies consolidated balance sheet, 2017)

The capital markets that include the stock market, Sukuk, and investment funds market is

valued at SDG 11.2 billion (UD$ 625.84 million) and represents 4.9% out of the total size of the

financial sector. The capital market, however, is dominated by sukuk valued at SDG 10.396

billion (USD 578 million), representing 92.5% of the capital markets, and the remaining 7.48%,

constituting stock market capitalization of SDG 841 million (USD 46.84 million). Furthermore,

trading in sukuk in KSE is dominated by Government Musharakah Certificates (GMCs), which

represent approximately 80% of their traded value (KSE, 2014).

0.23

0.16

0.11

0.33

0.27

0.21

0.13

0.05

0.00

0.00

0.05

0.10

0.15

0.20

0.25

0.30

0.35

OIC Average

Africa

Sudan

Index Value (0-1 Highest)

Financial Development Index

Financial Institutions Index

Financial Markets Index

211.25

5.24

11.24

227.72

92.8%

2.3%

4.9%

100.0%

0%

20%

40%

60%

80%

100%

120%

0

50

100

150

200

250

Bank Assets

Insurance Assets Capital Market Value Total Assets

% of total

SDG Billion

SDG Billion % of overall industry