Infrastructure Financing through Islamic

Finance in the Islamic Countries

136

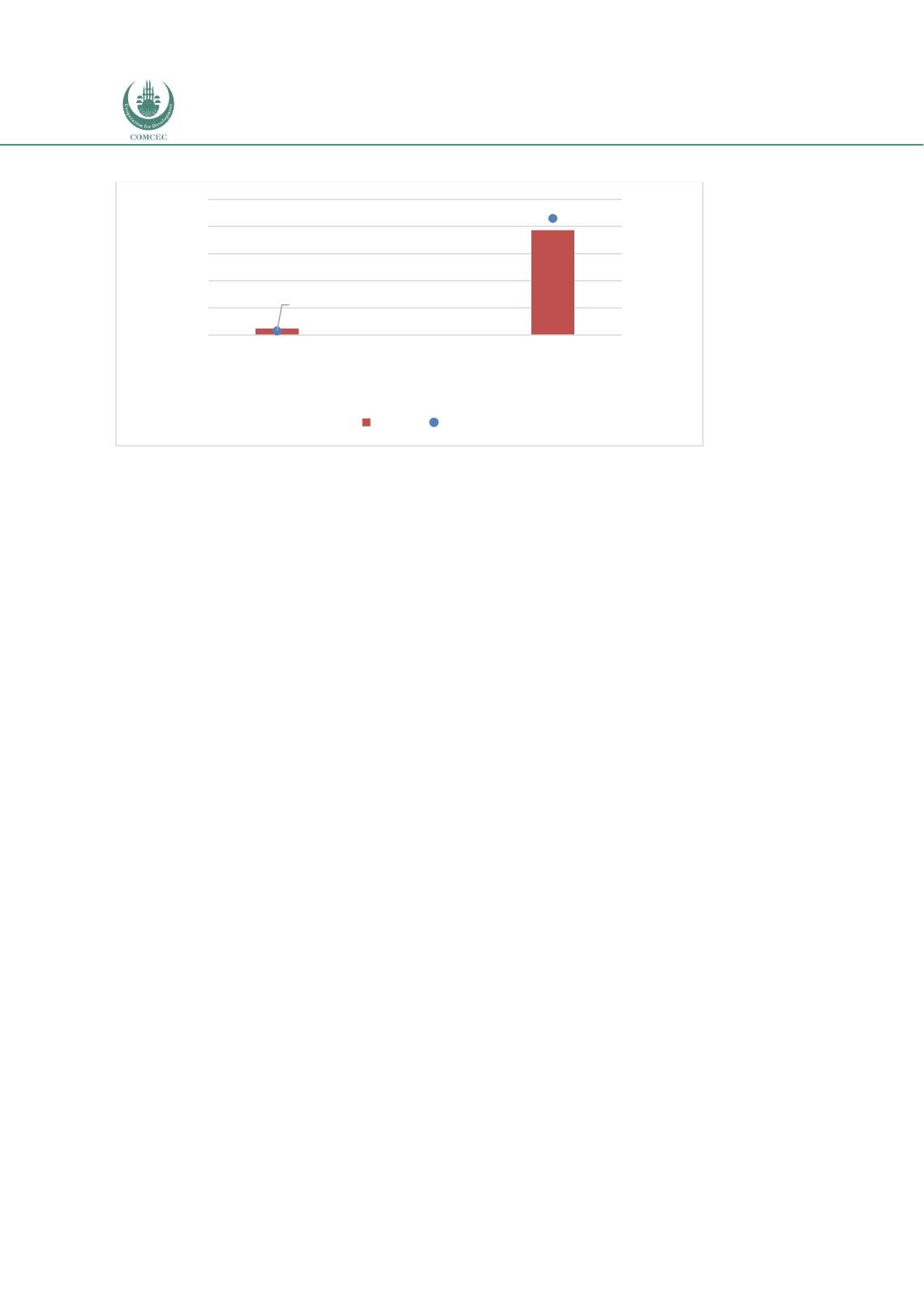

Chart 4.4. 10: IDB Project Financing in Saudi Arabia (USD million)

Source:

https://isdbdata.github.io/monograph2017.html4.4.5.6. Case Studies

Case Study: Prince Mohammad Bin Abdul-Aziz International Airport (Madinah airport)

Madinah is a major hub for pilgrims and a designated centre for the knowledge-based industry

in the country (World

Bank, 2012). Prince Mohammed Bin Abdulaziz International Airport,

popularly known as Madinah airport, is an international airport that serves the Madinah

region, and, because of the strategic importance of the region, the airport alone cannot

adequately cater for the growing numbers of passengers flying that route, mainly due to

inadequate infrastructure. Therefore, Saudi Arabia’s General Authority of Civil Aviation (GACA)

initiated a project to attract investors using a PPP model to rehabilitate, expand, modernize

and operate the airport to international standards (World Bank, 2017). In addition, the project

was designed to fulfil two objectives, namely to introduce private sector expertise and to

develop a stable revenue stream for the government.

The target of the project was to expand the capacity of the airport from 5 million to 8 million

passengers per year at the initial phase (Madinah

Airports, 2012). The projection was to

further expand it to 16 million passengers per year at the later phase. After the bidding, the

TIBAH, a consortium comprising of TAV Airports Holding (Turkey), Al Rajhi Holding (KSA) and

Saudi Oger Ltd (KSA), won the concession for 25 years to rehabilitate, expand and operate the

entire airport (Madinah

Airport, 2018). The contract was awarded and signed in October 2011

with the promise to invest $1.4 billion to build and expand a new terminal facility that could

accommodate around 8 million passengers per annum (MPPA) by 2015 and 18 MPPA by the

end of the concession period.

To finance the project, two modes of Islamic finance were used for the two stages involved in

the project. The stages of the project are the construction and operation stage. In the

construction stage, Istisna was used where a special purpose vehicle (SPV) transferred some of

the rights in the build-transfer-operate (BTO) concession agreement to the TIBAH consortium,

the financiers of the project. In the second stage, the TIBAH consortium transferred the

ownership of the asset back to the SPV gradually based on rental payments using a lease

119.5

1,931.7

3

86

0

20

40

60

80

100

0

500

1,000

1,500

2,000

2,500

Total Project Financing

2016+

Total Project Financing

Since Inception (1975-

2016)

No. of projects

USD (Million)

US mill.

No.