Infrastructure Financing through Islamic

Finance in the Islamic Countries

137

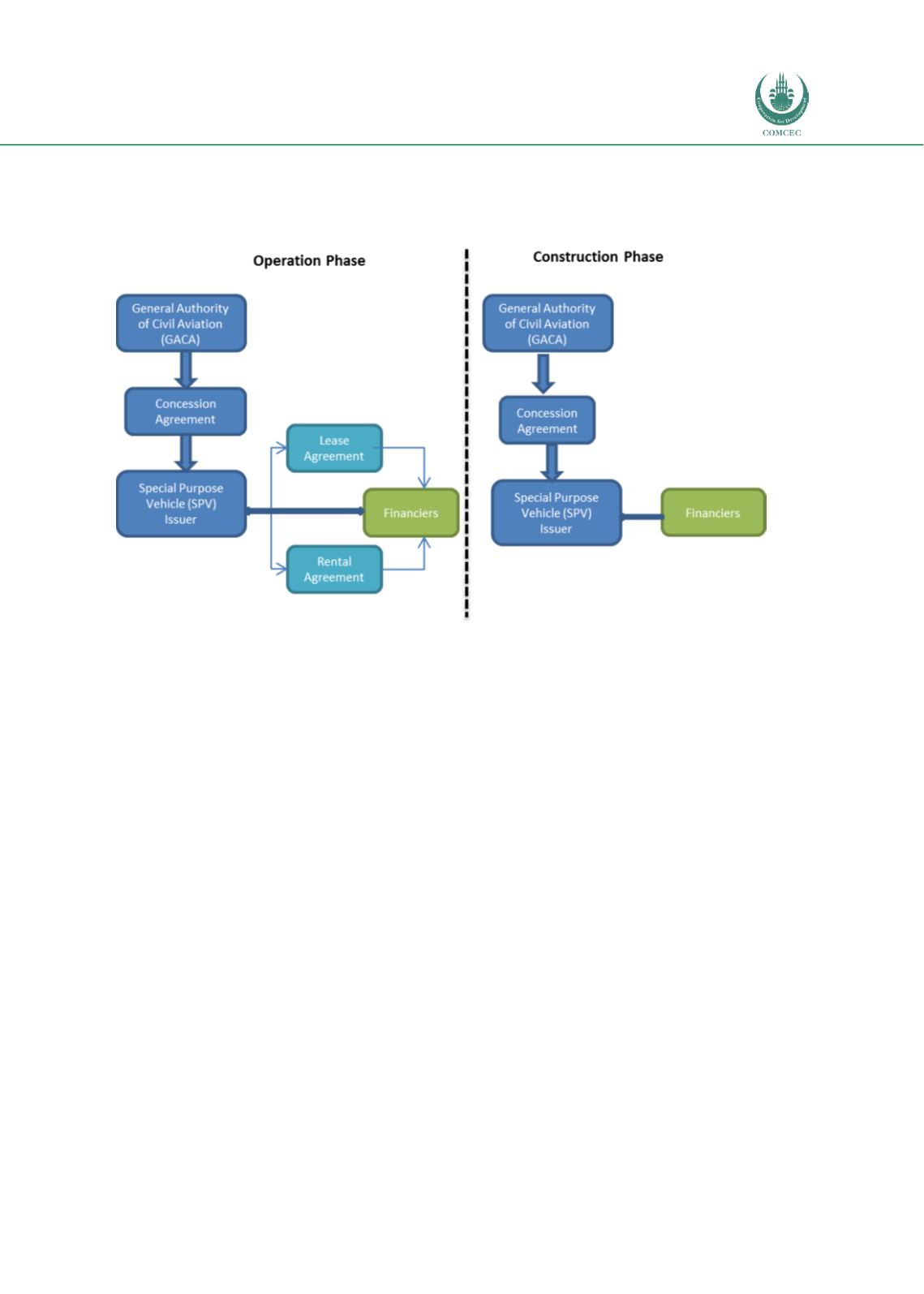

agreement with a put and call option for sale and purchase undertaking. The project finance

structure of the project is summarised in Chart 4.4.11.

Chart 4.4. 11. Summary of Madinah PPP Airport Project Islamic Finance Structure

Source: World Bank (2017)

After the completion of the construction of the assets, the complete ownership over the

project’s assets was transferred to the government and the commercial rights were

transferred to the SPV based on the concession agreement. During the period of operations,

the SPV transferred its own commercial rights based on the concession agreement of the

project assets to the Islamic financiers (TIBAH group consortium). This SPV is designated as

the manager of the project by default, meaning it is designated as the party responsible for the

design and implementation of all the rights under the BTO concession. Based on the PPP

design scheme, the financiers have to obtain direct agreement with the government authority

and the SPV provider in the event that the SPV defaults.

By virtue of the direct agreements, the government authority will pay the financiers if the

project is terminated because the SPV defaults. The project was successful and was delivered

within the time frame. However, because of the lack of proper PPP in Saudi Arabia then, the

fact that there was no central PPP Unit, coupled with the fact that it was not clear that these

were high on the agenda, there were a lot of challenges facing the PPP style in Saudi Arabia.

The success of the Medina project was a result of the introduction of specific resolutions by the

Council of Ministers to aid in guiding the concession. Recently, the National Centre for

Privatization & PPP (NCP) published a draft of the Private Sector Participation Law for public

consultation to fast-track the development of the PPP model in the Kingdom. This will guide

the future financing of projects through PPP.

Key selection criteria included meeting or exceeding minimum technical and operational

requirements, financial commitment, and adherence to best practices in energy and

environmental practices and modern design that reflect Madinah’s historic and religious

importance. Interest in the project was strong with 10 international, regional and local firms