Infrastructure Financing through Islamic

Finance in the Islamic Countries

139

government has been involved in the infrastructure sector of the country, under the Vision

2030 the plans are to use the private sector to contribute to infrastructure development. Given

the financing gap for infrastructural development, Islamic finance can play an important role.

While the Islamic banking sector represents more than 50% of the overall banking assets, the

contribution to the infrastructure sector has been only 3.7%. As indicated, this can be

explained by the nature of liabilities and the capital adequacy regulatory regimes. Since Islamic

banks are relatively large in Saudi Arabia, one option of increasing investments in

infrastructure projects would be to arrange syndicated financing whereby a few banks can

contribute the funds so that the risks are spread. The case study of Madina airport in which

several banks contribute shows the way in which different parties can contribute to the

development of infrastructure projects.

The government has issued several sukuk to raise funds to cover budgetary expenses. Some

infrastructure-linked GLCs such as

Saudi Electricity Company have also issued sukuk to

expand their operations. The Islamic social sector can also be revived so that they can

contribute to the provision of social infrastructure services.

Since there is a change in the funding approaches from the public sector to the private sector

under the 2013 vision, the sukuk market is expected to play a more important role in raising

funds for the infrastructure sector.

However, encouraging the private sector to contribute

more to the infrastructure sector

under Saudi Vision 2030

would require

strengthening the

PPP regime by especially introducing a PPP-specific legislation framework in the Kingdom to

enable PPP projects to be delivered outside the existing procurement framework.

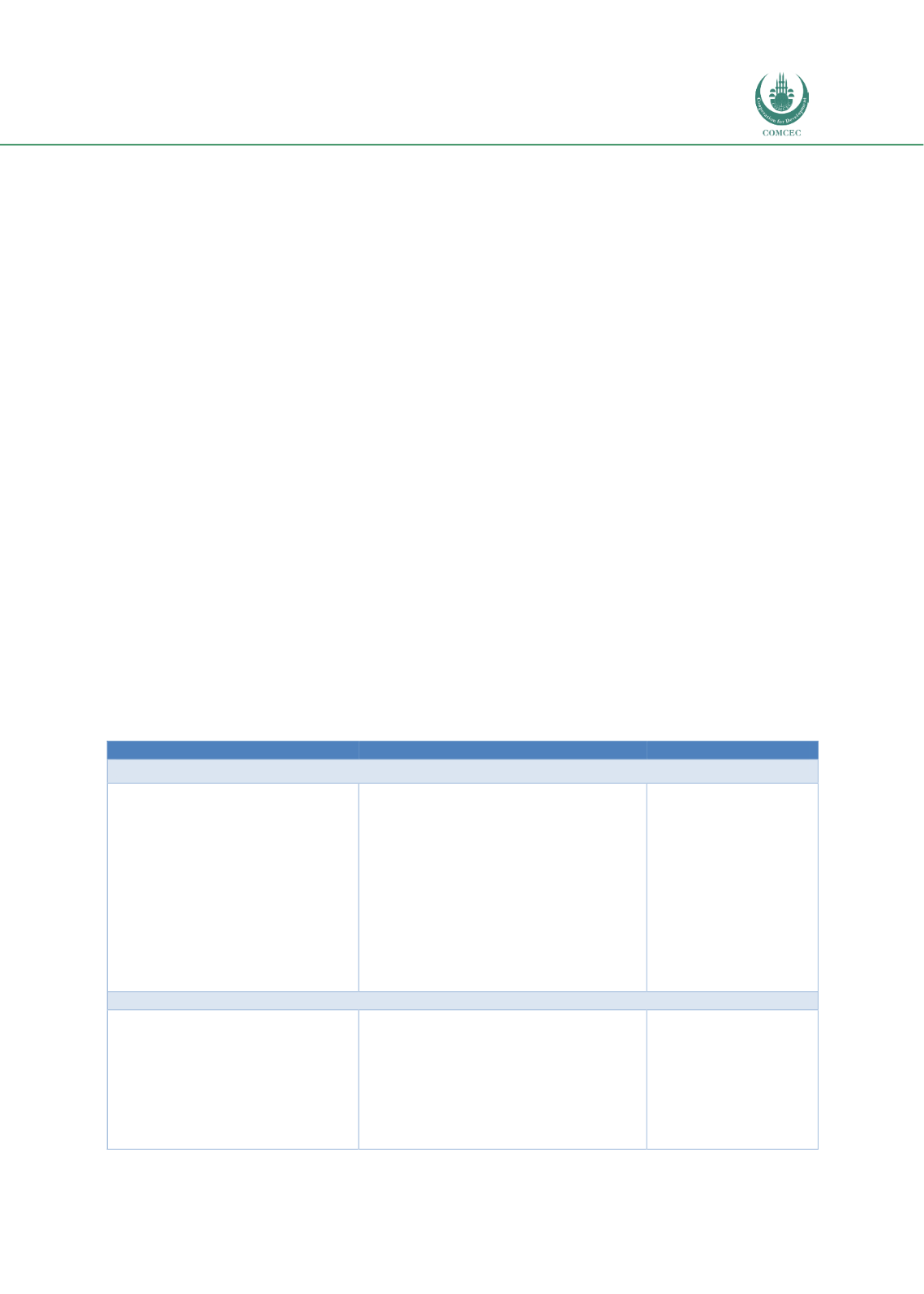

Table 4.4.4 shows the issues and the recommendations to further enhance the role of Islamic

finance in infrastructure development in Saudi Arabia.

Table 4.4. 4: Issues and Policy Recommendations: Saudi Arabia

Issues

Recommendations

Implemented by

Infrastructure-Related Strategies and Policies

The government plans to increase

the role of the private sector to

develop the infrastructure sector.

The Islamic financial sector can

contribute to this effort.

Since infrastructure projects are

complex and long term, there is a

need to provide guarantees to

project specific risks to encourage

private sector participation in

infrastructure investments.

Develop Shariah-compliant contract

templates that can be used for different

types of PPP projects and make these

available to potential Islamic investors.

Provide guarantees and insurances to

cover risks such as political risks and

partial credit risks in a Shariah-

compliant manner to create incentives

for the private sector to invest in

infrastructure projects.

National Centre for

Privatization (NCP)

Islamic financial

industry stakeholders

Relevant public bodies

Private sector

insurance/takaful

companies

Legal and Regulatory Regimes

Saudi Arabia does not have specific

Islamic financial laws. Islamic

banking

operates

under

a

traditional banking law, the takaful

sector operates under cooperative

insurance law and the Capital

Markets Law does not have any

specific mention of sukuk.

Enact Islamic financial (banking, takaful

and capital markets) laws to provide a

sound legal and regulatory basis for the

development of the Islamic financial

industry.

Relevant government

ministries