Infrastructure Financing through Islamic

Finance in the Islamic Countries

134

A key institution that is involved in the infrastructure sector is the Public Investment Fund

(PIF), the sovereign wealth fund of the country that has invested through many infrastructure-

related companies. Infrastructure-related companies owned by PIF include power, water

utility and sewerage (Marafiq, NWC, Saudi Electric Company), Telecommunications (Saudi

Telecomm Company) and transportation (Saudi Railway SAR). While the bulk of the

government-linked companies get their equity capital from the government, they can raise

further funds through capital markets by issuing sukuk.

4.4.5.2. Islamic Banks

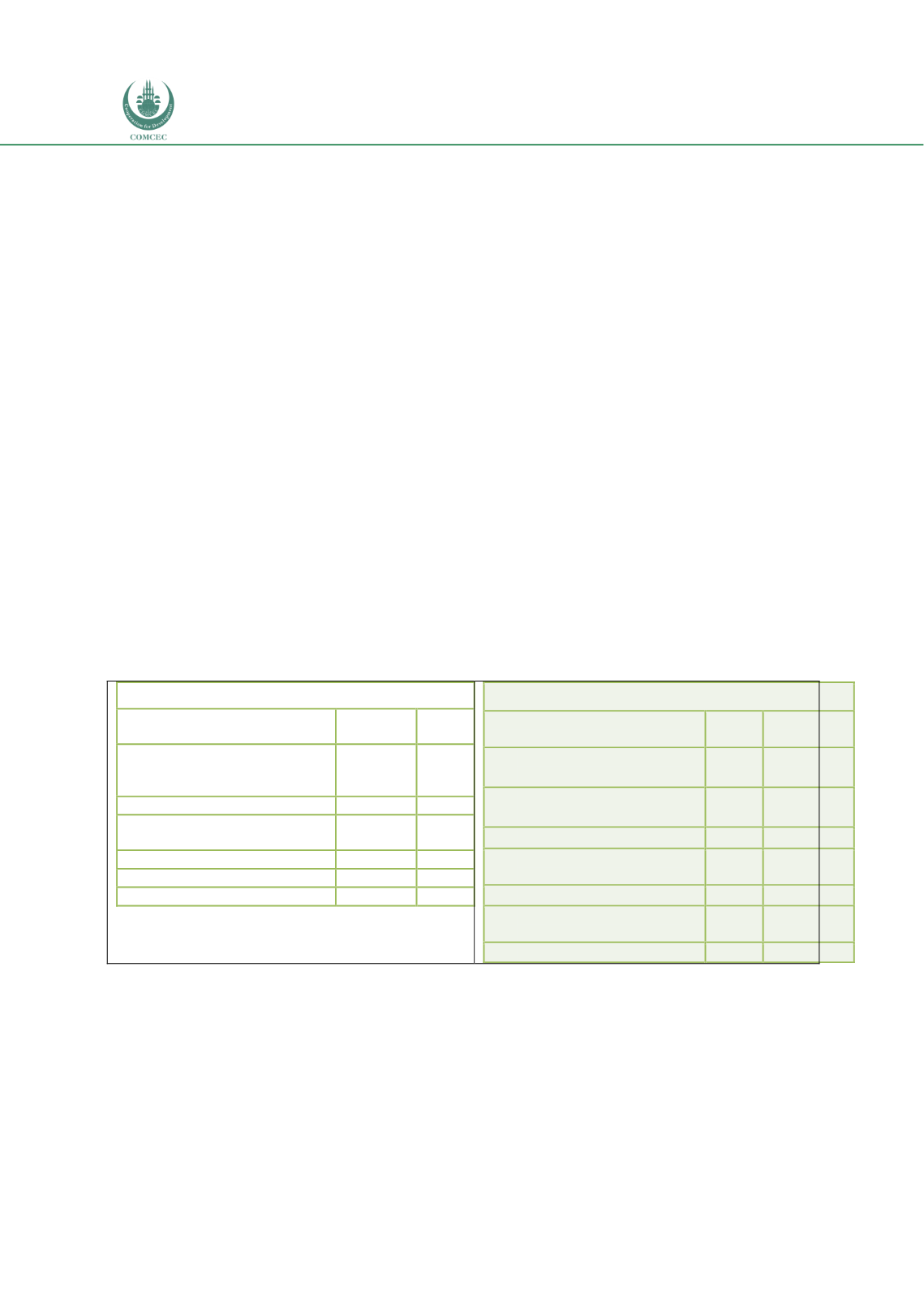

The role of Islamic banks in financing the infrastructure sector can be seen by examining the

composition of the asset side of banks. Table 4.4.3 shows the asset contribution and

composition of the Saudi Arabian Islamic banking sector for the Q1 2018 period. Of the total

assets of SAR 596.744 billion (USD 159.131 billion), the total Shariah-compliant financing

(excluding interbank financing) is SAR 397,266.7 million constituting 66.6% of the total assets.

The Islamic banks held sukuk worth SAR 51.401 billion which is 8.6% of the total assets. The

table shows that, of the Shariah-compliant financing, only SAR 22.332 billion (USD 5.955

billion), equivalent to 3.74% of the total assets, was used in the infrastructure sector. Among

the infrastructure sectors that were financed, electricity, gas, steam and air-conditioning

supply received the highest financing of SAR 11.97 billion followed by SAR 10.31 billion for

transportation and storage and SAR 48.5 million for the health and social work sector.

However, Islamic banks did not provide any financing for the water supply, sewerage and

waste management, information and communication, and education sectors.

Table 4.4. 3: Islamic Banks Assets Structural Composition and Financing of Infrastructure

Sector (Q1 2018)

Total Islamic Banking Assets

Asset Composition

SR

(million)

% of

total

Total

Shariah-compliant

financing (excluding interbank

financing)

397,266.7

66.6%

Sukūk holdings

51,401.4

8.6%

Other

Sharī`ah-compliant

securities

4,935.4

0.8%

Interbank financing

38,531.6

6.5%

All other assets

104,609.2

17.5%

Total assets

596,744.3

100%

Infrastructure Financing by Islamic Banks

Financing going to infrastructure

SR

(million)

% of

total

Electricity, gas, steam and air-

conditioning supply

11,973.1 2.01%

Water supply, sewerage and

waste management

0.0

0.00%

Transportation and storage

10,311.3 1.73%

Information

and

communication

0.0

0.00%

Education

0.0

0.00%

Human health and social work

activities

48.5

0.01%

Total Infrastructure

22,332.9

3.74%

Source: (IFSB, 2018),

https://www.ifsb.org/psifi_03.php4.4.5.3. Capital Markets

As shown in Chart 4.4.9, the sukuk sector in Saudi Arabia is relatively small compared to the

Islamic banking sector. The total number and value of debt and sukuk instruments during

2016 and 2017 that are listed in the CMA are shown in Chart 4.4.9. While in 2016 a total of 31

instruments were offered worth SAR 21.35 billion, in 2017 28 instruments worth SAR 86.25

billion were listed with the CMA. As noted before, the bulk of the domestic sukuk was issued by

the government to finance budget deficits.