Infrastructure Financing through Islamic

Finance in the Islamic Countries

98

As discussed in Chapter 2, the World Bank identifies three stages of procurement regimes.

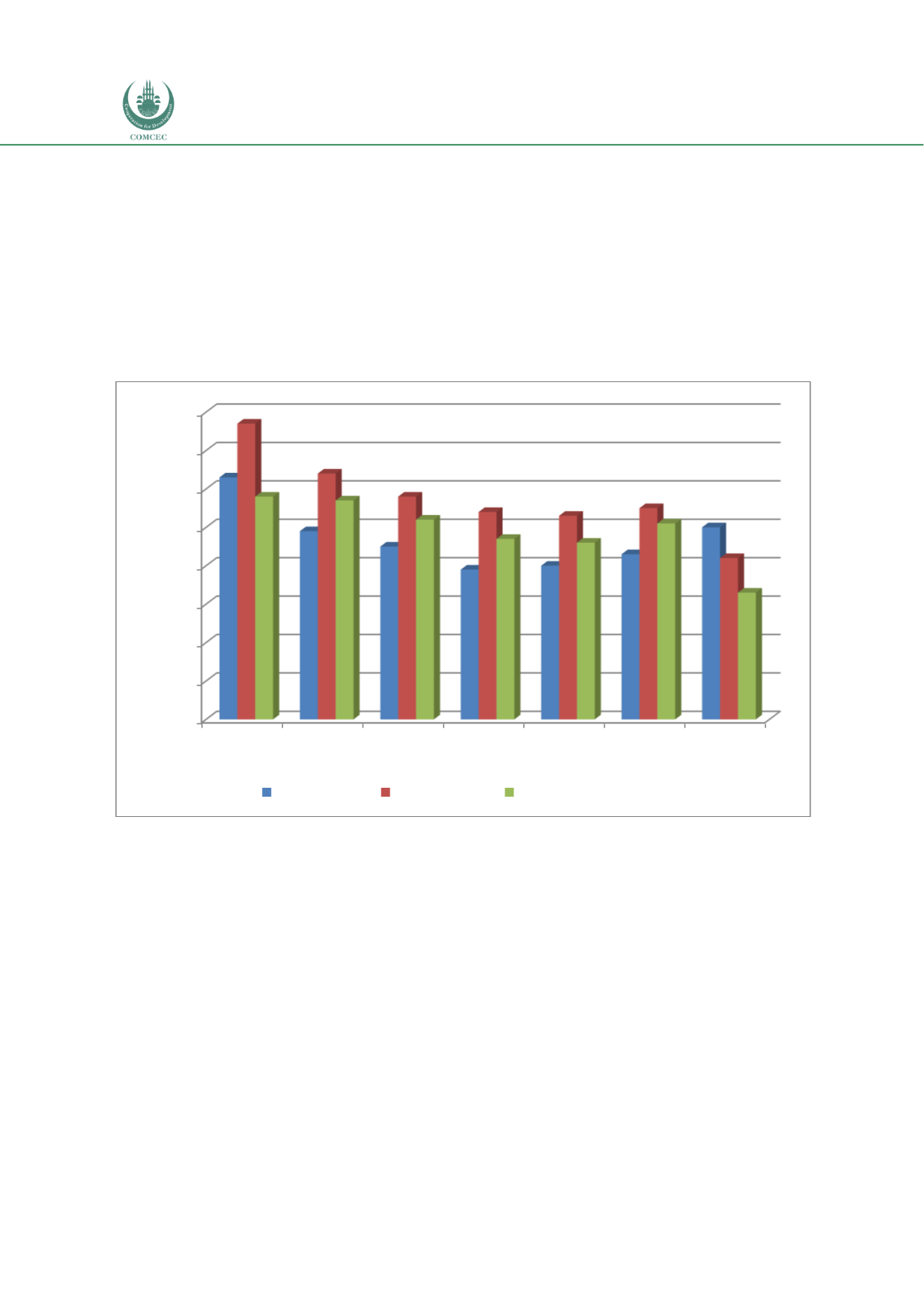

Chart 4.2.8 shows the status of the procurement regime for PPPs in Malaysia in terms of

preparation, procurement and contract management relative to different income groupings in

the East Asia & Pacific region. While the status of the preparation stage for PPPs is relatively

good in Malaysia with a score of 50 which is higher than all country groupings except high

income countries, the procurement and contract management of PPPs achieves relatively low

scores of 42 and 33 respectively. The chart shows that while Malaysia’s score for the

preparation stage is better than the average OIC members, the procurement and contract

management scores are lower.

Chart 4.2. 8: Procurement Regime of PPPs: Malaysia (1-100 Highest)

Source: WB (2018f).

4.2.4.1.

Laws and Regulation Supporting Islamic Finance

The Malaysian government has been very supportive of the Islamic financial industry and has

instituted a sound legal and regulatory framework and institutional setup for its development

and growth. The Islamic Banking Act 1983 (IBA 1983) was legislated in 1983 to provide the

legal basis for Islamic banks, and the Takaful Act 1984 was legislated to govern the

establishment and regulation of

takaful

companies. The Banking and Financial Institutions Act

1989 (BAFIA amended 1993) was amended to accommodate Islamic banking practices in

conventional banks to carry out Islamic banking business through windows. The Islamic

Financial Services Act 2013 (IFSA 2013) updated and consolidated the legal framework for

Islamic banks and the

takaful

sector by repealing IBA 1983 and Takaful Act 1984. IFSA 2013

provides robust legal foundations for the development of a stable Islamic banking and takaful

sector by reinforcing the regulatory and supervisory framework to foster the soundness of

financial institutions and strengthen the business conduct, consumer protection and integrity

0

10

20

30

40

50

60

70

80

High income Upper-middle

income

Lower-middle

income

Low income East Asia &

Pacific

OIC Members

(40)

Malaysia

63

49

45

39

40

43

50

77

64

58

54

53

55

42

58

57

52

47

46

51

33

index value (1-100 Highest)

Preparation Procurement

Contract management