Islamic Fund Management

80

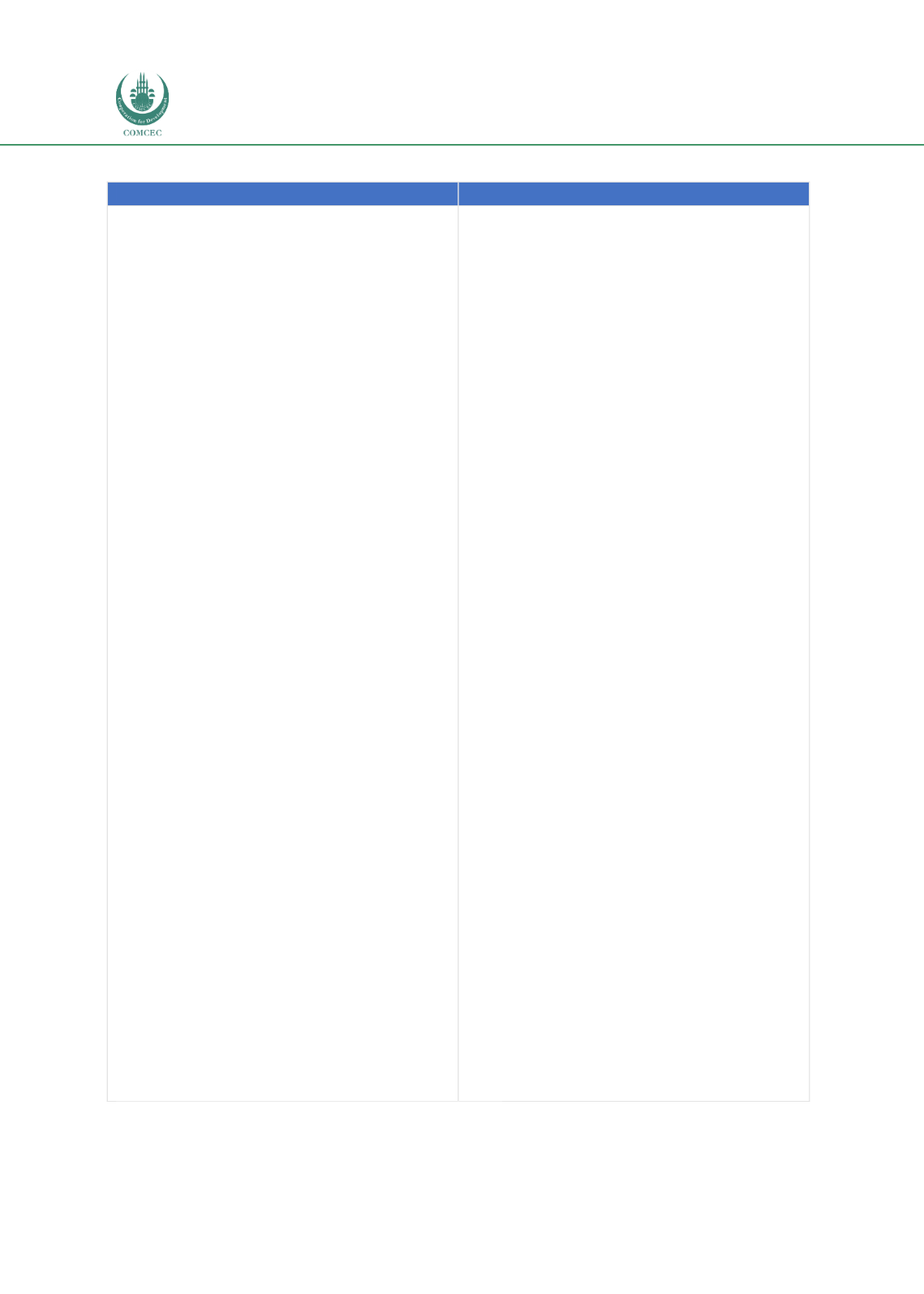

Table 4.5: Tax Incentives for the Malaysian Fund Management Industry

Fund Management Company

Collective Investment Scheme

Licensed foreign fund management company:

A 10% tax on chargeable income from the

provision of fund management services to

foreign investors.

Licensed fund management company:

Tax exemption on statutory income derived

from

the

business

of

providing

fund

management services to:

1.

Local and foreign investors in Malaysia.

2.

Business trusts and REITs in Malaysia.

The fund must be managed in accordance with

Shariah principles and certified by the SC (until

YA 2020)

Tax exemption on management fee income from

managing conventional and Shariah-compliant

SRI funds, for YA 2018 to 2020. The SRI funds

must be approved by the SC.

Unit Trust:

Tax exemption on interest income from any

licensed bank/financial institution/development

financial institution. In the case of a wholesale

fund which is a money market fund, the

exemption will only apply if the fund complies

with the criteria set out in the relevant

guidelines of the SC.

Tax exemption on gains following the realisation

of investments.

Tax exemption of interest or discount.

PRS:

The GOM will match RM1,000 per qualified

person (aged between 20 and 30) if the

individual made PRS contributions every year

from YA 2014 to YA 2018.

Tax relief of up to RM3,000 for PRS and

deferred annuity scheme premium (YA 2012 to

YA 2021).

REIT:

Tax exemption on all income if at least 90% of

total income is distributed and the REIT is listed

on Bursa Malaysia.

Exemption of stamp duty on instruments of

transfer/deeds of assignment relating to the

purchase of real property, and instruments of

transfer of real property to REIT.

Exemption of real property gains tax on the

disposal of real property to REIT.

Final withholding tax of 10% on income

distribution received by non-corporates or

foreign institutional investors from a REIT which

has been exempted from tax (until YA 2019).

Final withholding tax of 24% on income

distribution received by non-resident companies

from a REIT which has been exempted from tax.

Special single deduction for consultancy, legal

and valuation service fees incurred in the

establishment of a REIT.

No balancing charge on the disposal of an

industrial building by a company to a REIT. The

REIT is eligible to claim the balance of any

unclaimed industrial building allowance of the

disposer if the disposer company owns 50% or

more of the units in the REIT.

An SPV established by a REIT is treated as a tax-

transparent entity, where its income is deemed

received by that REIT for income tax purposes.

Closed-end fund:

Tax exemption on gains following the realisation

of investments.

Tax exemption on interest or discount.

Source: 2018 Malaysian Budget announced on 27 October 2017