Islamic Fund Management

82

3.

Wider Investor Base

Demand for Shariah-compliant investments has been increasing rapidly, driven by Malaysia’s

relatively large Muslim population. The level of financial inclusion has also grown in tandem

with market education on the importance of savings and financial planning (e.g. children’s

education, retirement). The GOM’s tax-related incentives for the channelling of private savings

to institutional funds (e.g. PRS, children’s education) have further fuelled demand for Shariah

funds.

The presence of institutional investors in Malaysia’s capital market has also played a critical

role in deepening the market’s liquidity. Additional players in the ICM (e.g. Tabung Haji,

investors with a sole appetite to invest in Shariah-compliant assets) enables access to wider

investors.

Islamic REITs

In 2005, Malaysia was the first country to introduce guidelines on Islamic REITs. This

pioneering effort has become one of the many initiatives undertaken by Malaysian regulators

to turn the country into a leader in Islamic finance. The response to the launch of the

guidelines on the development of Islamic REITs had been positive, followed by the listing of

four such REITs.

Table 4.6provides a brief description of Malaysia’s Islamic REITs while

Figure 4.3an

d Figure 4.4depict the structures of selected Islamic REITs. Traditionally, REITs

are close-ended funds that focus on holding/investing in real estate and related assets.

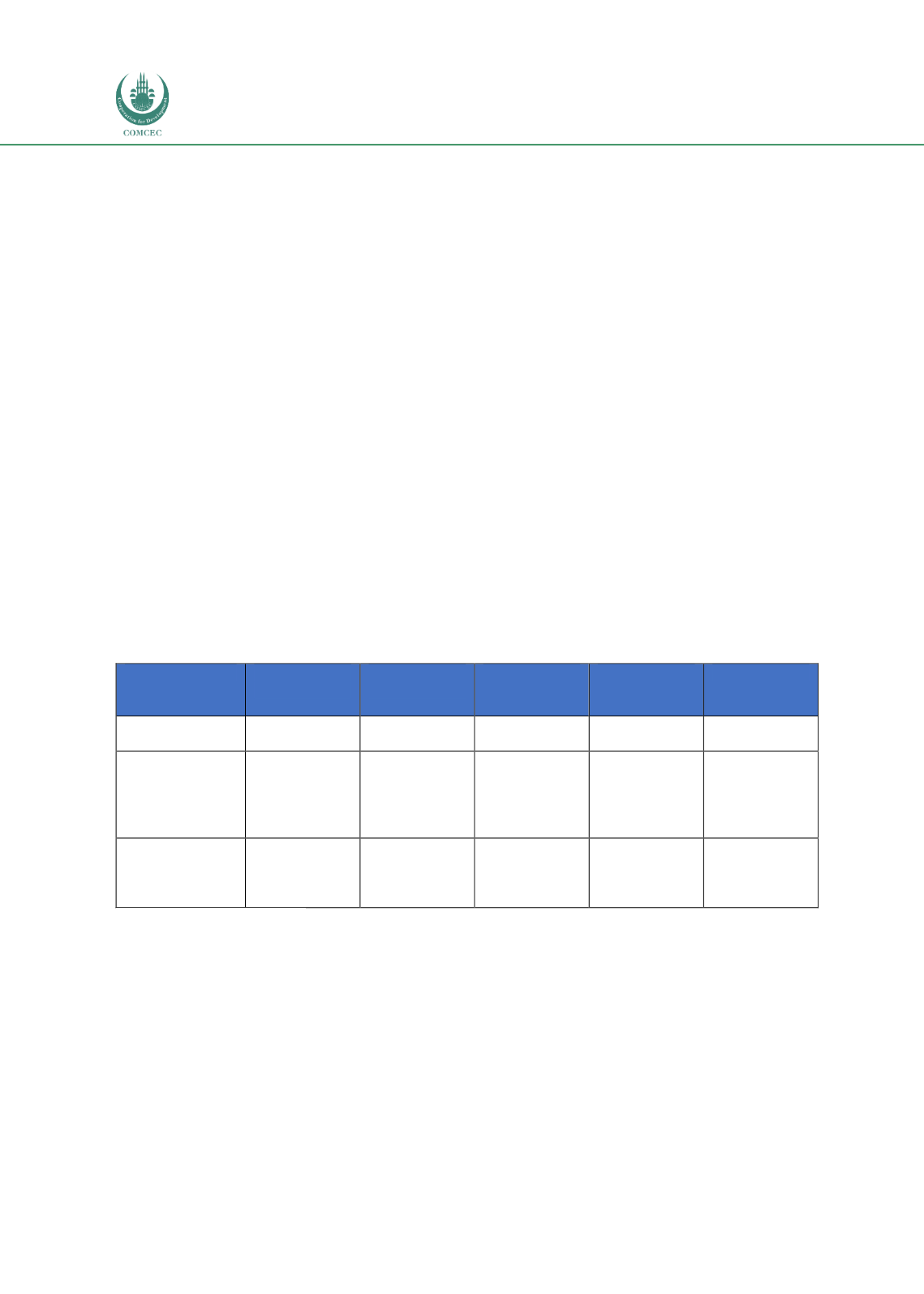

Table 4.6: Islamic REITs in Malaysia

Al-Aqar KPJ

REIT

Al-Hadharah

Boustead

REIT

AXIS REIT

KLCC REIT

Al-Salam REIT

Date listed

June 2006

January 2007

August 2005

May 2013

September

2015

Type of property

Healthcare

Oil palm

plantations

Industrial and

office buildings

Commercial

building,

shopping

complex, land

Commercial

building,

shopping

complex,

restaurants

Market

capitalisation (as

at end-2017)

RM1.04 billion

Delisted in

2014

RM1.71 billion

RM13.45

billion

RM496.0

million

Source: Islamic REITs’ websites

Note: AXIS REIT had originally been established

as a conventional REIT, but was restructured into a Shariah-

compliant REIT in December 2008.