Islamic Fund Management

86

As at end-2017, i-VCAP managed 4 of the total 5 Islamic

ETFs listed on Bursa Malaysia. These Islamic ETFs’

collective market capitalisation stood at RM468.4

million as at the same date, representing a 24.2% share

of the market (ETFs’ total market capitalisation stood at

RM1.9 billion). Penetration of ETFs has been slow, as

depicted by Chart 1. In terms of market capitalisation, it

is the lowest compared to other funds (refer to

Table 4.3 for comparison). Lack of market awareness and

accessibility (i.e. investing is undertaken by brokers

and individuals with CDS accounts) have been

identified as some of the challenges faced by the ETF

industry.

Source:

i-VCAP

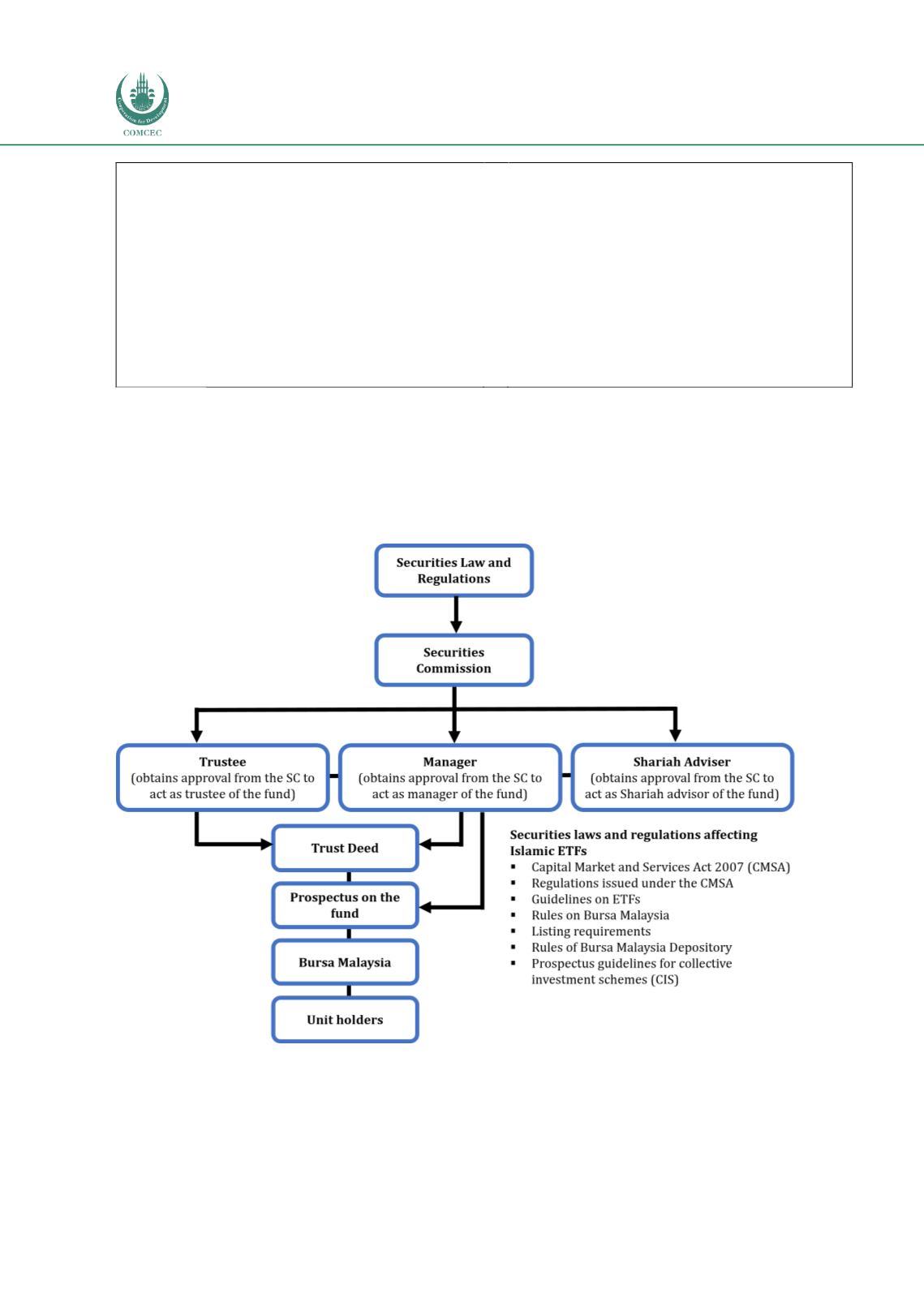

The establishment, operation and listing of Islamic ETFs in Malaysia are subject to the various

provisions and requirements of the SC.

Figure 4.6provides an overview of Malaysia’s

regulatory environment for Islamic ETFs.

Figure 4.6: Concept and Regulation of Islamic ETFs in Malaysia

Source: Investment in Unit Trust Funds that are Listed and Traded on the Stock Exchange, SC