Islamic Fund Management

76

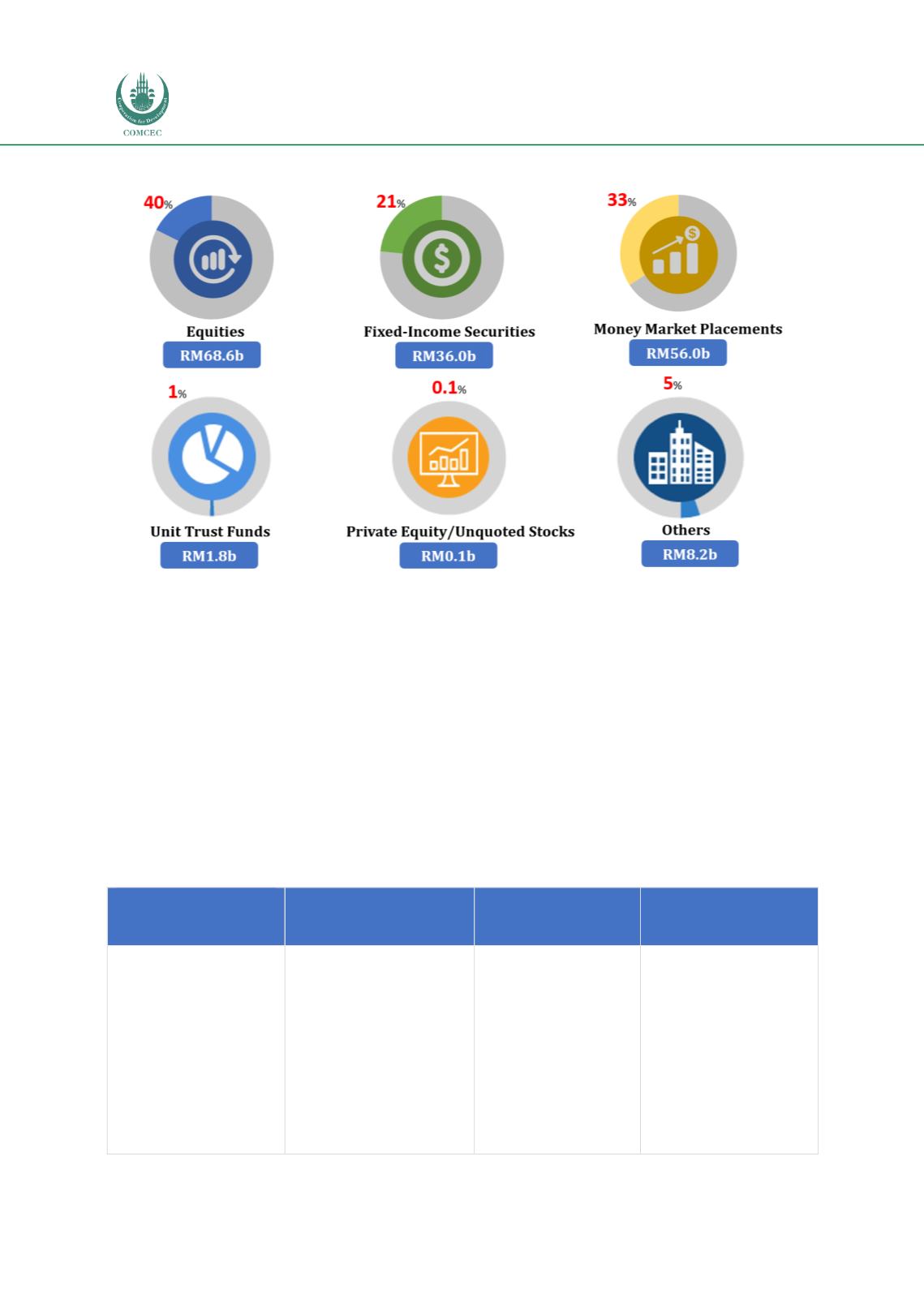

Chart 4.5: Allocation of Shariah Investment Assets from Total AuM (end-2017)

Source: SC

Note: Balance of RM8.21 billion is classified as ‘others’, which include uninvested cash, REITs, wholesale funds,

ETFs, derivatives, business trusts, futures and close-ended funds.

Demand for Shariah-compliant assets can be traced back to Tabung Haji, which acted as a

catalyst for product innovation when it was founded in 1963. It had shaped the value chain for

Shariah-compliant assets. Apart from equities and sukuk, Malaysia’s ICM also offers a diverse

range of Islamic funds consisting of CIS which include unit trust funds, wholesale funds, REITs

and ETFs, private retirement scheme (PRS) and private mandate.

Table 4.3provides a broad description of the performance of key ICM segments. Given the

industry’s robust performance, Malaysia took second place in terms of global Islamic AuM

(excluding Iran) as at end-2017, with RM170.8 billion, and also boasted the world’s most

numerous Islamic funds.

Table 4.3: Performance of Key Segments of ICM in Malaysia

Islamic AuM as a

percentage of Total

Funds Managed

Shariah-compliant

Securities

Sukuk

Islamic REITs

As at end-2017, Islamic

AuM stood at RM170.8

billion (or

22.2

%) of

Malaysia’s total funds

managed, valued at

RM776.23 billion.

As at end-2017, 688 stocks

(or

76

%) listed on Bursa

Malaysia complied with the

SC’s Shariah screening

methodology. These had a

market capitalisation

worth RM1.1 trillion

against the entire market’s

total market capitalisation

of RM1.9 trillion.

As at end-2017, the

value of domestic

sukuk issuances stood

at RM168.68 billion (or

53.3

%) of the total

bonds issuances

Domestic sukuk

outstanding comprised

58.8% of total domestic

debt securities.

As at end-2017, there

were 4 Islamic REITs

against a total of 18

REITS, with a market

capitalisation of RM19.1

billion (or

41.0

%)

compared to RM46.5

billion for the overall

market.