Islamic Fund Management

75

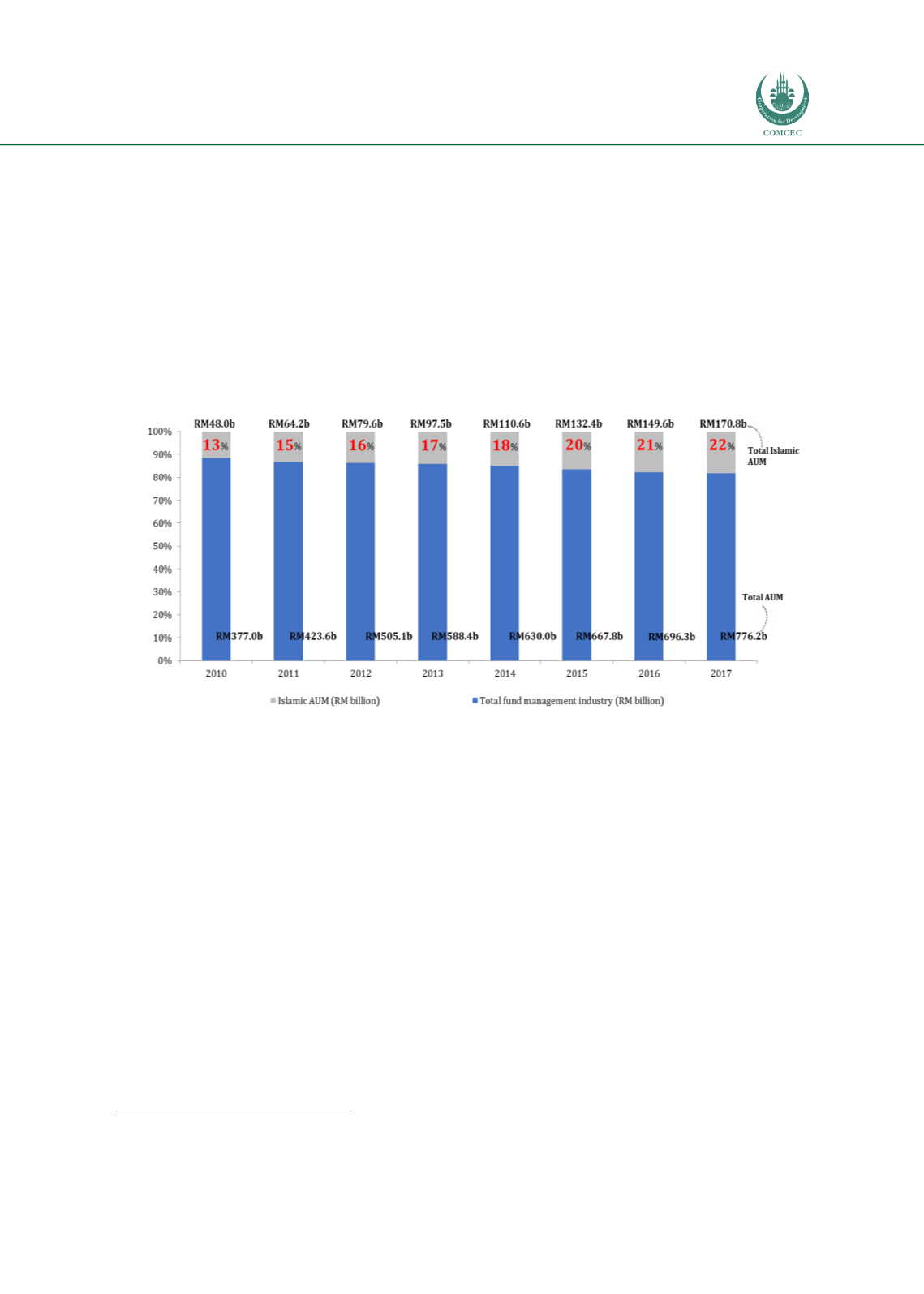

Share of Domestic Islamic Funds against Total Funds Managed

Development initiatives and industry-driven innovations have been achieved through the

initiatives mapped out under the SC’s Capital Market Masterplan (CMP) (2001-2010) and

CMP2 (2011-2020). These have led to a comprehensive offering of Islamic investment and

financing products for both retail and institutional (or wholesale) investors. Given the

increasing demand for and supply of Shariah-compliant products, the country’s Islamic AuM

have been growing steadily and rapidly

. Chart 4.4shows the rise in the percentage of Islamic

AuM, from 13% (or RM49.0 billion) in 2010 to 22% (or RM170.8 billion) in 2017 of Malaysia’s

overall fund management industry, which was valued at RM776.2 billion as at end-2017.

8

Chart 4.4: Malaysia’s Islamic AuM as a Percentage of Total AuM (2010-2017)

Source: SC

Islamic AuM is further segregated into various categories of asset allocation, as depicted in

Chart 4.5 .As at end-2017, by asset class, Shariah-compliant equities accounted for the largest

slice (40%), followed by money market placements (33%) and fixed-income securities (21%).

8

Data extracted from SC’s website on 27 July 2018.