Islamic Fund Management

77

Islamic ETFs

Islamic Unit Trusts

Islamic PRS

Islamic Wholesale

Funds

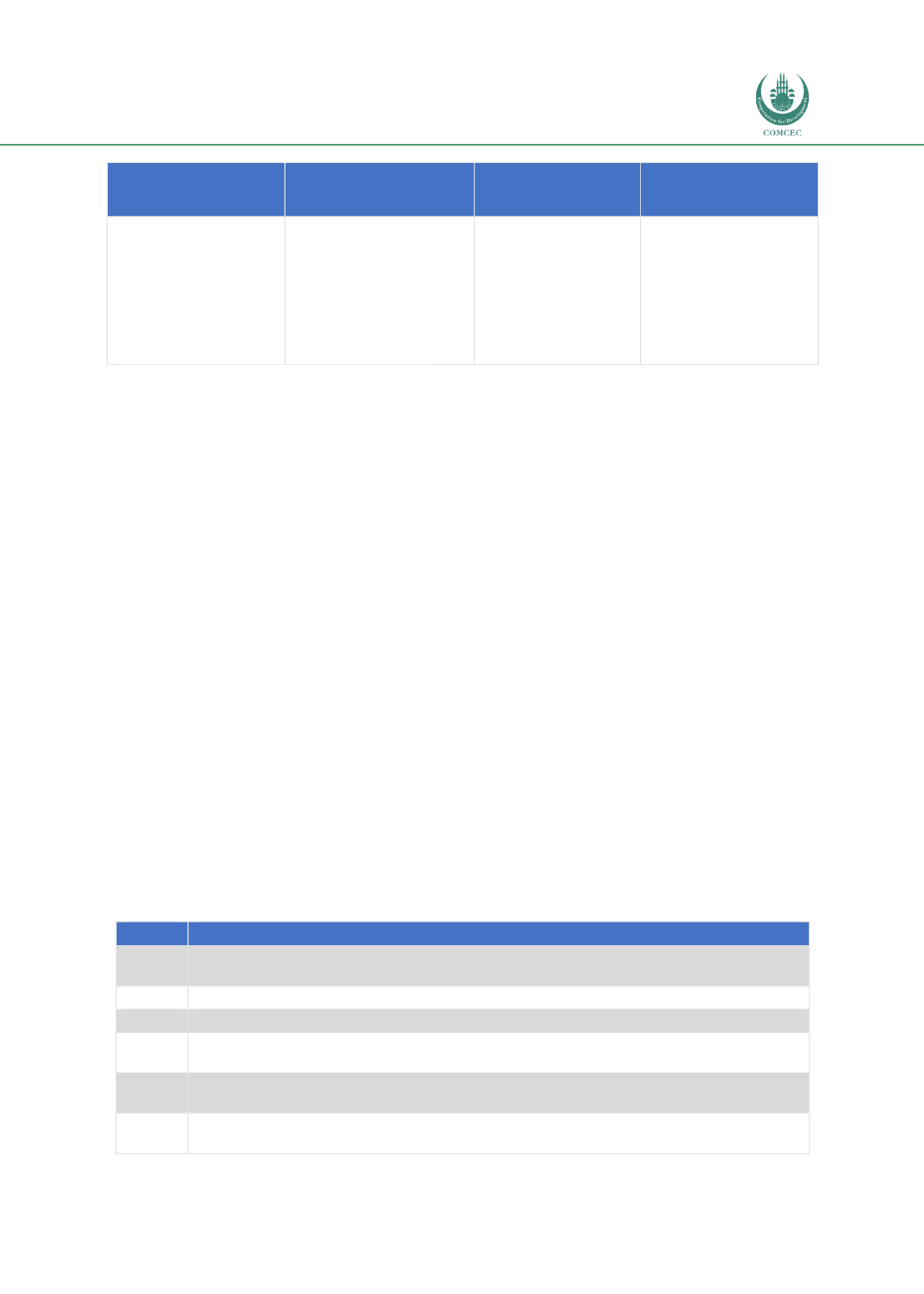

As at end-2017, there

were 5 Islamic ETFs

among the 9 ETFs in

total, with a market

capitalisation of RM468.4

million (or

24.2

%)

compared to RM1.9

billion overall.

As at end-2017, there were

213 Islamic unit trusts

with a collective NAV of

RM77.8 billion (or

18.2

%) compared to the

entire market’s RM427.0

billion.

As at end-2017, there

were 25 Islamic PRS

with an NAV of RM0.72

billion (or

32.3

%)

compared to the

overall market’s

RM2.23 billion.

As at end-2017, there

were 77 Islamic

wholesale funds, with an

NAV of RM37.7 billion

(or

44.5

%) compared

to the entire market’s

RM84.7 billion.

Sources: SC, Bursa Malaysia, Eikon-Thomson Reuters

4.2.2

Evolution of Malaysia’s Islamic Fund Management Industry

Malaysia’s ICM operates within a well-established and facilitative regulatory environment

under the umbrella legislation of the Capital Markets and Services Act 2007 (CMSA). Its capital

market regulatory framework is benchmarked against the International Organisation of

Securities Commissions’ (IOSCO) principles of securities regulation, which are aimed at

ensuring the protection of investors; maintaining fair, efficient and transparent markets; and

reducing systemic risks.

The issuance and offering of all products and services, including Shariah-compliant, are subject

to identical requirements for disclosure, transparency, governance and best practices, as well

as oversight of intermediaries and their agents carrying out regulated activities, to be

conducted within a single supervisory framework. Investors in the ICM, therefore, receive at

least the same level of legal and regulatory protection as those in conventional markets.

The regulatory framework for the ICM is further enhanced by Shariah governance and tax

frameworks. The SC has established a two-tier Shariah governance framework through a

national-level SAC and the requirement of appointing Shariah advisers registered with the SC

at the firms’ level. Various Shariah rulings and scholarly reasonings are compiled and

published in a transparent manner, to provide guidance and assurance to issuers, investors

and intermediaries on the consistency of application of Shariah principles.

Table 4.4outlines the developmental milestones and release of policies and guidelines that

have had an impact on Malaysia’s Islamic fund management industry.

Table 4.4: Timeline of Key Regulatory Initiatives in Malaysia

Year

Timeline Description

1995

Guidelines on public offerings of securities of closed-end funds.

Release of Shariah screening methodology.

2000

Guidelines on the establishment of foreign fund management companies.

2002

Release of CMP

2005

Guidelines on the compliance function in fund management.

Guidelines on Islamic REITs.

2007

Guidelines on Islamic fund management.

SC signed mutual recognition agreement (MRA) with Dubai Financial Services Authority.

2008

Guidelines on unit trust funds.

Guidelines of CIS.