Islamic Fund Management

78

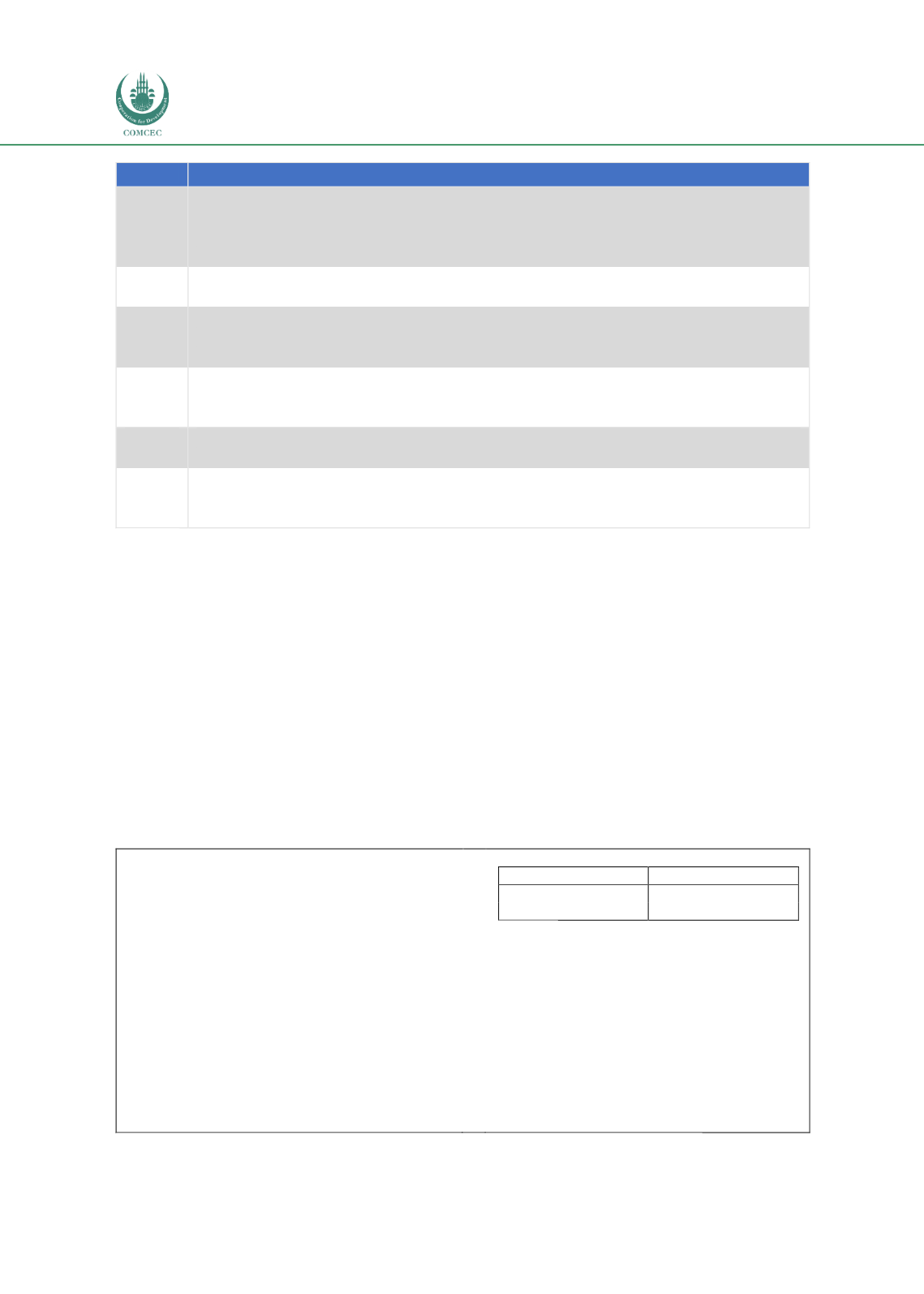

Year

Timeline Description

2009

Guidelines on ETFs.

SC signed MRA with the Securities and Futures Commission of Hong Kong.

Liberalisation of equity holdings in capital market intermediaries, to allow foreign

ownership of conventional and Islamic fund management companies.

2011

SC signed a memorandum of understanding (MOU) with Central Bank of Ireland.

Launch of CMP2

2012

SC signed MOU with Commission de Surveillance du Secteur Financier Luxembourg to

facilitate the offering of Islamic undertakings for collective investment in transferable

securities.

PRS framework.

SAC amended the Shariah screening methodology and adopted a two-tier quantitative

approach.

2014

Launch of the ASEAN CIS framework by Malaysia, Singapore and Thailand to facilitate cross-

border offering of CIS, including Islamic CIS.

2017

SC’s Islamic Fund and Wealth Management Blueprint.

Guidelines on SRI funds.

Digital investment management framework.

Source: SC

International managers managing a significant portion of Islamic funds in Malaysia as the

liberal environment permits full foreign ownership, with no restrictions on overseas

investments. As a result, as at end-2017, 20 full-fledged Islamic fund management companies

are operating in Malaysia, half of which are entirely foreign-owned while one is a local-foreign

joint venture.

A major deliverable by the SC under the CMP2 is the development of Malaysia’s private

retirement landscape. The key goals of the CMP2 includes facilitating markets’ effective

utilisation of domestic savings for capital formation, increasing the capacity and efficiency of

the capital markets in financing the investment requirements for economic growth, and

addressing the efficiency of savings intermediation, which includes the development of PRS, as

described i

n Box 4.1 .Box 4.1: Malaysia’s PRS landscape

The retirement landscape in Malaysia has been

boosted by the development of a PRS framework,

Under Budget 2012, the Government of Malaysia

(GOM) announced a tax relief of up to RM3,000 per

annum for eligible individuals from YA2012 to YA

2022. An additional incentive was provided under

Budget 2014, whereby RM500 contributed by

persons aged between 20 and 30 will be matched by

the GOM. Budget 2017 raised the incentive to

RM1,000. As a result of these initiatives, the PRS

sector has been expanding about 30% annually

since its launch in 2012, although the relatively

small number of contributors suggests that more

needs to be done to encourage investment in this

scheme.

Fact sheet

As at Dec 2017

Number of members

301,279

NAV

RM2.2 billion

Source: SC

Since its launch in 2012, the AuM of PRS has

swelled from RM66.0 million (contributed by

22,000 members) to RM1.7 billion (from

248,000 members) in 2017. Notably, the number

of contributors still constitutes fewer than 1% of

the Malaysian population. In contrast, the AuM

of the unit trusts industry augmented from

RM505.0 billion to RM750.0 billion during the

same period, suggesting that PRS is growing at a

slower rate than unit trusts.

Source:

FIMM Today – State of the Malaysian Investment Management Industry, December 2017