Islamic Fund Management

84

Islamic ETFs

As at April-2018, there were six Islamic ETFs listed on Bursa Malaysia. The main difference

between a conventional ETF and an Islamic ETF is the benchmark index that the latter tracks.

An Islamic ETF only tracks an Islamic benchmark index, the constituents of which comprise

Shariah-complaint companies. Islamic ETFs are considered a liquid and cost efficient financial

instrument that offers investors lower transaction costs than buying and selling unit trusts.

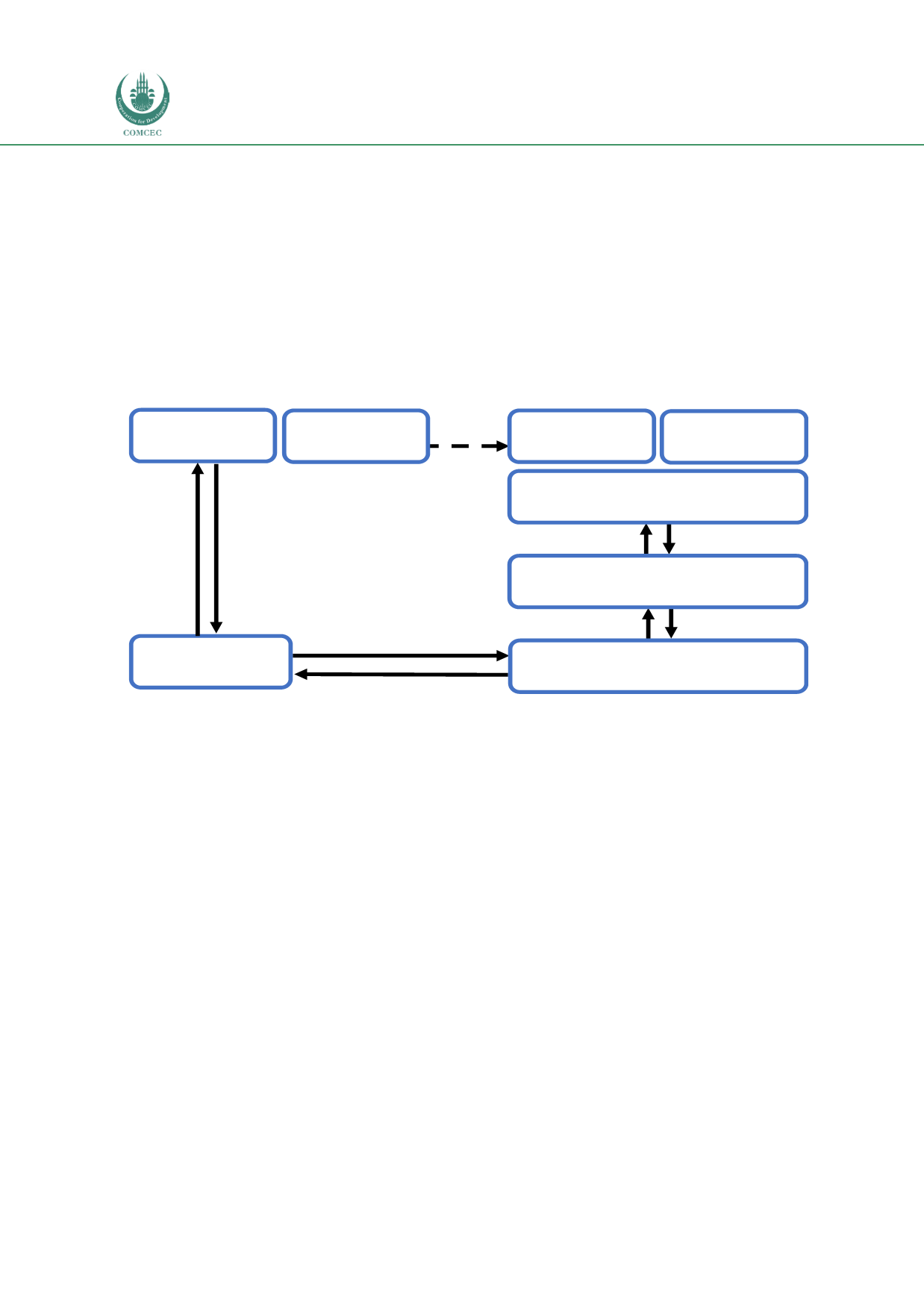

Figure 4.5depicts the basic structure of an Islamic ETF in Malaysia while

Table 4.7summarises the Islamic ETFs listed on Bursa Malaysia as at April-2018. Typically, ETFs are

structured as open-ended funds.

Figure 4.5: Basic Structure of an Islamic ETF in Malaysia

Buy ETF units

Advisory on

Shariah

matters

Sell ETF units

Manager

Trustee

Investors

ShariahAdvisor/

Committee

StockExchange

Islamic ETF

Sell ETF units

Buy ETF units

Liquidity Providers

Sell ETF units

Participating Dealers

Buy ETF units

Sell ETF units

Buy ETF units

Source: Investment in Unit Trust Funds that are Listed and Traded on the Stock Exchange, SC