Islamic Fund Management

85

Table 4.7: Islamic ETFs Listed on Bursa Malaysia (as at April-2018)

MyETF

Dow Jones

Islamic

Market

Malaysia

Titans 25

MyETF

MSCI

Malaysia

Islamic

Dividend

MyETF

MSCI SEA

Islamic

Dividend

MyETF

Thomson

Reuters

Asia

Pacific ex-

Japan

Islamic

Agribusin

ess

GOLDETF

MyETF

Dow Jones

US Titans

50

Date listed

31 January

2008

21 March

2014

7 May 2015

3 December

2015

December

2017

28 February

2018

Fund

background

MyETF-

DJIM25

provides

investors

access to the

performanc

e of

Malaysia’s

Shariah

equity

market

MyETF-

MMID

provides

investors

the

opportunity

to obtain

potential

periodic

income and

capital gains

from

Malaysia’s

Shariah

equity

market

MyETF-

MSEAD

provides

investors

the

opportunity

to obtain

periodic

income and

capital gains

from the

vast

universe of

companies

in South-

east Asia

MyETF-

AGRI

provides

investors

the

opportunity

to invest in

agriculture-

based

Shariah-

compliant

stocks listed

on selected

exchanges in

the Asia-

Pacific

region

GOLDETF

aims to

provides

investors

with

investment

results that

closely track

the

performanc

e of gold

prices,

through a

Shariah-

compliant

investment

structure

MyETF-

US50 is

designed for

investors

wishing to

invest in

liquid

financial

instruments,

with an

index-

tracking

feature that

focuses on

blue-chip

companies

in the US

AuM (as at

end-April

2018)

RM304.9 mil

RM29.8 mil

RM44.1 mil

RM20.0 mil

RM41.2 mil

RM45.1 mil

Source: Islamic ETFs’ annual reports.

Note: The listed Islamic ETFs are all managed by i-VCAP Management Sdn Bhd, except for GOLDETF, which is

managed by Affin Hwang Asset Management Berhad.

Malaysia’s ETF industry started with the incorporation of ValueCAP Sdn Bhd (ValueCAP) on 16

October 2002

. Box 4.2 gives a snapshot of the evolution of Islamic ETFs in Malaysia.

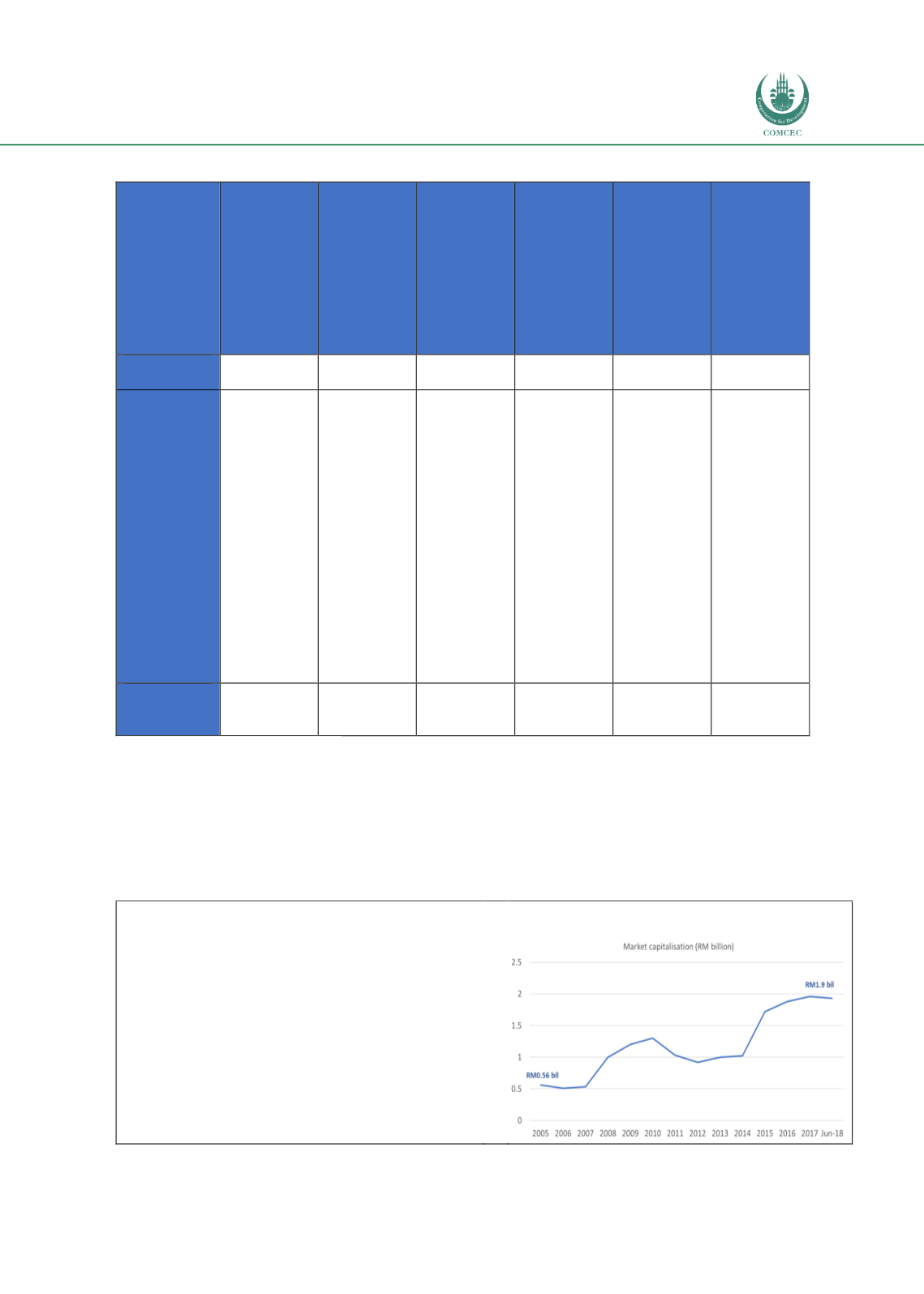

Box 4.2: Evolution of ETFs in Malaysia

ValueCAP, equally owned by Khazanah Nasional

Berhad, Kumpulan Wang Persaraan (Diperbadankan)

and Permodalan Nasional Berhad, commenced

operations as an investment-holding company of

entities listed on Bursa Malaysia. Following its strong

investment performance, ValueCAP’s business model

had then transformed into a holding company with

investments

in

two

licensed

AMCs―i-VCAP

Management Sdn Bhd (i-VCAP), which manages the

Islamic ETFs, and VCAP Asset Managers Sdn Bhd

(VCAM) which manages conventional funds.

Chart 1: Growth of ETFs by market

capitalisation