Islamic Fund Management

73

4.2

Malaysia

4.2.1

Overview of Malaysia’s Islamic Finance and Islamic Fund Management

Industries

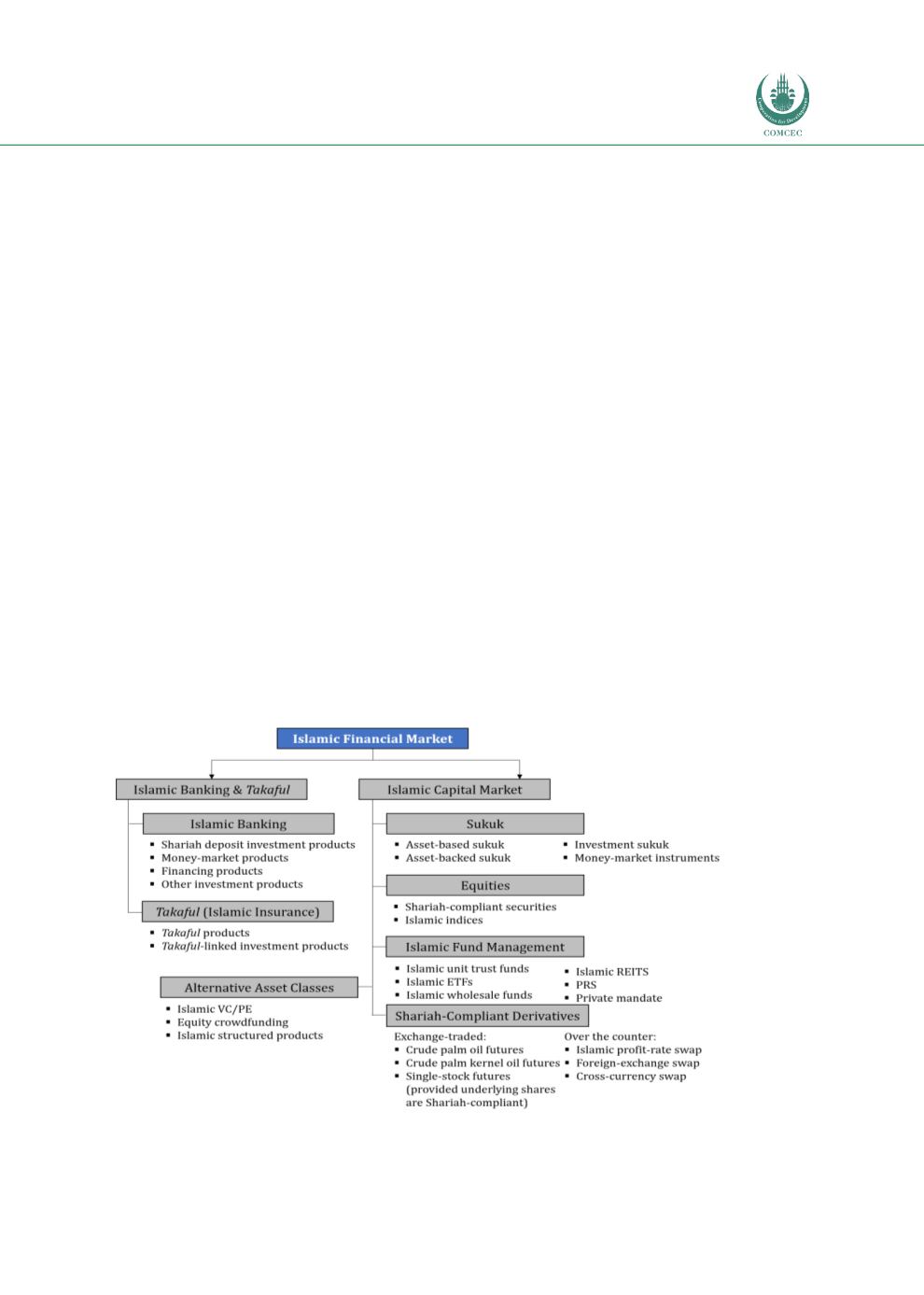

A Snapshot of Malaysia’s Islamic Financial Market Landscape

As depicted in

Figure 4.1and

Chart 4.2,Malaysia boasts one of the world’s most advanced

Islamic financial markets. Its ICM hosts the world’s largest sukuk market, with an average

annual growth rate of 11.0% between 2007 and 2017. As at end-2017, Malaysia accounted for

USD36.5 billion (or 34.6%) of the total USD105.5 billion of global sukuk issuance.

The country’s Islamic fund management industry has been charting strong growth and is

ranked second as at end-2017, after Saudi Arabia (excluding Iran). Malaysia has been chosen

as a country case study and is categorised as ‘matured’ due to the following factors:

Level of its Islamic financial market development and recognisable market share in

global Islamic banking, ICM (e.g. sukuk, fund management) and

takaful

.

Operates within a well-established and facilitative regulatory environment

benchmarked to the IOSCO principles, supported further by its Shariah governance

and tax frameworks.

Clear methodology and guidelines on Shariah screening.

Robust performance of its ICM has contributed significantly to a sustainable supply of

investable Shariah-compliant assets.

Figure 4.1: Malaysia's Islamic Financial Market

Source: Adapted from SC