Islamic Fund Management

74

Chart 4.2: Growth of Malaysia’s ICM (2010-2017)

46%

48%

50%

52%

54%

56%

58%

60%

62%

-

1,000.00

2,000.00

3,000.00

4,000.00

5,000.00

6,000.00

2010

2011

2012

2013

2014

2015

2016

2017

RM billion

Total size of ICM

Total capital market

% ICM to total capital market

54

%

59

%

Sources: BNM, SC

Note: Based on the SC’s definition, the size of the ICM is equivalent to the total market capitalisation of Shariah-

compliant securities and the amount of outstanding sukuk.

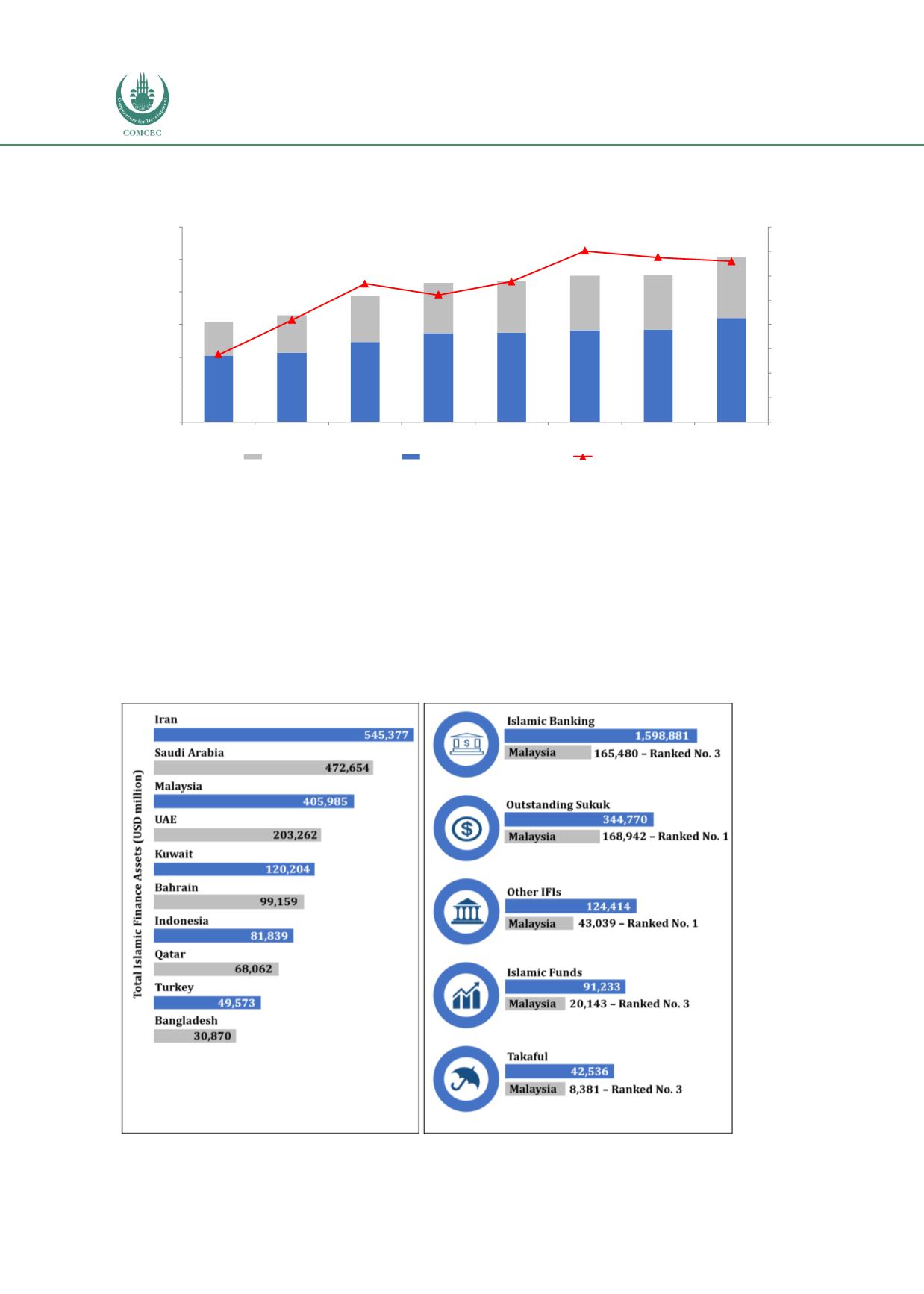

The robust performance of Malaysia’s equity, sukuk and Islamic funds market have

contributed to the strong growth of Islamic fund management industry. According to the ICD-

Thomson Reuters Islamic Finance Development Report 2017, as depicted in

Chart 4.3 ,Malaysia’s share of global Islamic funds came up to 22.1% (or USD20.1 billion), ranking it third

after Iran and Saudi Arabia as at end-2016. By 2022, the aforesaid report expects the global

Islamic outstanding AuM to hit USD403.0 billion (end-2016: USD91.2 billion).

Chart 4.3: Malaysia’s Market Share of Islamic Finance Assets (end-2016)

Source: ICD-Thomson Reuters Report (2017)