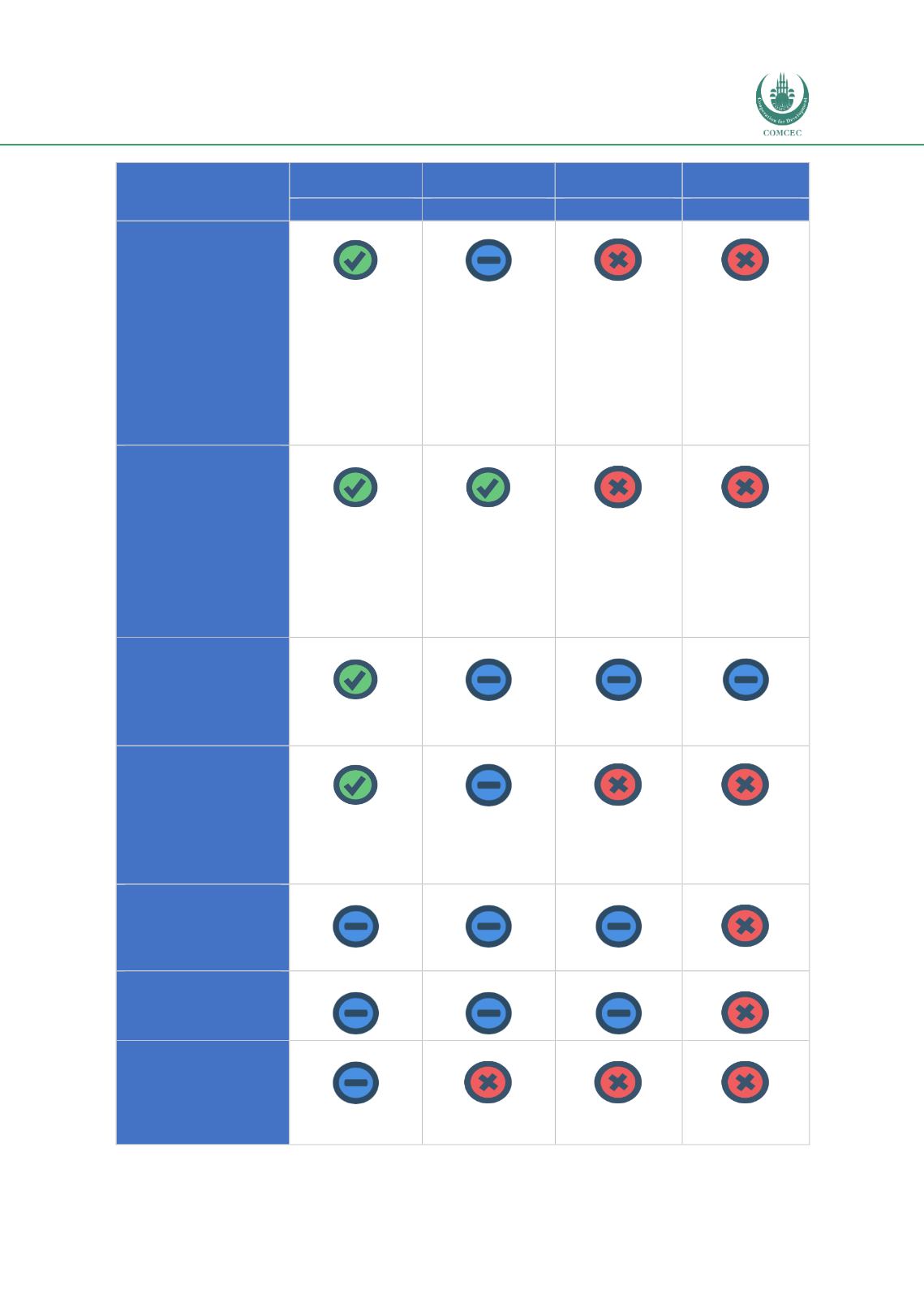

Islamic Fund Management

69

Matured

Developing

(Advanced)

Developing

(Intermediate)

Infancy

Malaysia

Pakistan

South Africa

Morocco

Regulatory

framework:

-

Strong and single

regulatory framework

to govern the Islamic

financial market

-

Specific guidelines on

Islamic fund

management

-

Regulatory protection

for investors in

Islamic finance

market

Shariah governance

framework:

-

Centralised Shariah

board

-

Shariah resolutions/

standards on Islamic

fund structures

-

Key functions such as

advisory, review and

audit

-

Shariah screening

Infrastructure:

-

Trading platform

-

Clearing and

settlement

-

Listing and approval

processes

Tax neutrality and

incentives:

-

Removal of taxes

related to transfer of

assets

-

Incentives for Islamic

fund management

industry

Diversification of

funds:

-

Diversity in Islamic

fund structures and

products

Diversification of asset

class:

-

Diversity in allocation

of Islamic funds

Diversification of

investor base:

-

Institutional investors

-

Inclusion of retail

investors