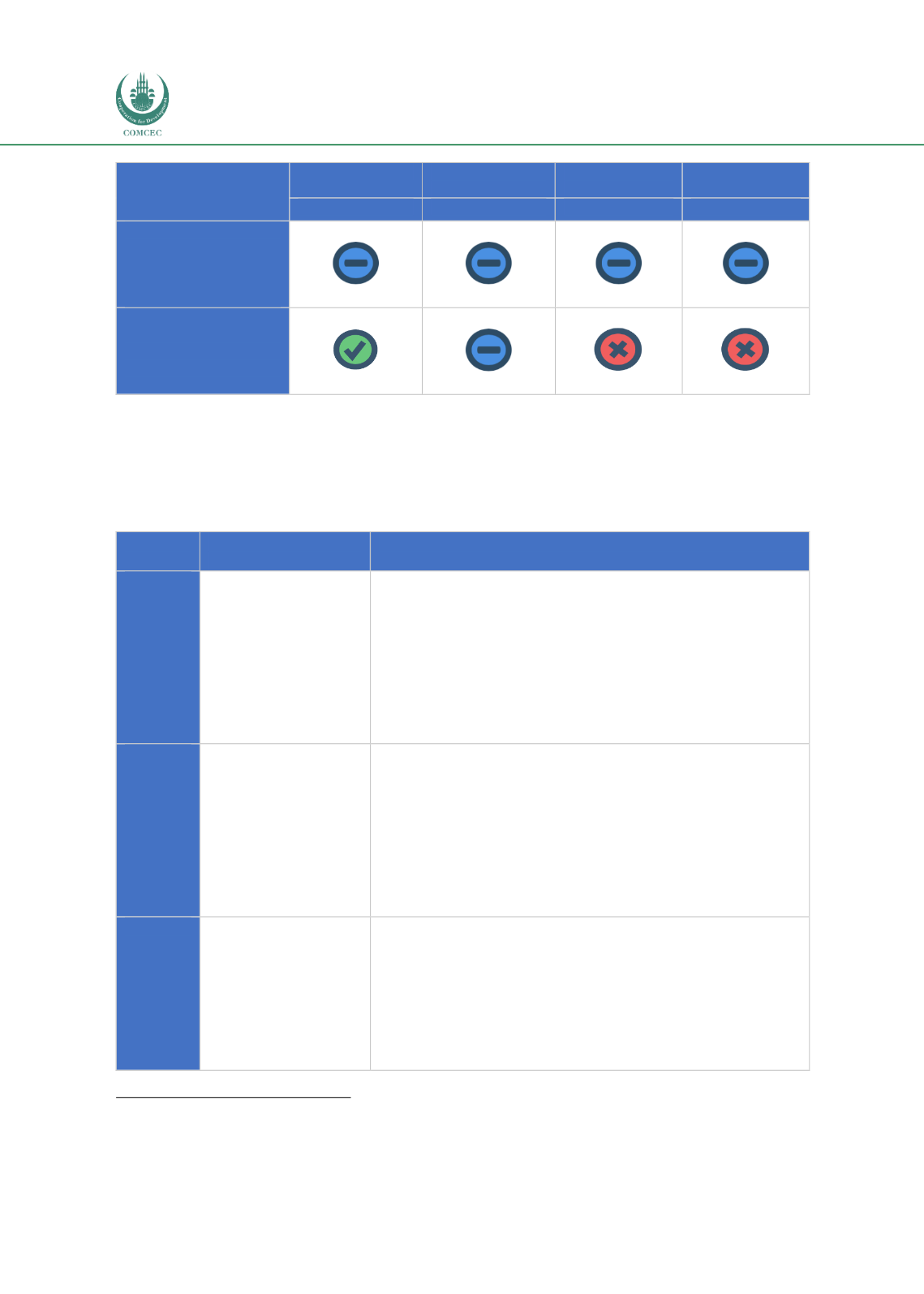

Islamic Fund Management

70

Matured

Developing

(Advanced)

Developing

(Intermediate)

Infancy

Malaysia

Pakistan

South Africa

Morocco

Transparency of

transaction costs:

-

All-in cost in terms of

legal, pricing, issuance

timeline

Capacity/Talent

development:

-Experts in Islamic

finance and Islamic fund

management industry

Sources: RAM, ISRA

Further details on the development-stage matrix are provided in

Table 4.2

. The ‘developing’

category is further segregated into i) advanced; ii) intermediate; and iii) beginner to

differentiate the level of market development in each country.

Table 4.2: Description of the Development-Stage Matrix

Country

Stage of

Development

Rationale

Malaysia

Matured

Malaysia’s Islamic finance industry is among the world’s

most advanced. Its level of maturity supports the sturdy

performance of its ICM, including Islamic funds. This is

reflected by the Malaysian ICM’s share of the overall capital

markets (2017: 59%). The country’s strong GDP per capita

of USD9,944.9 in 2017 further highlights its healthy

economic growth.

7

The adoption of a two-tier quantitative

Shariah

screening

approach

has

boosted

the

competitiveness of its Islamic fund management industry.

Pakistan

Developing

(Advanced)

According to the Islamic Finance Development Indicator

(IFDI) 2017 Rank, Pakistan is among the top five performers

in Islamic finance. Its GDP per capita stood at USD1,547.9 in

2017. Out of the 559 companies listed on the Pakistan Stock

Exchange (PSX), 250 were Shariah-compliant as at end-

March 2018. In March 2018, Pakistan issued a draft Shariah

Governance Regulation 2018, which will further strengthen

its existing Shariah screening methodology. This supports

its categorisation as a ‘developing (advanced)’ market.

South

Africa

Developing

(Intermediate)

South Africa’s Islamic fund management industry is slowly

emerging, coming in at eighth position with a 2.4% share of

global Islamic funds as at end-2017. The lack of a

harmonised approach to Shariah screening and the absence

of a healthy sukuk pipeline are among the challenges

hampering its current performance. Based on the latest data

from JSE, there are now 160 Shariah-compliant companies

out of 400. The GDP per capita of South Africa stood at

7

The figure of GDP per capita for each country is extracted from The World Bank Data on 28 August 2018, available at

http://data.worldbank.org/indicator/NY.GDP.PCAP.CD