Islamic Fund Management

54

3.1.3

Advantages and Disadvantages of Various Funds

With any type of investment, investors are exposed to risks and rewards. Having a clear

financing objective and awareness of the associated risks will help manage the expectations on

investment performance. A summary of the potential advantages and disadvantages of funds

by asset class is presented in

Table 3.4

.

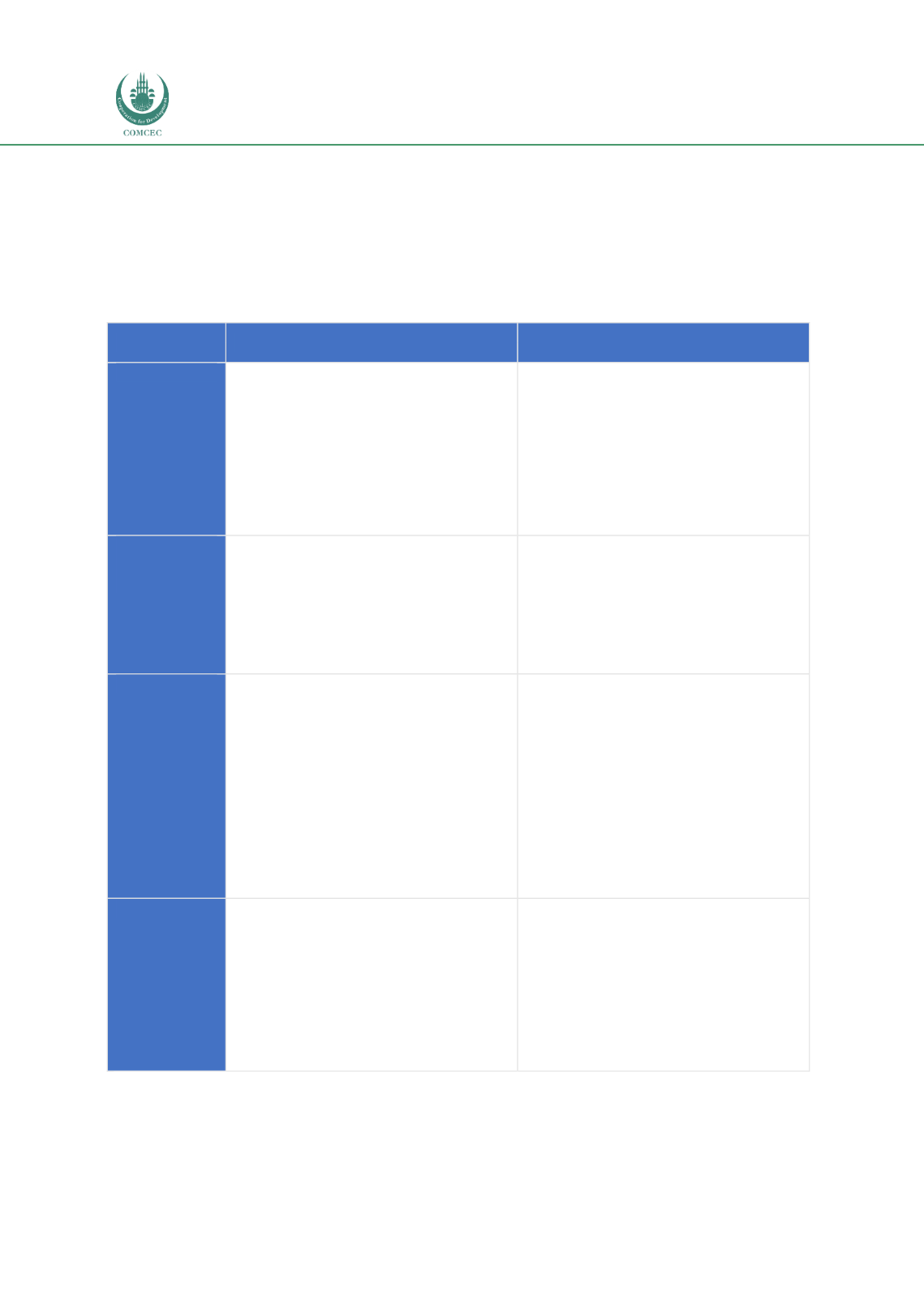

Table 3.4: Advantages and Disadvantages of Funds by Asset Class

Asset Class

Advantages

Disadvantages

Equities

Higher returns than fixed deposits and

other types of funds.

Steady income.

Capital appreciation.

Portfolio diversification.

Funds are professionally managed, with

access to better information compared

to average investors.

Minimum entry cost for investment.

Exposed to upfront and recurring

transaction costs that will have an

impact on returns.

Unpredictability - cyclical market

conditions may not suit risk-averse

investors.

Medium-to-long-term

investment

horizon.

Fixed-

Income

Securities

Portfolio diversification.

Suitable

for

low-to-medium-risk

investors.

Steady income.

Funds are professionally managed.

Minimum entry cost for investment.

Exposed to upfront and recurring

transaction costs that will have an

impact on returns.

Less exposure to market volatility

compared

to

equity-based

funds.

However, investors are still exposed to

market cycles.

ETFs

Offer

investors

more

diversified

exposure than investment in individual

stocks/forex/commodities.

Entry cost is lower compared to direct

investments, e.g. gold.

Lower

annual

management

fees

compared to unit trust funds.

Transparency – investors know exactly

which assets are held in the ETF.

Since ETFs are traded like stocks,

investors have easy access to liquidity.

Funds are professionally managed.

Limited number of ETFs to choose from

in the market compared to unit trust

funds.

Intraday price swings may make short-

term investors jittery.

Costs could be higher than trading in

stocks, which attract no management

fees.

REITs

Portfolio diversification.

Potentially higher returns in return for

medium-level risk.

Income is secured by long-term leases.

Properties are professionally managed.

Potentially slower growth since only

10% is allowed to be reinvested.

Exposed to potentially high leverage

ratios.

Higher tax rate on dividends.

Need to operate in a REIT-compliant

manner.

Sensitive to other higher-yielding

investments.

Sources: Sharmila (2014), RAM