Islamic Fund Management

49

infrastructure sector, which may have complementing effects to securities in the

construction, cement and steel sectors.

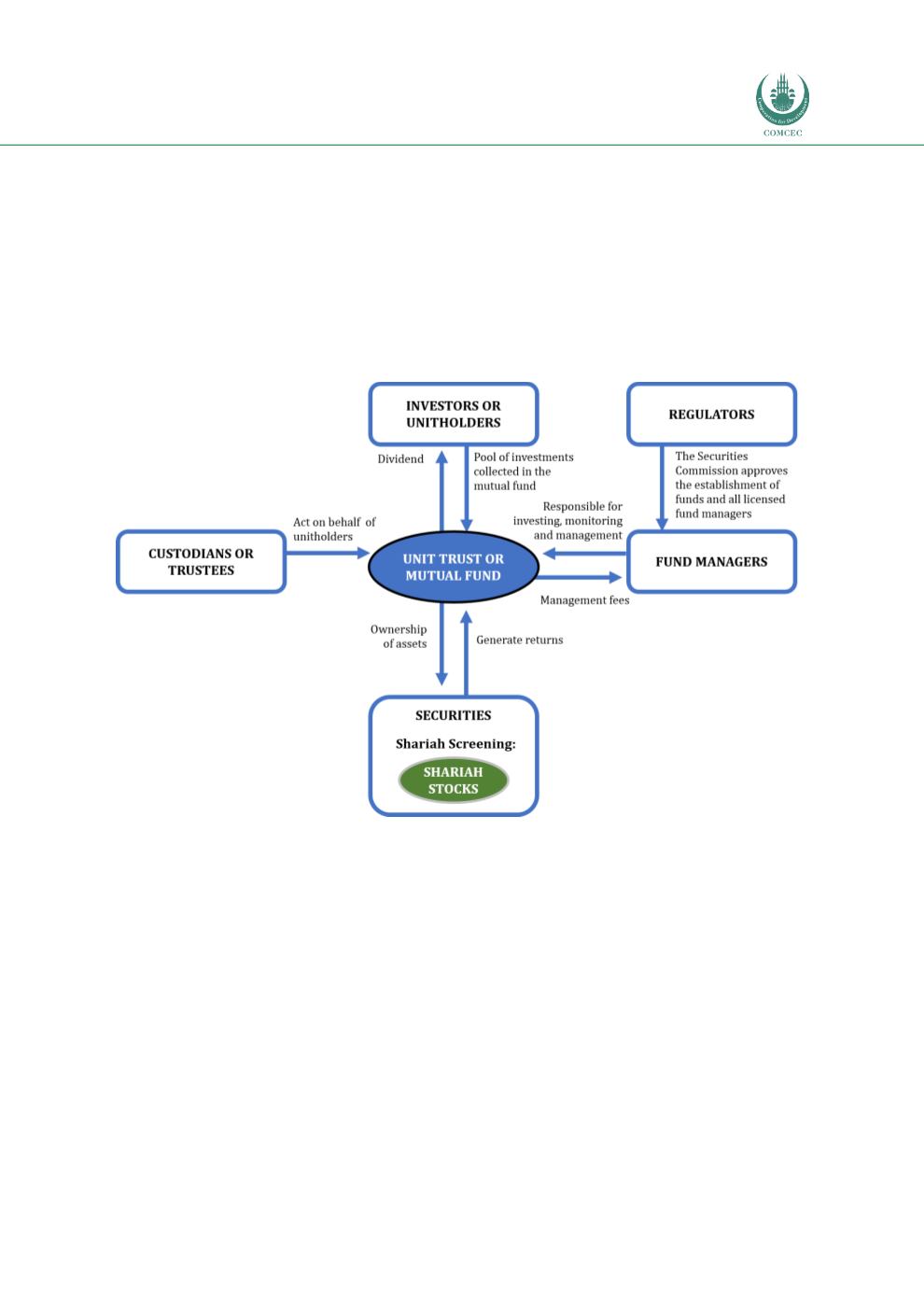

In the structuring of Shariah-based investment funds, the asset manager will choose the

various screening methodologies available in the market. For example, depending on the

geographical location of the investors, the Dow Jones, the MSCI or the FTSE Shariah screening

standards can be adopted to meet the requirements of global investors.

Figure 3.4 shows the

basic structure of an Islamic equity fund.

Figure 3.4: Basic Structure of an Islamic Equity Fund

Source: RAM

2.

Fixed-Income Funds

Debt funds invest in fixed-income securities such as bonds and treasury bills. A debt fund is

less volatile and provides a steady but low income relative to an equity fund. The basic

structure will be similar to an equity-based fund, except the type of investments will be fixed-

income securities or sukuk, as shown i

n Figure 3.5 .Types of fixed-income funds include:

a)

Liquid funds

: These funds invest in highly liquid money market instruments and

provide easy liquidity. They invest in securities with a residual maturity of not more

than 91 days. Investors can park their money in these for a short period of, say, a few

days to several months. Compared to other funds, these fluctuate very little.

b)

Ultra short-term funds

: Most ultra short-term funds invest in securities with a residual

maturity of not more than one year. These funds are suitable for investors who are