Islamic Fund Management

60

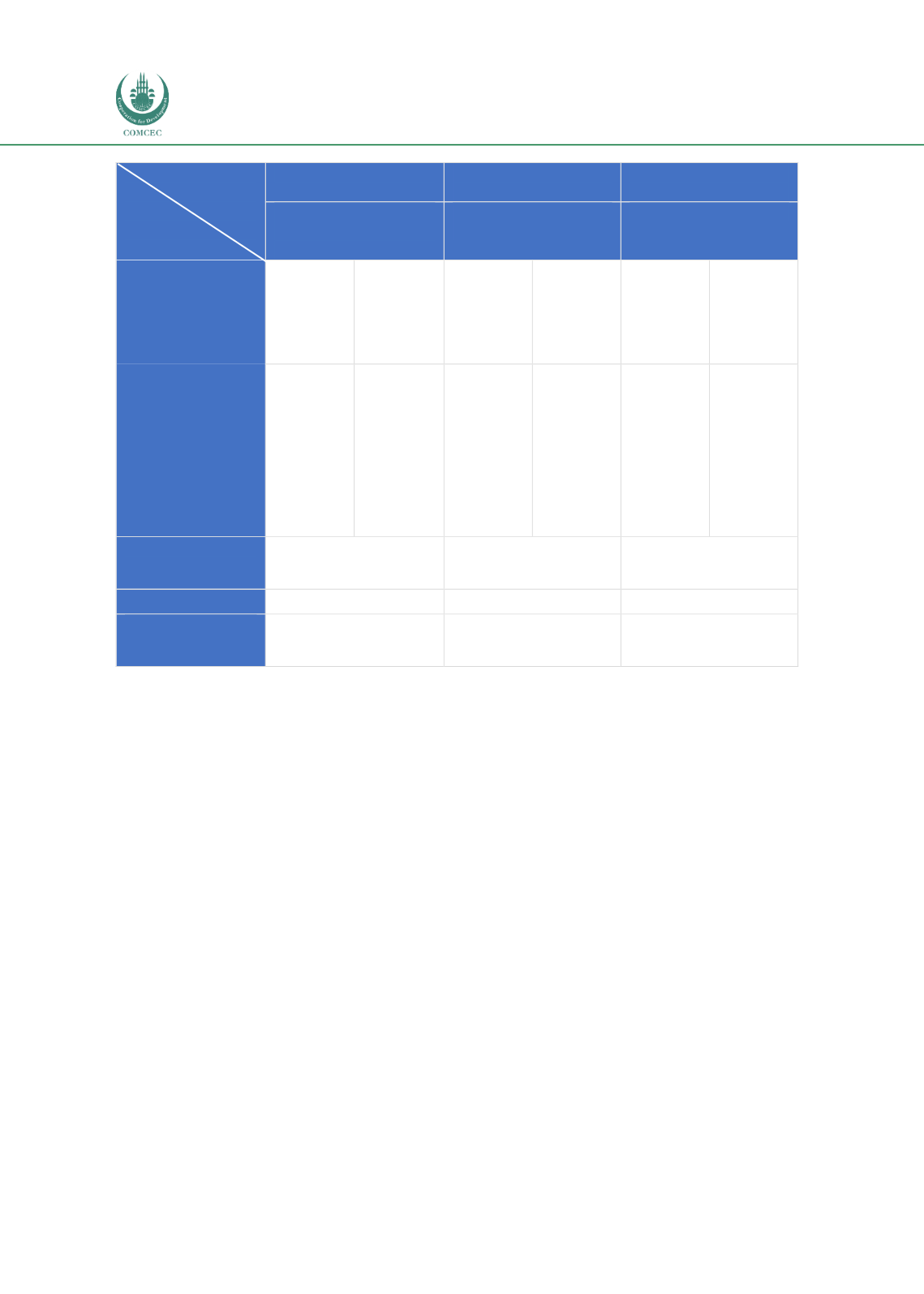

Type of Fund

Type of Fees

Islamic Equity Fund

Islamic Money

Market Fund

Islamic Commodity

Fund

National Investment

Trust (NIT) Islamic

Equity Fund

HLB Money Market

Fund

Meezan Gold Fund

p.a. of NAV,

on amount

exceeding

PKR1,000

million

%p.a. of

NAV, on

amount

exceeding

PKR1,000

million

%p.a. of

NAV, on

amount

exceeding

PKR1,000

million

Above

5000

PKR5.1

million

plus 0.07%

p.a. of

NAV, on

the

amount

exceeding

PKR5,000

million

Above

5000

PKR5.1

million

plus 0.07%

p.a. of

NAV, on

the

amount

exceeding

PKR5,000

million

Front-End Load

Currently 0%, but can

charge up to 3% of NAV

(for Class C only)

Currently 0%, but can

charge up to 5% of NAV

Currently 2%, but can

charge up to 5% of NAV

Back-End Load

-

-

-

Transfer of Units

Fee

0%

Up to 1% of NAV on the

date the request is

lodged

Up to 1% of NAV on the

date the request is

lodged

Sources: NIT Islamic Equity Fund Offering Document (2015, April), HBL Islamic Money Market Fund Offering

Document (2011, May), Meezan Gold Fund Offering Document (2015, April)

Note: The table above provides a comparison of basic transaction costs. Other applicable costs are detailed in the

respective offering documents.

3.2.3

Target Investors and Geographical Distribution

There are three main groups of investors: individuals, institutions and quasi-institutions. The

first group can be differentiated by wealth into mass affluent, high-net-worth, and ultra high-

net-worth individuals (refer to

Figure 3.12 ). Mass affluent individuals (with USD50,000-

USD500,000 of liquid wealth) usually invest in short-term, safe and simple products (e.g.

insurance- and annuity-linked ones). High-net-worth individuals (with at least USD1.0 million

of liquid wealth) and ultra high-net-worth individuals (with at least USD30.0 million of liquid

wealth) tend to focus on safe assets and capital preservation (IRTI-UNDP, 2017).

Institutional investors include

takaful

and pilgrimage funds, which solely invest in Shariah-

compliant instruments, sovereign wealth funds and pension funds. Sovereign wealth funds

may turn to Islamic finance if they seek ethical investments. According to IRTI-UNDP (2017),

these institutions are mostly interested in ‘sophisticated, structured products and exposure to

international markets’, as well as competitive returns and top-notch service. Pension funds,

which by nature seek long-term investments, focus on international investments in mature

markets.