Islamic Fund Management

55

3.2

Investment and Commercial Considerations

3.2.1

Factors Influencing the Decision-Making Process of Funds

Risk appetite varies from one investor to another. Accordingly, funds are structured to meet

the wide-ranging risk appetites of investors. Understanding the different risks and rewards of

available funds is important in managing investment objectives. A general rule of thumb is: the

higher the risk, the higher the return and/or loss. Although some funds are less risky than

others, all funds entail some level of risk. A review of publicly available fund prospectuses is

the first step towards understanding the types of risks involved.

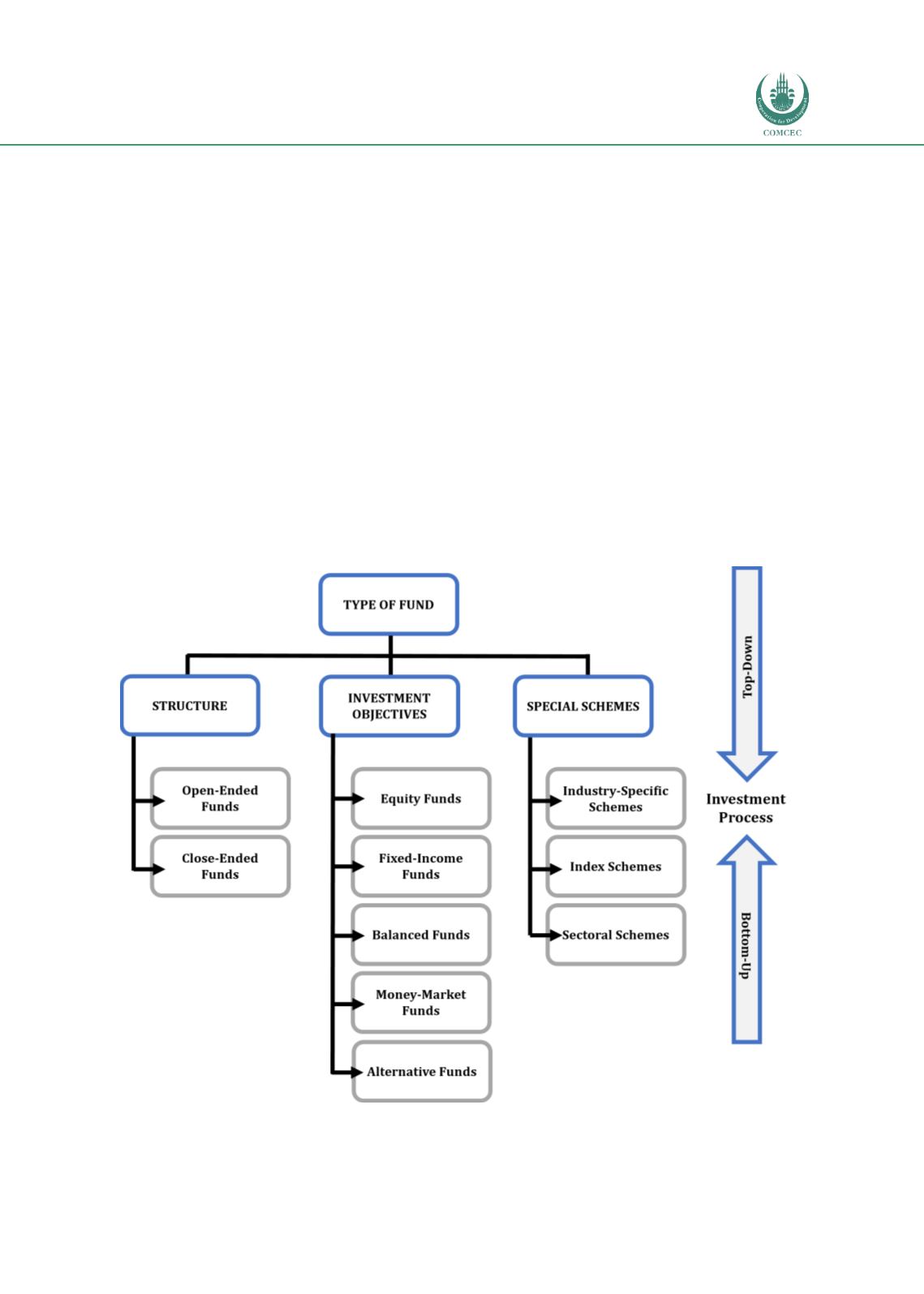

As described in

Figure 3.9 ,each fund will have a predetermined investment objective that

tailors the fund’s asset size, type of investments, investment strategies and/or schemes. At the

fundamental level, funds can be classified based on the following parameters:

1.

Fund structure

2.

Investment objective

3.

Type of special scheme

Figure 3.9: Overview of Funds’ Characteristics

Sources: Mutual Funds (2013), RAM