Islamic Fund Management

50

ready to assume a marginally higher risk in return for slightly higher returns. Investors

can park their short-term surplus funds for a few months to a year in these funds.

c)

Short-term funds

: These funds invest predominantly in debt securities with an average

maturity of one to 4.5 years. They are suitable for conservative investors with a small to

moderate risk appetite and an investment horizon of a few years.

d)

Dynamic bond funds

: They invest across all classes of debt and money market

instruments, with various maturities. Their actively managed portfolios vary

dynamically with the fund managers’ views on interest rates. They are ideal for

investors who do not wish to make a call on the future direction of interest rates, but

still want to benefit from any positive movement.

e)

Income funds

: These funds invest in corporate bonds, government bonds and money

market instruments with an average maturity of 4.5 years or more. They are highly

vulnerable to changes in interest rates. They are suitable for investors who are ready to

assume high risks and have a long-term investment horizon.

f)

Short-term and medium- and long-term gilt funds

: They invest in government

securities with short- or medium- to long-term maturities. The average maturity of their

holdings can vary greatly as per their declared objectives. These funds do not carry

default risk since the bonds are issued by the government. The NAVs of these schemes

fluctuate according to changes in interest rates and other economic factors. These funds

have a high degree of interest-rate risk, depending on their maturity. The longer the

maturity of the instrument, the higher the interest-rate risk.

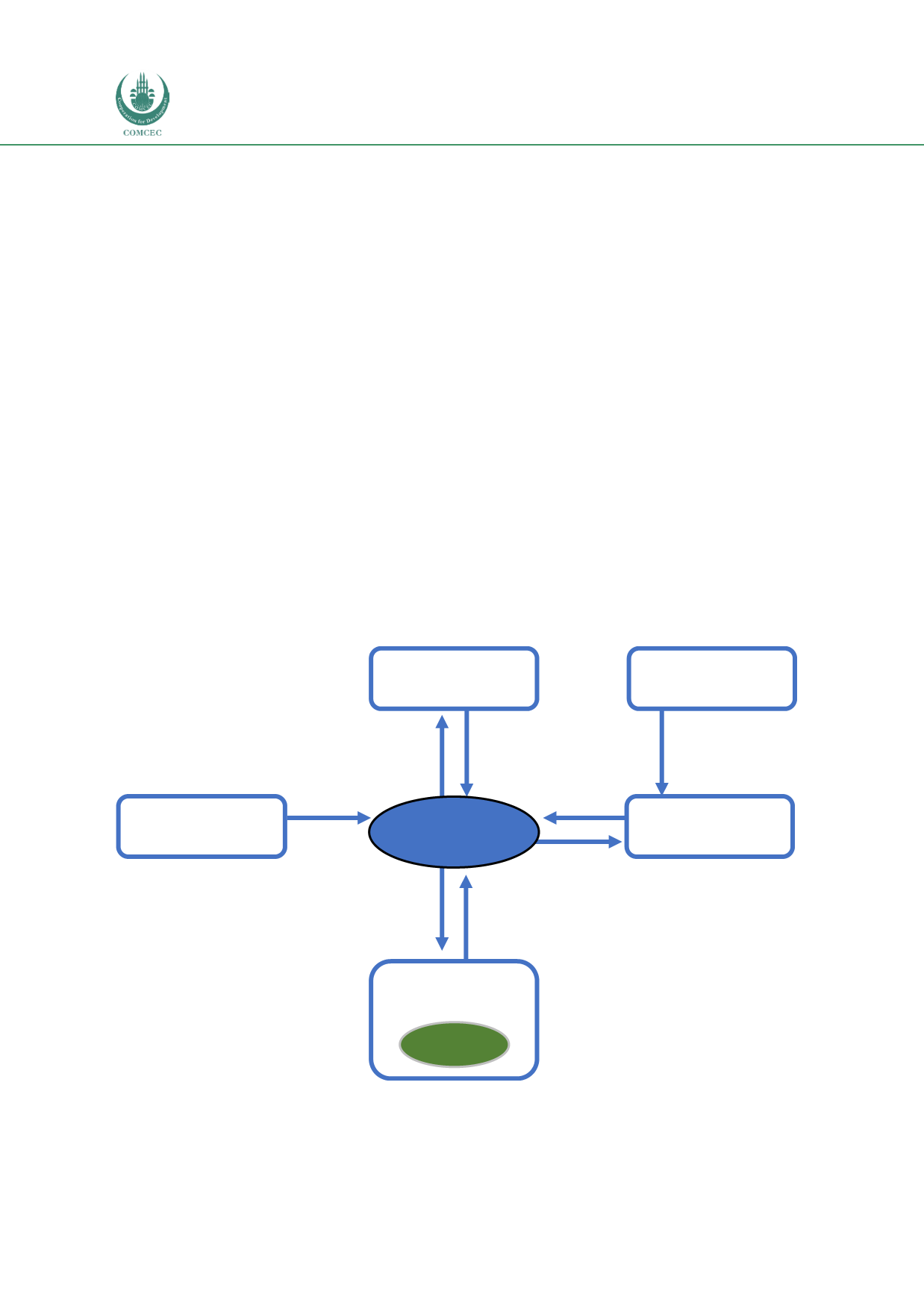

Figure 3.5: Basic Structure of an Islamic Fixed-Income Fund

Ownership

of assets

Generate returns

Pool of investments

collected in the

mutual fund

Dividend

Responsible for

investing, monitoring

and management

Management fees

FUNDMANAGERS

CUSTODIANS OR

TRUSTEES

FIXED-INCOME

SECURITIES

Act on behalf of

unitholders

SUKUK

The Securities

Commission approves

the establishment of

funds and all licensed

fund managers

UNITTRUSTOR

MUTUAL FUND

INVESTORS OR

UNITHOLDERS

REGULATORS

Source: RAM