Islamic Fund Management

56

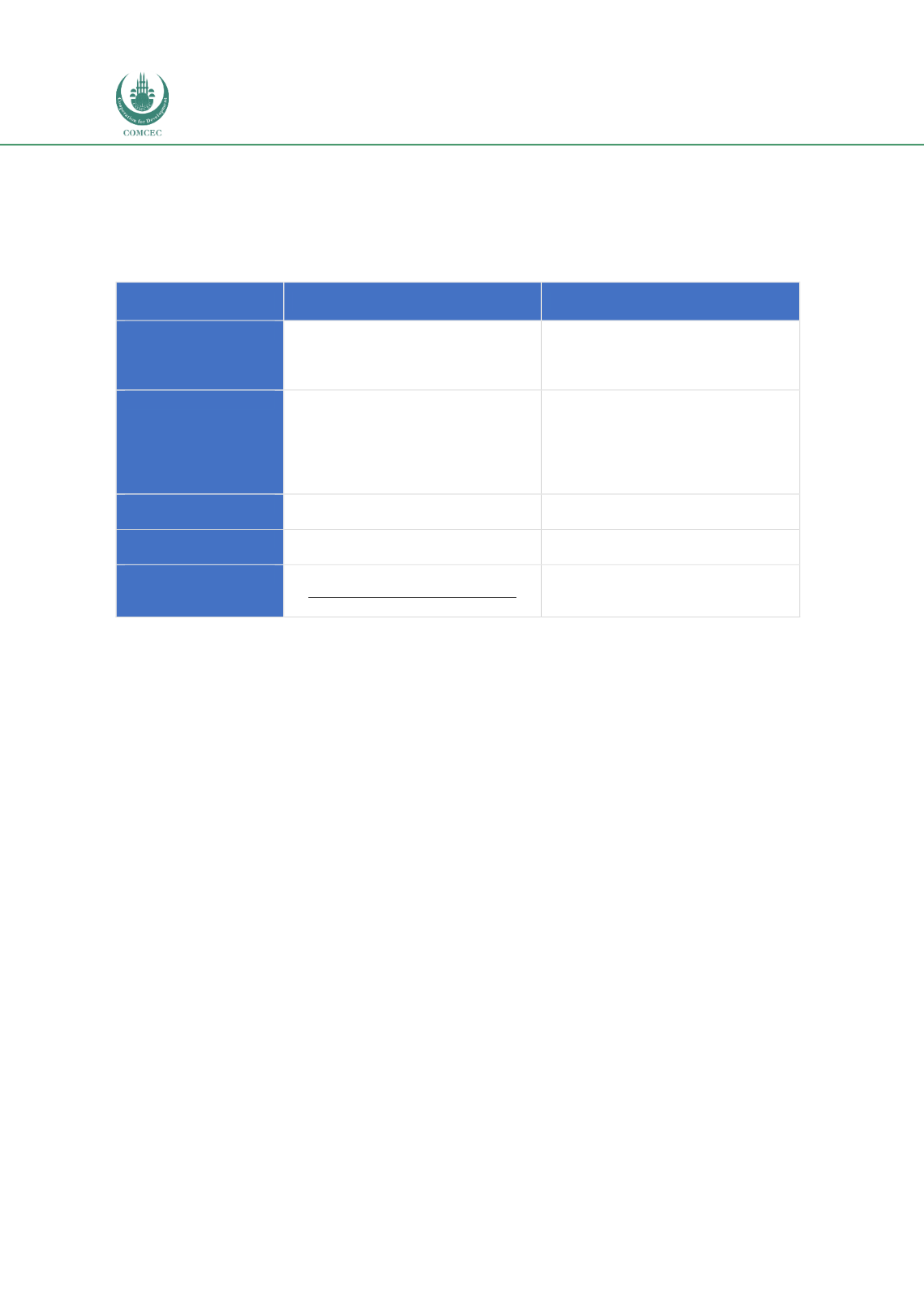

Fund Structure

Funds can be structured as open-ended or close-ended. Most of the funds in circulation have

open-ended structures. The key distinctions between the two are explained i

n Table 3.5.Table 3.5: Comparison between Open-Ended and Close-Ended Funds

Type

Open-Ended Fund

Close-Ended Fund

Feature

A fund which can issue and redeem

units at any time (e.g. most mutual

funds, ETFs).

A company (investment company)

which issues shares for subscription

(e.g. REITs). Redemption period is

specified.

Characteristic

Refers to a fund operated by the fund

manager that makes an offer to the

public and invests the proceeds in a

group of assets, in accordance with

the fund’s objectives.

Refers to a fund with a fixed number

of outstanding units. Similar to a

stock, units can be redeemed/sold by

investors on the stock exchange. Once

listed, the fund manager will not

create new units.

No. of Units

No restriction on the number of units

the fund will issue.

Limited number of units.

Tradability

Buying and selling through unit trust

companies.

Appoint broker to buy and sell the

units on the stock exchange.

Price – NAV

Computed daily:

(Fund’s Total Assets – Liabilities)

No. of Outstanding Units

Based on market demand―higher or

lower than the NAV per share.

Source: SC

Investment Objectives

As highlighted earlier in

Figure 3.9 ,investment objectives are generally based on the

following themes:

Equity Funds:

The aim of growth funds, which include income funds, is to achieve

capital appreciation over the medium to long term. Such funds have comparatively high

risks.

Fixed-Income Funds:

Funds that invest in medium to long-term debt instruments

issued by private companies, financial institutions, governments and other entities in

various sectors.

Balanced Funds:

These funds provide both growth and regular income as they invest in

both debt and equity. The NAVs of these schemes are less volatile than those of pure

equity funds.

Money Market Funds:

Invest in short-term (maturing within one year) fixed-income

securities. These instruments are highly liquid and provide investment safety. Money

market funds are therefore the safest investment option relative to other types of

mutual funds.