Islamic Fund Management

58

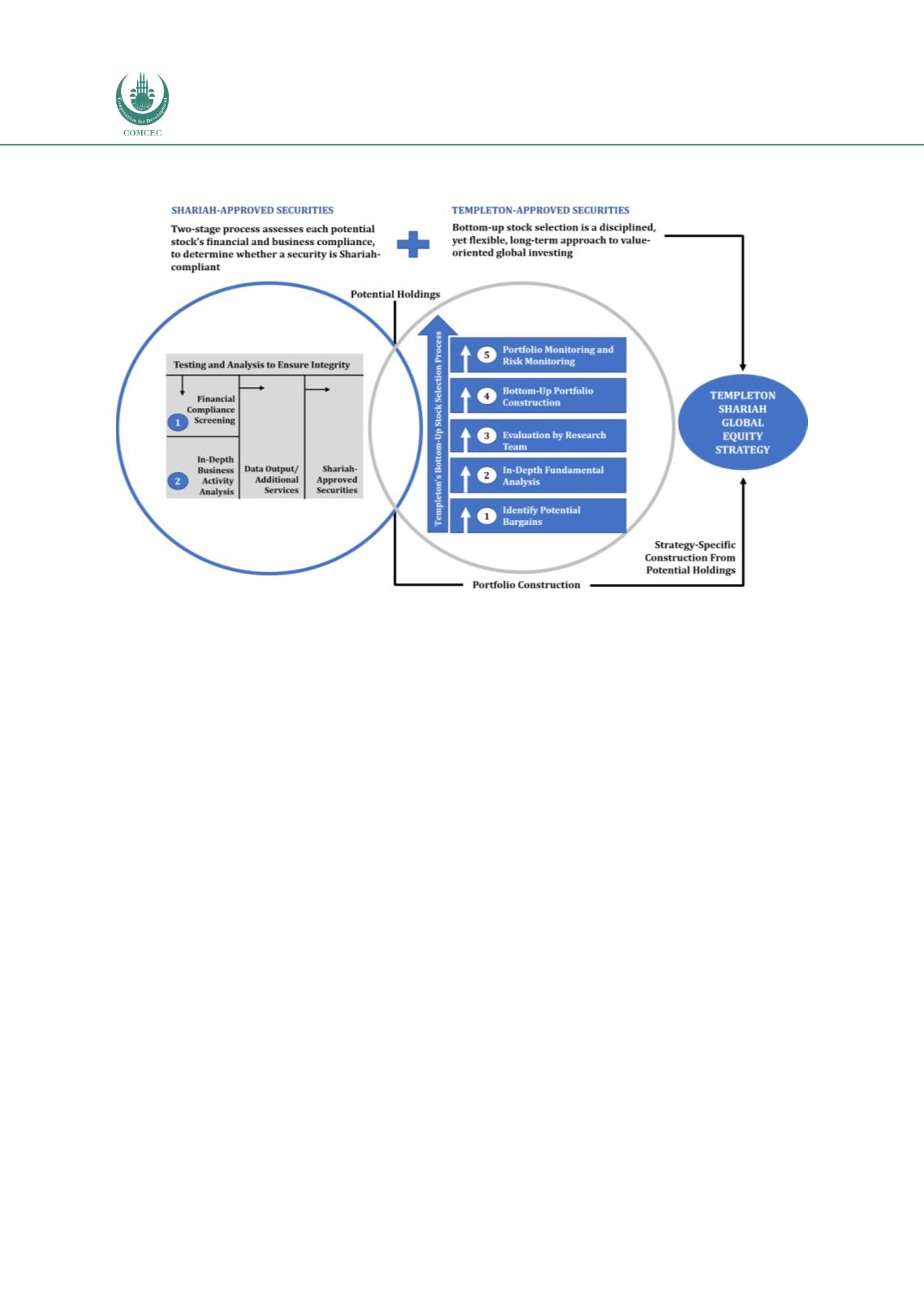

Figure 3.11: Example 2 of an Investment Process

Source: Franklin Templeton Investments (2018, p. 9)

3.2.2

Comparison of Transaction Costs

Investments in funds attract a variety of transaction costs, all of which will reduce an investor’s

potential return. According to O’Shea (2016), examples of common investment and brokerage

fees include the following:

Brokerage account fees:

These include annual fees to maintain a brokerage account,

subscriptions for premium research to help with trading strategies, and fees to access

trading platforms.

Trade commissions:

Charged by a broker when the investor buys or sells certain

securities, such as stocks.

Mutual fund transaction fees:

Charged by a broker to buy and/or sell some mutual

funds.

Expense ratios:

Annual fees charged by all mutual funds, index funds and ETFs, as a

percentage of the investor’s investment in that fund.

Sales loads:

A sales charge or commission on some mutual funds, paid to the broker or

salesperson who sold the fund.

Management or advisory fees:

This is stated as a percentage of AuM, paid by the

investor to a financial advisor or robo-advisor.

Based o

n Table 3.6 ,the transaction cost for an Islamic equity fund―in the case of Malaysia―is

the highest compared to other types of investments, particularly ETFs. As explained earlier,

due to the passive management of ETFs, the management and trustee fees are substantially

lower.