Islamic Fund Management

59

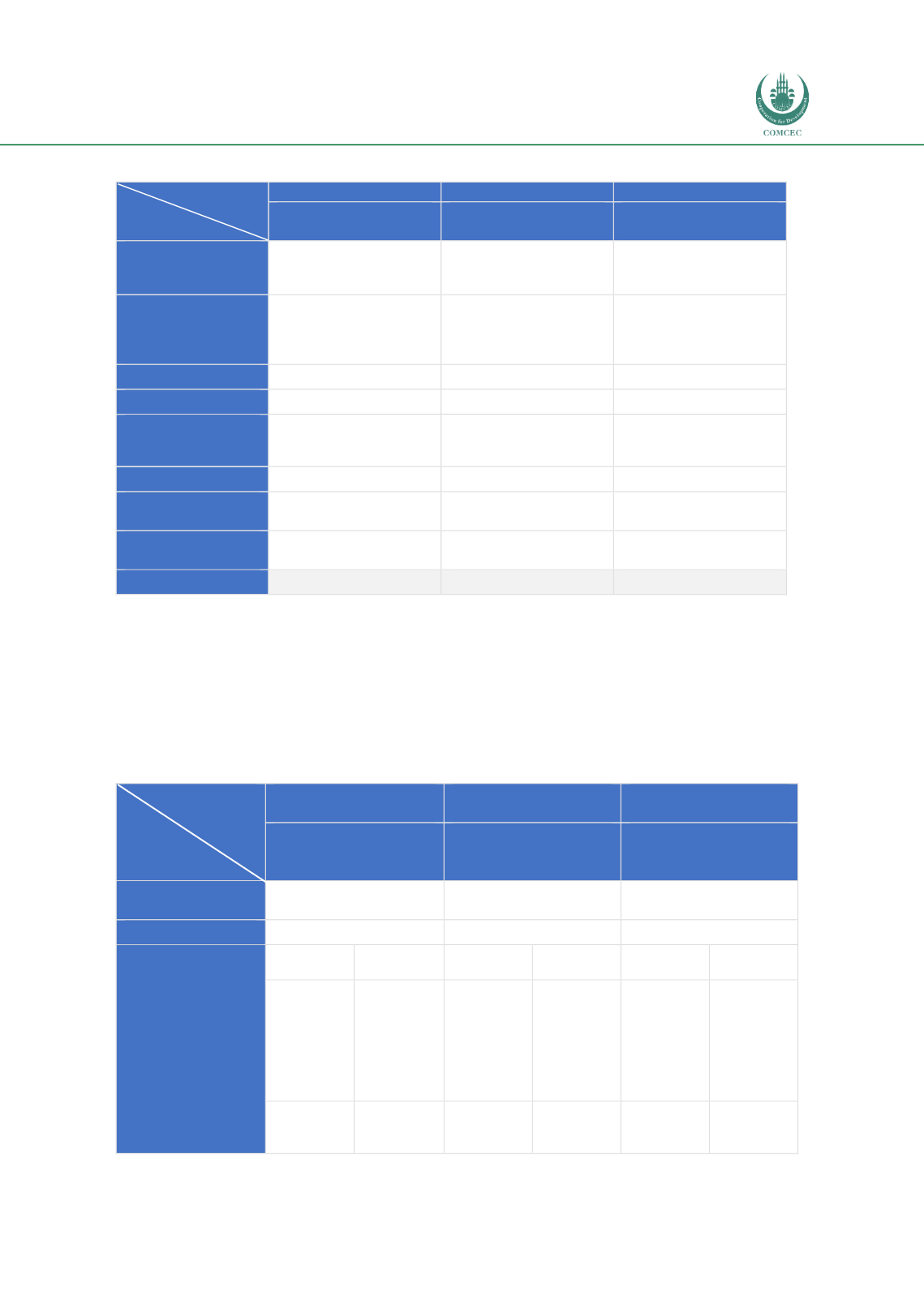

Table 3.6: Comparison of Transaction Costs by Asset Class – the Malaysian Experience

Type of Fund

Type of Fee

Equity Fund

Fixed-Income Fund

ETF

CIMB Islamic DALI

Equity Growth Fund

Franklin Malaysia

Sukuk Fund

MyETF Dow Jones

US Titans 50

Minimum

Investment

RM500

RM1,000

Minimum lot of 100

units based on the

market price

Initial Fee

(Upfront)

Sales charge:

Up to 6.50% of the NAV

per unit

Sales charge:

Up to 3.00% of the NAV

per unit

Brokerage fee:

Up to 0.70% of the

contract value (subject

to a minimum of RM40)

Management Fee

1.50%

0.95%

0.40%

Trustee Fee

0.06%

0.06%

0.035%

Switching Fee

Difference of application

fees between the two

funds

-

-

Redemption Fee

-

-

-

Annual Index

Licence Fee

-

-

0.04%

Bursa Securities

Clearing Fee

-

-

-

Total Fee

Up to 8.06%

Up to 4.01%

Up to 1.175%

Sources: CIMB Islamic DALI Equity Growth Fund Prospectus (2016, June), Franklin Malaysia Sukuk Fund

Prospectus (2016, November), MyETF Dow Jones US Titans 50 Prospectus (2017, September)

Note: The table above provides a comparison of basic transaction costs. Other applicable costs are detailed in the

respective prospectuses.

In the case of Pakistan, as shown in

Table 3.7 ,the total transaction costs for Islamic equity

funds and Islamic commodity funds are more or less the same, except that the former charges

higher management and trustee fees.

Table 3.7: Comparison of Transaction Costs by Asset Class – the Pakistani Experience

Type of Fund

Type of Fees

Islamic Equity Fund

Islamic Money

Market Fund

Islamic Commodity

Fund

National Investment

Trust (NIT) Islamic

Equity Fund

HLB Money Market

Fund

Meezan Gold Fund

Minimum

Investment

PKR5,000

PKR1,000

PKR5,000

Management Fee

2%

1%

1%

Trustee Fee =

Actual custodial

expenses/Charges

plus the specified

tariff

Net Assets

(million)

Tariff

Net Assets

(million)

Tariff

Net Assets

(million)

Tariff

Up to

PKR1,000

PKR0.7

million or

0.20% p.a.

of NAV,

whichever

is higher

PKR 1-

PKR1,000

PKR0.6

million or

0.17% p.a.

of NAV,

whichever

is higher

PKR1-

PKR1,000

0.17% p.a.

of NAV

Above

PKR1,000

PKR 2.0

million

plus 0.10%

Above

PKR1,001-

PKR5,000

PKR1.7

million

plus 0.085

Above

PKR1,001-

5,000

PKR1.7

million

plus 0.085