Islamic Fund Management

51

3.

Money Market Funds

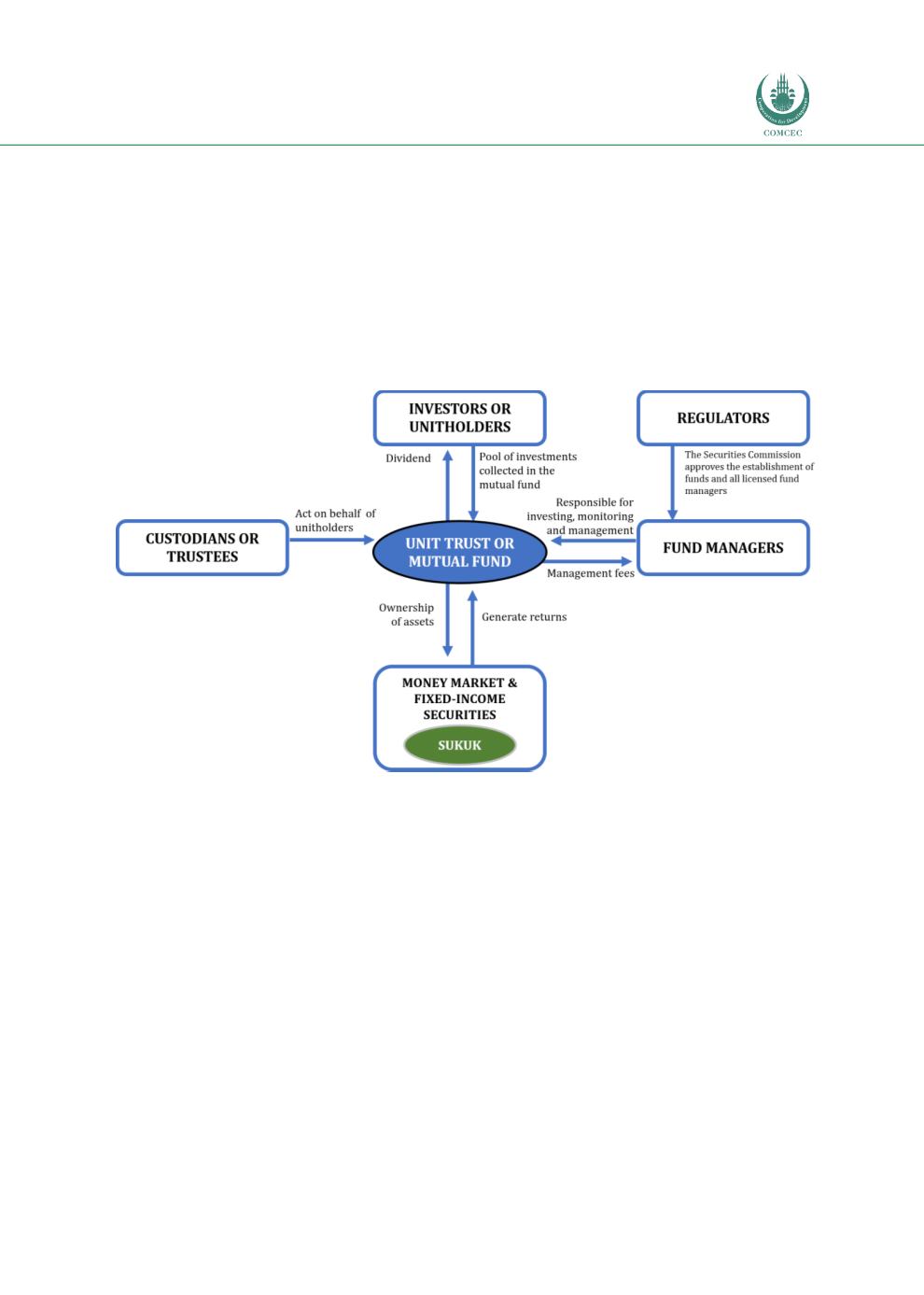

A money market fund is a type of fixed-income fund that invests in debt securities,

characterised by their short maturities and minimal credit risk (refer to

Figure 3.6 ). Money

market funds are among the least volatile types of investments. The income generated by a

money market fund can be taxable or tax-exempt, depending on the type of securities the fund

invests in (SC, 2016).

Figure 3.6: Basic Structure of an Islamic Money Market Fund

Source: RAM

4.

REITs

REITs invest in real estate, either in the form of physical property or the securities of

companies engaged in the real-estate business. Real-estate mutual funds are an alternative to

purchasing investment property, especially if the investor wants to limit his or her investment,

level of risk and/or involvement in the management of real estate. The key differentiating

factor between Islamic REITs and conventional REITs is the Shariah-compliant assessment to

be undertaken by a Shariah advisor appointed to oversee the operations of the Islamic REIT.

Such monitoring includes tenants’ activities, rental earnings, deposits and financing decisions,

acquisition and disposal of properties and investments. These are closed-end funds and some

are listed on the stock exchange. Interestingly, even though Islamic REITs have been in several

countries (e.g. Malaysia, Pakistan, Kuwait, Bahrain and the UAE), only Malaysia has issued

guidelines on Islamic REITs (refer to

Table 3.3on the salient terms of the guidelines)

. Figure 3.7provides an example of an Islamic REIT.