162

and Luxembourg. Since 2014, Hong Kong has issued 2 more international sukuk (in 2015 and

2017), both of which have proven successful, attracting AAA ratings by S&P, oversubscription

in orders received, and a diverse range of investors. Details on the Government of Hong Kong’s

sukuk issuances are provided in Table 4.30.

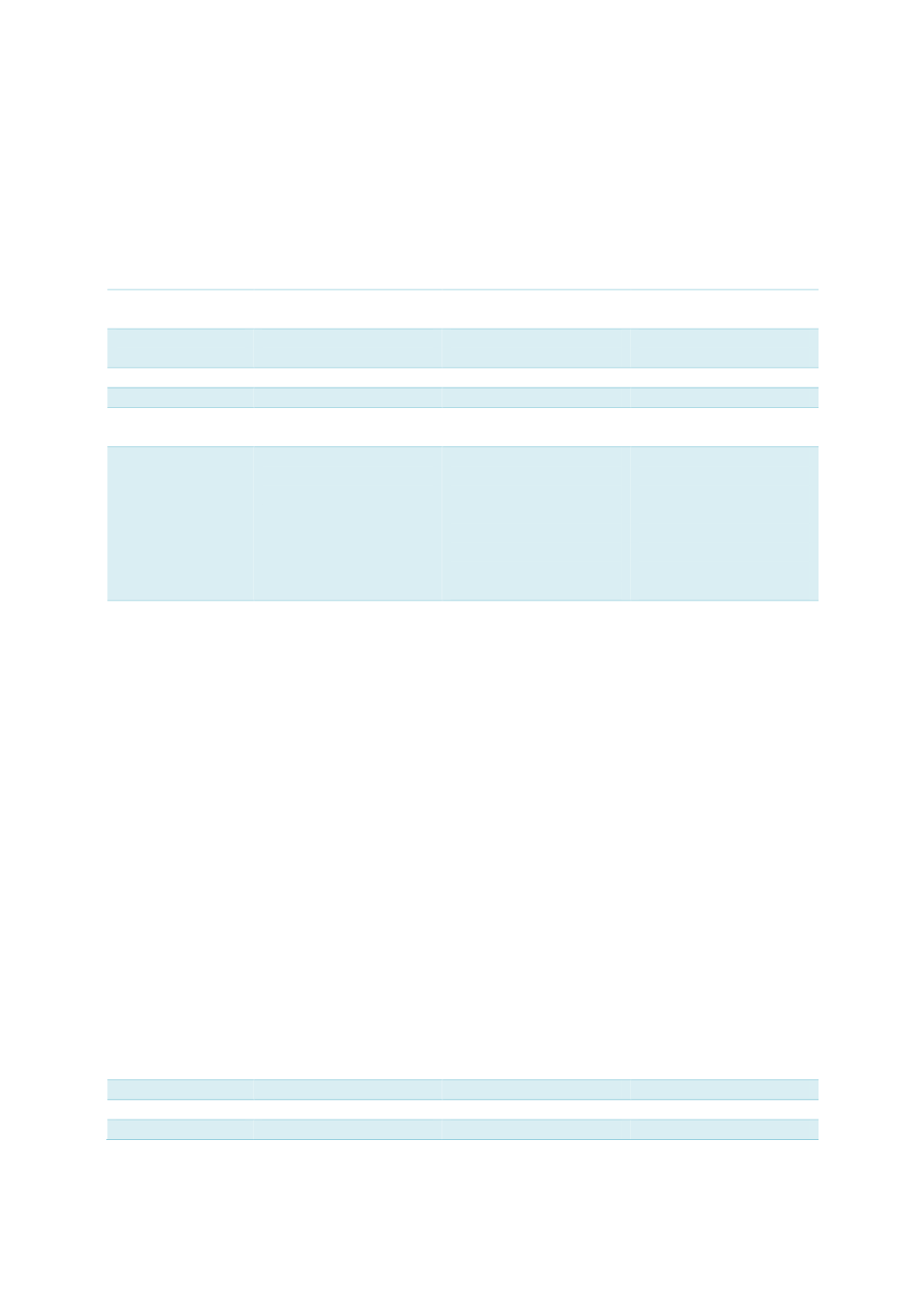

Table 4.30: Overview of Hong Kong Government’s Sukuk Issuances

SPV issuer

Hong

Kong

Sukuk

2014 Limited

Hong

Kong

Sukuk

2015 Limited

Hong Kong Sukuk 2017 Limited

Obligor

Hong Kong SAR

Government

Hong Kong SAR

Government

Hong Kong SAR

Government

Currency/format

USD

USD

USD

Structure

Ijarah

Wakalah

Wakalah

Sukuk ratings

AAA (S&P)

Aa1 (Moody’s)

AAA (S&P)

Aa1 (Moody’s)

AAA (S&P)

AA+ (Fitch)

Sukuk assets

Selected units in 2

commercial properties

in Hong Kong

A

third

of

assets

underpinned

by

selected units in an

office building in Hong

Kong; the other two-

thirds underpinned by

Shariah-compliant

commodities

A

third

of

assets

underpinned

by

selected units in an

office building in Hong

Kong; the other two-

thirds underpinned by

Shariah-compliant

commodities

Use of proceeds

As purchase price for

the assets pursuant to

the

purchase

agreement.

The proceeds received

by the FSI will be

credited to the Bond

Fund (set up pursuant

to resolution (Cap. 2S)

passed on 8 July

2009 under section 29

of the Public Finance

Ordinance (Cap.

2)) and then placed

with the Exchange

Fund.

No less than 34% as the

purchase price for the

Lease Assets pursuant

to

the

Purchase

Agreement;

the

remainder of not more

than 66% for the

acquisition

of

commodities to sell to

the HKSAR Government

pursuant

to

the

Murabahah

Agreement.

The proceeds received

by the FSI will be

credited to the Bond

Fund (set up pursuant

to resolution (Cap. 2S)

passed on 8 July

2009 under section 29

of the Public Finance

Ordinance (Cap.

2)) and then placed

with

the

Exchange

Fund.

No less than 34% as the

purchase price for the

Lease Assets pursuant

to

the

Purchase

Agreement;

the

remainder of not more

than 66% for the

acquisition

of

commodities to sell to

the HKSAR Government

pursuant

to

the

Murabahah

Agreement.

The proceeds received

by the FSI will be

credited to the Bond

Fund (set up pursuant

to resolution (Cap. 2S)

passed on 8 July

2009 under section 29

of the Public Finance

Ordinance (Cap.

2)) and then placed

with

the

Exchange

Fund.

Facility tenure

5 years

5 years

10 years

Issuance date

11 September 2014

3 June 2015

28 February 2017

Maturity date

11 September 2019

3 June 2020

28 February 2020