161

Year

Timeline description

2009

MOU signed between the HKMA and BNM in September 2009, to strengthen co-operation in

Islamic finance, particularly the development of human capital and financial infrastructure and

the promotion of cross-border financial activities.

A mutual recognition agreement was inked by the Hong Kong Securities and Futures

Commission with the SC in November 2009, to facilitate the cross-border offering of Islamic

funds.

2013

A previous study conducted by the Hong Kong government and the Treasury Management

Authority had found that there was no major legal or regulatory obstacle against Islamic

financial transactions in Hong Kong. However, to facilitate sukuk transactions and provide a

level playing field between sukuk and conventional bonds, there was a need to refine the tax

regime in Hong Kong.

In July 2013, the Inland Revenue and Stamp Duty Legislation (Alternative Bond Schemes)

(Amendment) Ordinance 2013 was enacted by the Legislative Council, to establish a

comparable taxation framework for sukuk and bonds.

2014

Enactment of the Loans (Amendment) Ordinance 2014 by the Legislative Council in March

2014, to enable the issuance of sukuk under the Government Bond Programme.

Source: Based on Speeches and Press Releases published by HKMA

Shortly after the 2007-2008 Policy Address that iterated Hong Kong’s aim of establishing an

Islamic finance platform, the first Islamic fund was introduced by a local bank in Hong Kong in

last 2007, to track the performance of the Dow Jones Islamic Market China/Hong Kong Titans

Index. In May 2008, a

new Dow Jones Islamic Market Index was launched, to track China-

related equities listed on the Hong Kong Stock Exchange (Lau, 2008). To date, there has not

been any significant activity in Hong Kong’s ICM, although the government has made efforts to

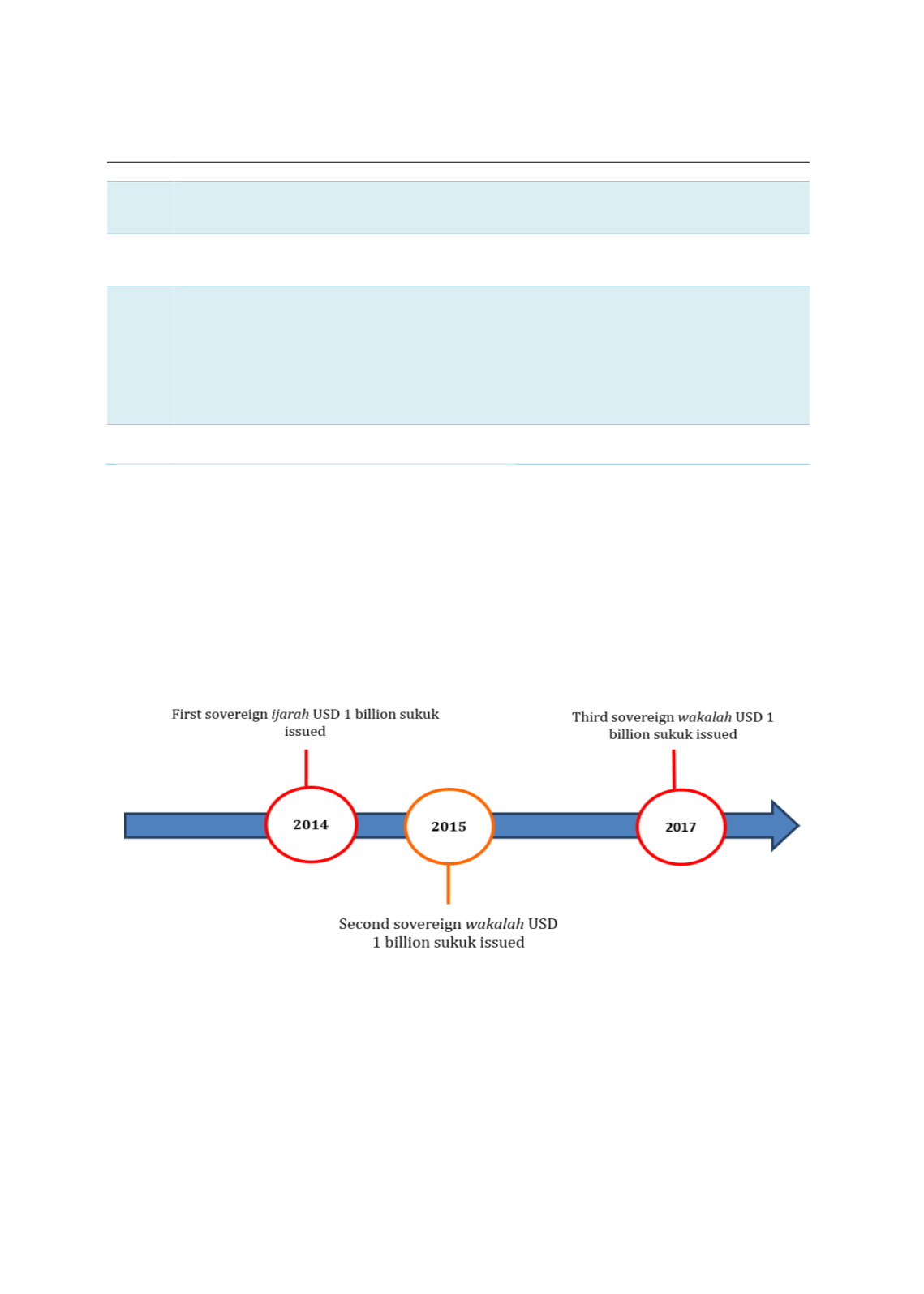

kick-start its sukuk market. As of October 2017, the Government of Hong Kong had issued 3

sovereign sukuk, as noted in Figure 4.18.

Figure 4.18: Hong Kong’s Sovereign Sukuk Issuances (2014-2017)

Source: ISRA

4.6.3

ANALYSIS OF SUKUK STRUCTURES, ISSUANCES AND INVESTMENTS

By entering the sukuk market, Hong Kong’s government is able to showcase its Islamic

financial platform to local and international issuers and investors. Its second and third

issuances have further built momentum in the sukuk market and demonstrated that Hong

Kong has a viable and flexible sukuk platform, which can attract international issuers and

investors. In 2014, it was among the sovereigns issuing their maiden sukuk, besides the UK