129

The major reasons that have led to an underdeveloped corporate sukuk market in Indonesia

are lack of understanding among corporates on ICM access and the viability of issuers’ credit

ratings.

6

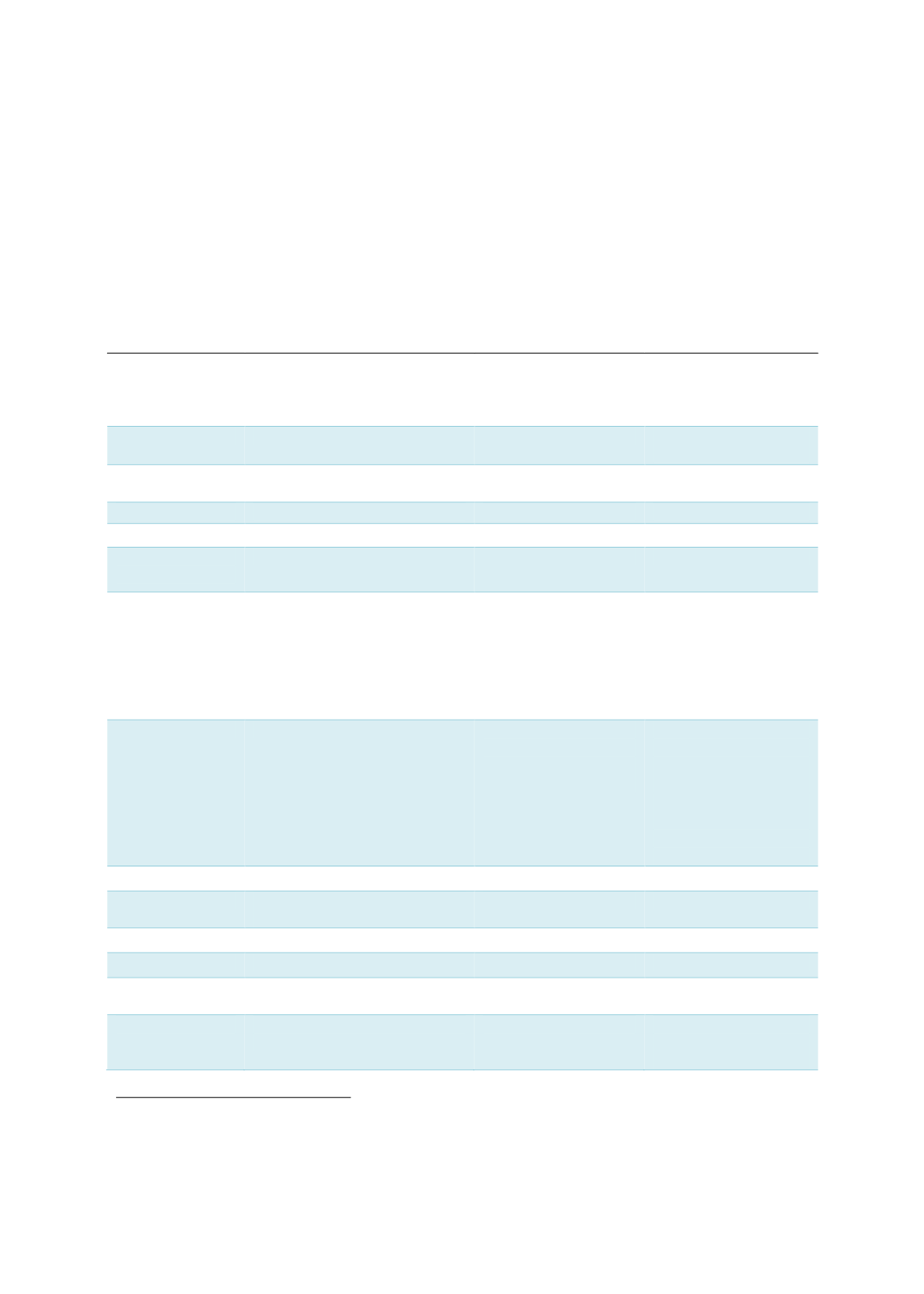

Most corporates assume that the process of issuing sukuk is too complicated, thereby

opting to issue conventional bonds instead. Additionally, the high returns expected by

investors who demand a premium to offset the additional risks related to the illiquid

secondary sukuk market have pushed up the overall cost of sukuk (IFAAS, 2014). Table 4.15

gives a snapshot of some Indonesia’s corporate sukuk deals.

Table 4.15: A Snapshot of Indonesian Corporate Sukuk Issuance

XL Axiata’s Ijarah Sukuk

Programme

(the largest corporate

ijarah

sukuk programme)

Subordinated

Mudarabah Sukuk

Bank BRI Syariah

Garuda Indonesia

Global Sukuk Limited

Wakalah Programme

Issuer

XL Axiata (EXCL)

Bank BRI Syariah

Garuda Indonesia

Global Sukuk Limited

Originator

EXCL

Bank BRI Syariah

Garuda Indonesia

Currency format

Rupiah

Rupiah

US Dollar 144A/Reg.S

Structure

Ijarah

Mudarabah

Wakalah

Obligor/sukuk

rating

AAA (Fitch Indonesia)

A+ (Fitch Indonesia)

Unrated

Sukuk assets

Rights to benefits of

telecommunication

equipment owned by

EXCL, such as base station

controller, home location

register and mobile

switching centre

(BRI) Syariah

financing assets

Rights to travel using

an orphan-based SPV

Purpose

To finance working capital

To strengthen the

capital

structure for business

expansion

To be used for Shariah-

compliant general

corporate

purposes, including the

repayment of certain

existing Islamic

financing

arrangements

Issuance date

28 October 2015

9 November 2016

3 June 2015

Tenure

2-year shelf-registration

programme

7 years

5 years

Maturity

November 2017

16 November 2023

3 June 2020

Amount

RP5 trillion

RP1 trillion

USD500 million

Periodic

distribution

8.75%

9.5% - 10.25%

5.95%

Listing

Indonesian Stock Exchange

(IDX)

IDX

Application has been

made to Singapore

Exchange

6

Under Bapepam Rule Number IX.C.11, it is mandatory for corporate bonds and sukuk

to complete a re-rating exercise each

year and publish the rating(s).