127

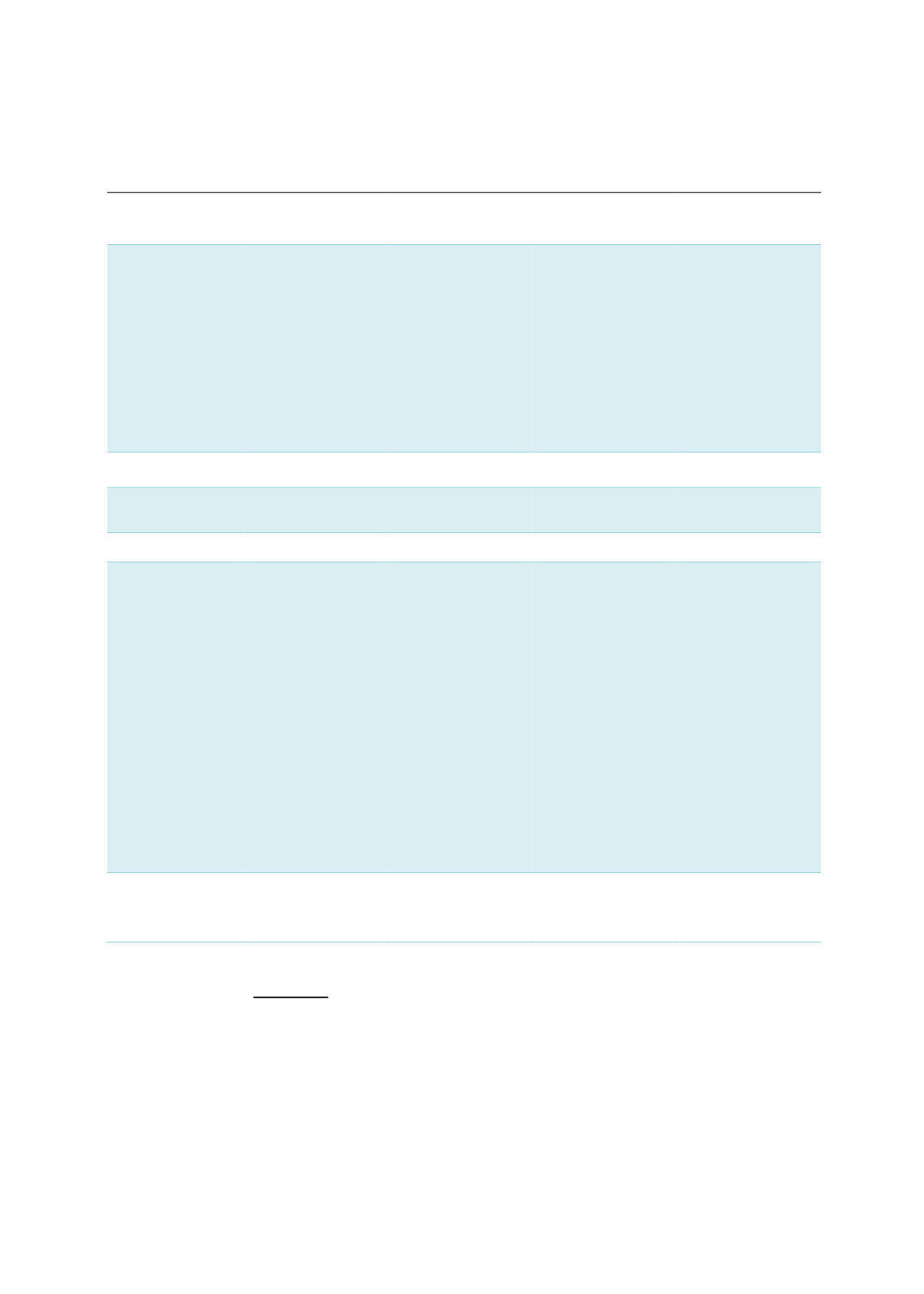

Table 4.14: Types of Sukuk Negara Shariah Structures Approved by DSN-MUI

Ijarah

(Sale and lease

back)

Ijarah

al-Khadamat

Ijarah

(Asset to be

leased)

Wakalah

Description

Sukuk issued based

on the sale-and-

leaseback

mechanism (asset

purchase

transaction,

whereby the

purchaser then

leases back the

purchased assets to

the seller).

Sukuk issued based

on Islamic

principles

represents

ownership of SBSN

assets in the form of

services.

Sukuk issued based

on Islamic

principles,

represents

ownership of SBSN

assets, either

already in existence

or will exist.

Sukuk issued based

on Islamic

principles

represents

ownership of

project or activities

managed on the

basis of an

investment agency,

by appointing an

agent to manage the

operation.

DSN-MUI fatwa

Number 72/2008

Number 9/2000

Number 76/2010

Number 95/2014

Underlying

assets

State-owned assets

Hajj

services

Project and state-

owned assets

Rent money/

margin/fixed fee

Tradability

Tradable

Non-tradable

Tradable

Tradable

Issuance

documents

Akad bay’

Akad ijarah

Sukuk asset-

management

agreement

Sale undertaking

and purchase

undertaking

Akad wakalah

Akad ijarah

Handover

(BAST) services

hajj

Booking letters

Akad wakalah

Akad ijarah

asset

to be leased

Sukuk asset-

management

agreement

Sale undertaking

and purchase

undertaking

Declaration of

trust

Purchase

agreement

Procurement

agreement

Lease agreement

Servicing agency

agreement

Substitution

undertaking

Transfer

undertaking

Purchase

undertaking

Cost undertaking

Agency

agreement

Sukuk

Negara

series

Islamic Fixed Rate

(IFR), Retail Sukuk

(SR), Sukuk Negara

Indonesia (SNI)

Hajj

Fund Sukuk

(SDHI)

Project based sukuk

(PBS), SR

SNI

Source: MOF

Analysis of Sukuk Issuances – Supply (Sell Side)

The pace of growth of LCY corporate sukuk remains a challenge for the government and the

regulators. Since the first sukuk issuance by PT Indosat in September 2002, there has been a

limited number of corporate sukuk issues (refer to Chart 4.41).