125

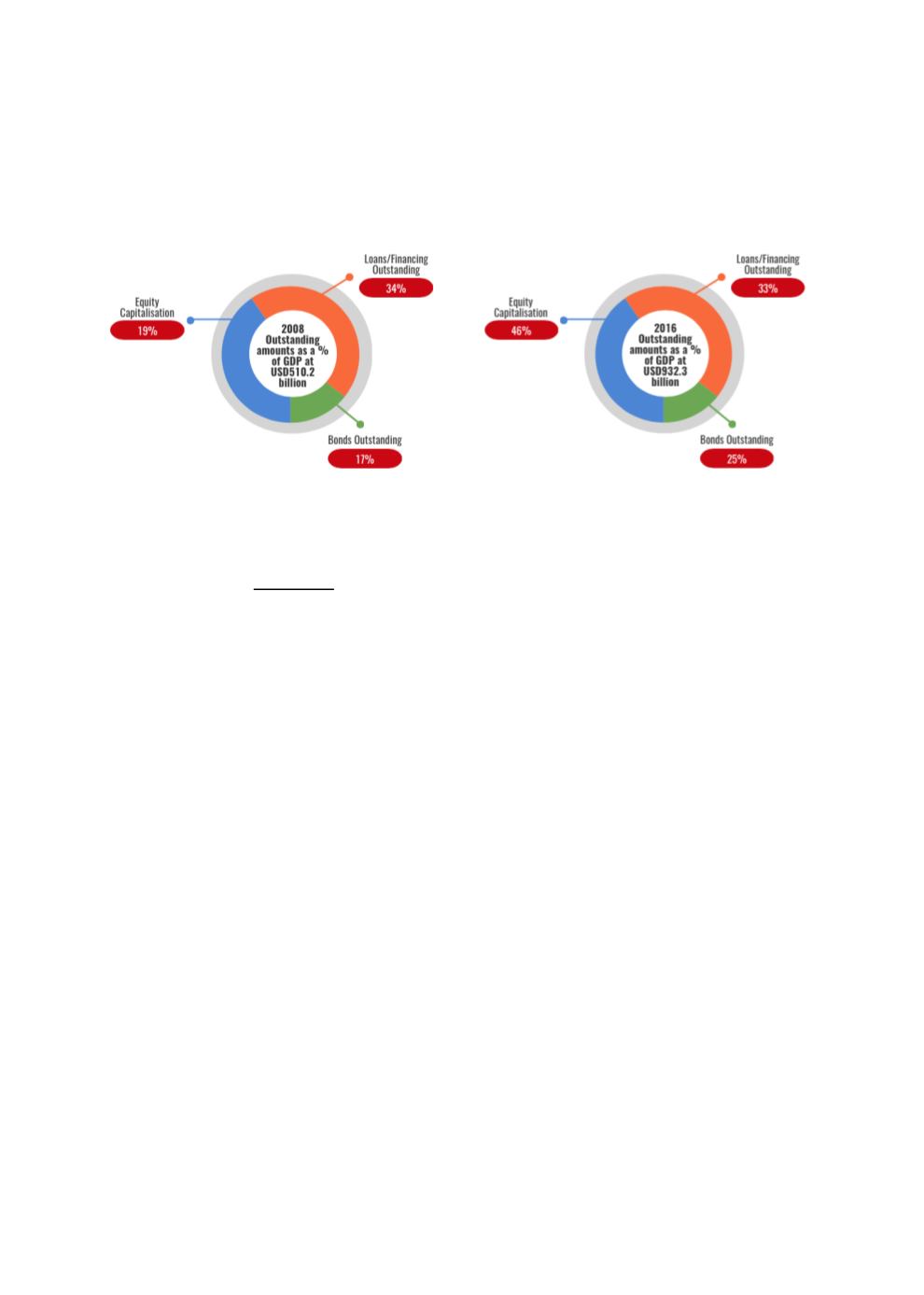

Accordingly, there is a plenty of room to expand total outstanding debts to GDP, which stood at

25% as at end-2016―a slight improvement over the 17% as at end-2008 (refer to Chart 4.38).

Chart 4.38: Indonesia’s Outstanding Capital Markets vs Bank Financing Relative to GDP

Sources: World Bank, Bloomberg, The Global Economy

4.4.3

ANALYSIS OF SUKUK STRUCTURES, ISSUANCE AND INVESTMENT

Analysis of Sukuk Structures

In 2003, Bapepam (the regulator at that time) and the National Shariah Board of the

Indonesian Council of Ulama (DSN-MUI) signed a memorandum of understanding to

collaborate on the development of Shariah-compliant capital market products. The DSN-MUI

remains the central Shariah body empowered to govern Indonesia’s Islamic finance landscape.

As of mid-2015, the DSN-MUI had issued 96 fatwas that covered every aspect of Islamic

financial services, including generic products such as

wadiah, mudarabah

and

musharakah

contracts, instruments for liquidity, hybrid products, the treatment of non-

halal

revenue,

penalties,

takaful

and ICM operations, as well as hedging instruments. BI and the OJK

regulation enforce the fatwas issued by the DSN-MUI; all Islamic financial services entities are

required to comply with the rulings (Thomson Reuters & IRTI, 2016).

As per the OJK’s sukuk guidelines, all sukuk issuances require the prior endorsement of a

Shariah advisor licensed by the OJK. In general, Indonesia’s regulatory framework applies to

both conventional and Shariah instruments. All securities to be issued via an offer to the public

are subject to the submission of a Registration Statement and supporting documentation, and

require the approval of the OJK. Issuers of Shariah instruments are required to observe BI

regulations on foreign exchange and the stability of the Indonesian rupiah. Shariah

instruments to be listed are subject to the same listing approval and disclosure requirements

as conventional instruments, with certain additions prescribed under OJK Regulation Number

18/POJK.04/2015 concerning issuance and requirements for sukuk.

Based on historical sukuk issuances, the

ijarah

contract is the preferred contract for sovereign

sukuk (as depicted in Chart 4.39) because this structure utilises underlying assets in the form

of fixed tangible assets and projects. Meanwhile, corporate sukuk issuers prefer a mix between

ijarah

and

mudarabah

as shown in Chart 4.40.