124

3.

Lack of understanding of ICM among corporates (i.e. unfamiliarity with Islamic

structures and principles).

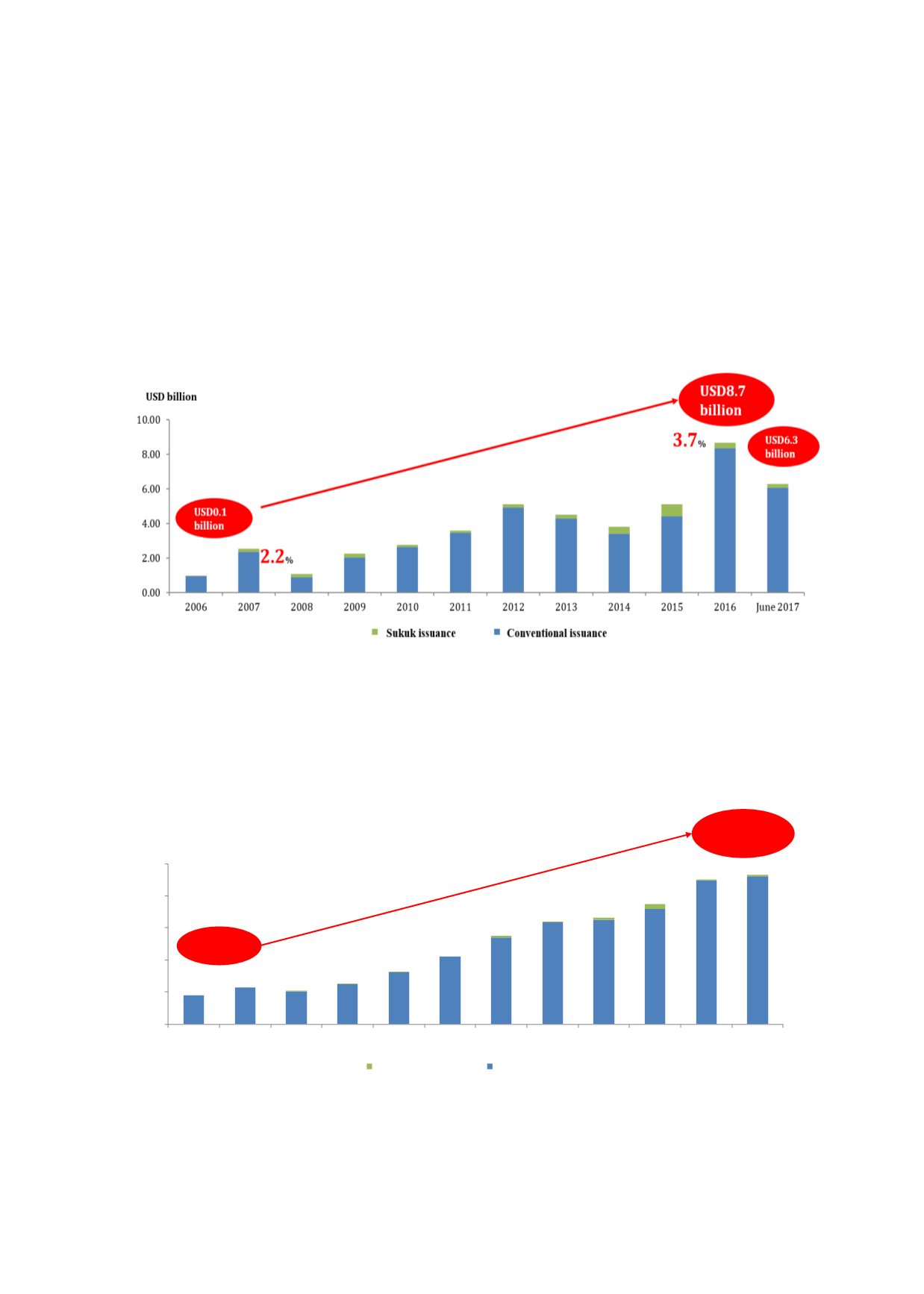

Given the aforementioned reasons, Indonesia’s corporate bond market has remained relatively

small; total corporate bond issuance came up to USD8.7 billion as at end-2016, compared to

USD47.4 billion for sovereign bonds. Of the total, corporate sukuk issuance only accounted for

a mere 3.7% in 2016 (or USD0.32 billion), (end-2015: USD0.70 billion) (refer to Chart 4.36).

The government and regulators are aware of the importance of growing the corporate bond

market, and are taking the necessary measures to provide viable stimuli.

Chart 4.36:

Indonesia’s Corporate Sukuk vs Conventional Issuance (2006-June 2017)

Sources: Bloomberg, OJK, RAM

Due to the declining trend in LCY corporate sukuk issuance, outstanding corporate sukuk only

accounts for a miniscule 1% of total outstanding private debt securities, as depicted in Chart

4.37.

Chart 4.37: Indonesia’s Corporate Sukuk vs Conventional Outstanding (2006-June 2017)

0.00

5.00

10.00

15.00

20.00

25.00

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016 June 2017

USD billion

Sukuk outstanding

Conventional outstanding

RM4.5

billion

RM23.2

billion

0.3

%

Sources: Bloomberg, OJK, RAM