128

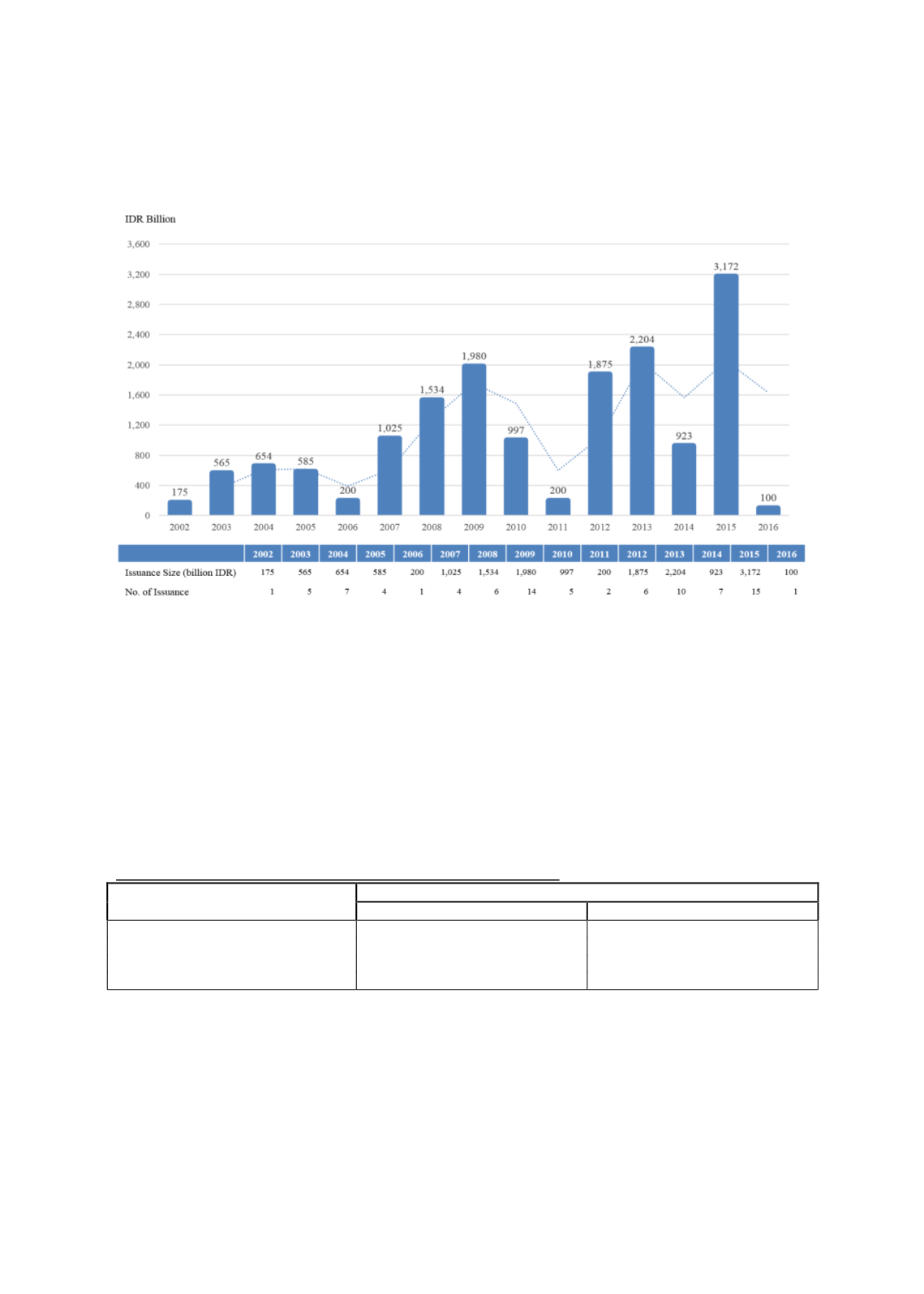

Chart 4.41: Development of Indonesia’s Domestic Corporate Sukuk (2002-2016)

Source: OJK

To address the challenges faced by the industry, the OJK (and its predecessor, Bapepam)

has―through its capital market master plans and roadmaps―identified strategic initiatives to

stimulate the market. These initiatives include the following:

1.

Reducing the amount of documentation required by issuers. As a result, the timeframe

needed to launch a bond/sukuk has been reduced from 45 to 35 days (The Banker Asia,

2017).

2.

Reducing the fees associated with the issuance of sukuk compared to conventional bonds

(as highlighted in the Indonesian Financial Services Sector Master Plan).

An example is the reduction of the OJK’s registration fee:

Issuance value

Registration fee

Sukuk

Bond

IDR 250 billion

IDR 125 million

IDR 125 million

IDR 500 billion

IDR 150 million

IDR 250 million

IDR 1 trillion

IDR 150 million

IDR 500 million

IDR 1.5 trillion

IDR 150 million

IDR 750 million

3.

Encouraging SOEs to fund government infrastructure projects via the sukuk market, and

amending the investment policies of domestic mutual funds to include investment in debt

instruments issued by SOEs. Previously, pension and provident schemes had been

restricted to channeling their funds towards: 1) bank time deposits and certificate-of-time

deposits; 2) corporate shares and bonds, as listed on the Indonesia Stock Exchange; 3)

promissory notes; 4) corporate equities; and 5) land and buildings (OCBC, 2017).