135

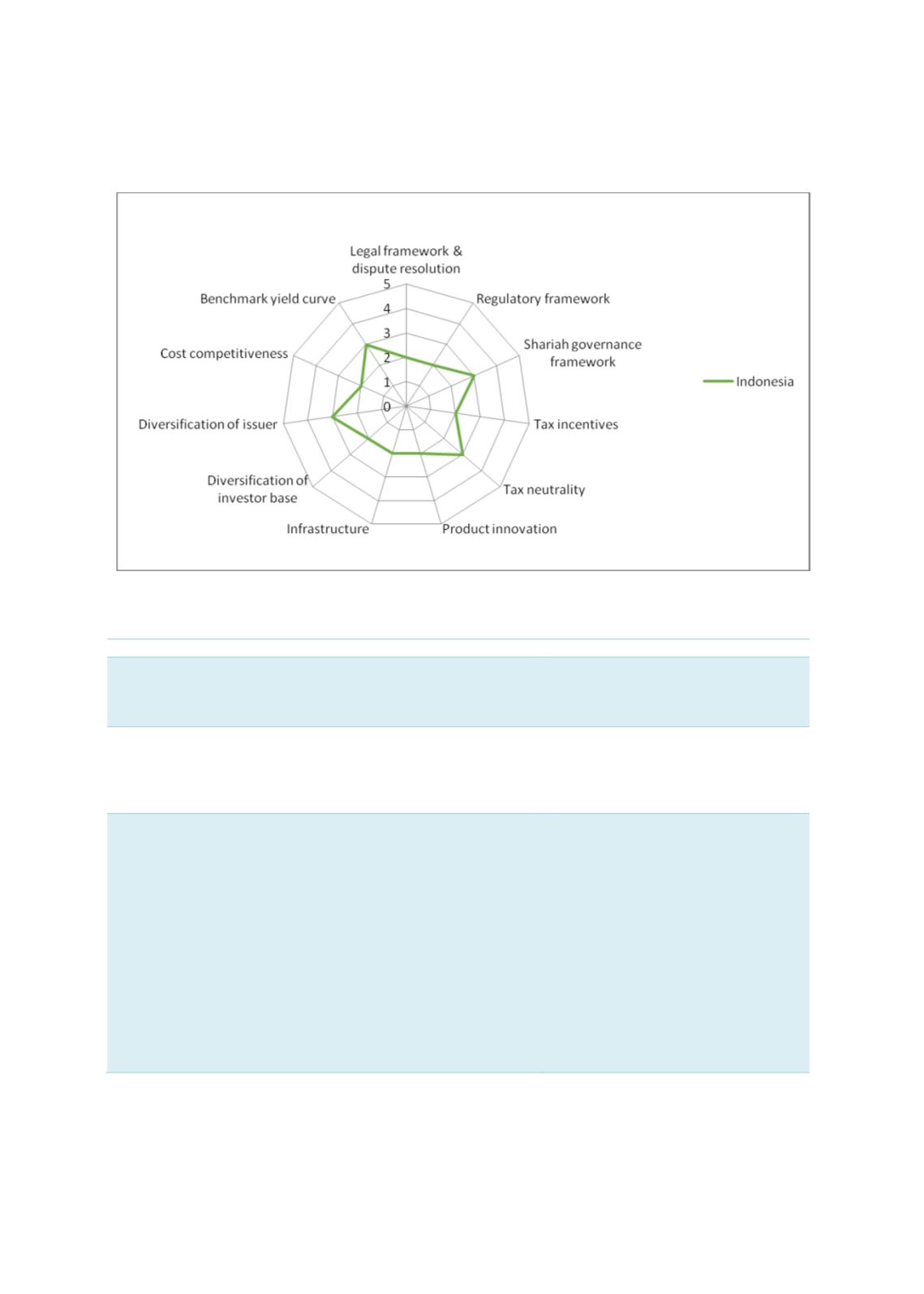

Chart 4.44: Factors Influencing the Development of Indonesia’s Domestic Sukuk Market

Sources: RAM, ISRA

Table 4.16: Recommendations to Improve Demand (Buy Side) – Medium-Term Solutions

Issues and challenges

Demand (buy side) opportunities

The local ICM is very fragmented, with many market

stakeholders that regulate the entire ecosystem.

KNKS’s strategic clout in synergising

the efforts of all market stakeholders

(e.g. MOF, BI, OJK, tax office) will help

strengthen coordination efforts.

Low liquidity intermediation by NBFIs for corporate sukuk

due to a preference for less risky sovereign papers

The OJK’s recommendation to expand

NBFIs’ investment portfolios to include

debt instruments issued by SOEs is a

good start towards encouraging

corporate issuance.

Investors’ lack of appetite to hold long-dated corporate debt

securities

Tenures of corporate sukuk in

Indonesia average between 3 and 5

years. The longest-dated corporate

sukuk had been issued by Perusahaan

Listrik Negara (PLN), with a maturity

of 12 years (Asian Development Bank,

2014).

Regulators and local rating agencies

need to educate domestic investors on

the effectiveness of matching their

assets with long-term, project-based

sukuk. The openness of NBFIs to hold

long-dated papers (> 7 years) will spur

the supply of infrastructure-based

sukuk.