132

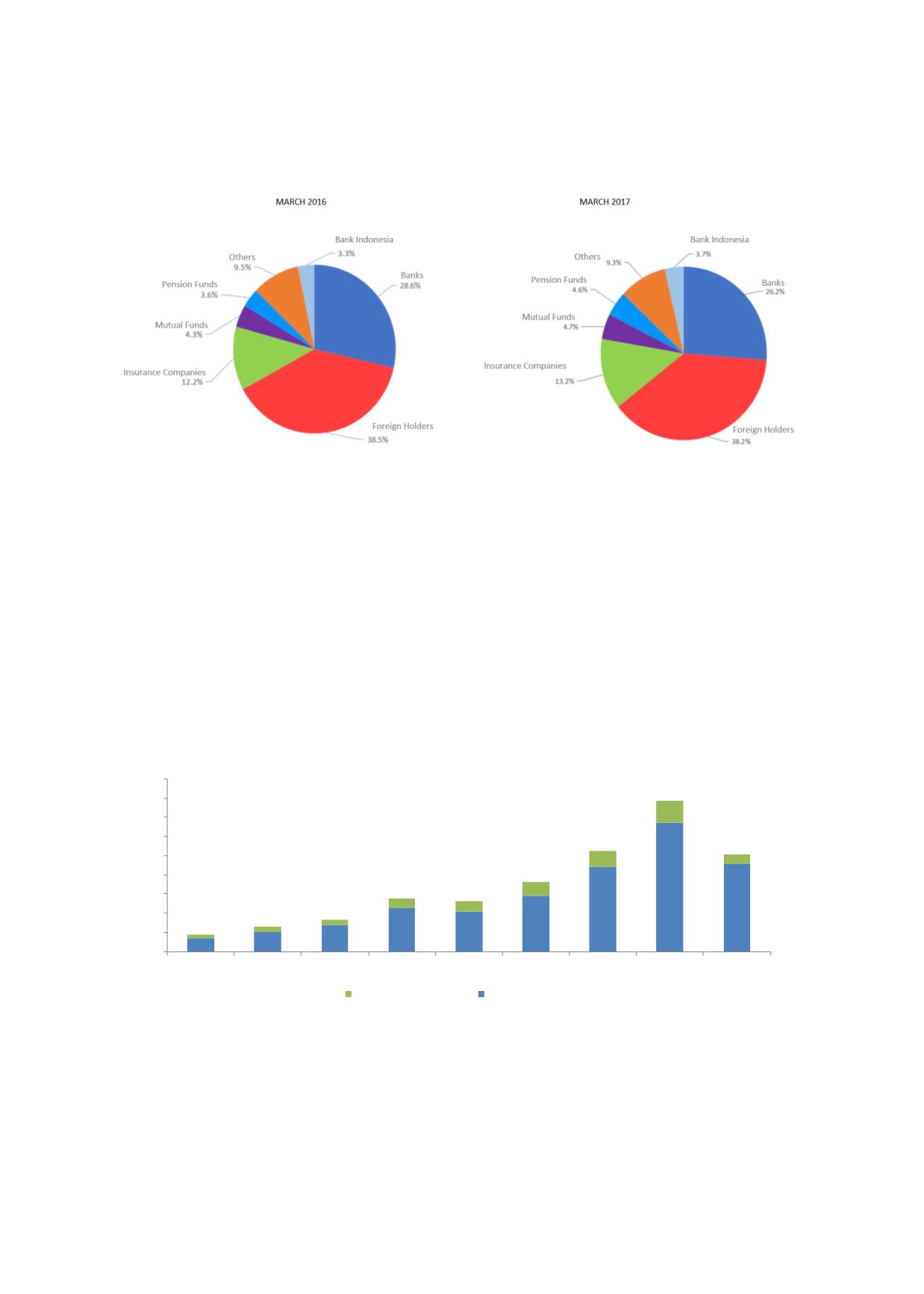

Chart 4.42: Investor Mix for LCY Government Bonds

Source: MOF

To further deepen the domestic investor base, the government has optimised the use of retail

sukuk as a source of financing since 2009. Retail sukuk, which remains significantly untapped

in most countries, increases financial inclusion and can serve as a tool in spreading awareness

on Islamic finance. As at end-June 2017, government retail sukuk accounted for approximately

11.5% of total sovereign sukuk issuance (as shown in Chart 4.43), and has been rising steadily.

Furthermore, the government launched a savings sukuk in 2016, to reach out to lower-income

investors; the sukuk was made available for sale for as low as IDR2.0 million-IDR5.0 million.

This initiative underlines the government’s commitment to product innovation in Islamic

finance and provides investment solutions to lower-income investors, a group which would

otherwise remain largely untapped.

Chart 4.43: Indonesian Retail Sukuk Issuance (2009-June 2017)

0.41

1.05

-

2.00

4.00

6.00

8.00

10.00

12.00

14.00

16.00

18.00

2009

2010

2011

2012

2013

2014

2015

2016 June 2017

S

Retail Sukuk Issuance

Sovereign Sukuk Issuance

Source: MOF