133

4.4.4

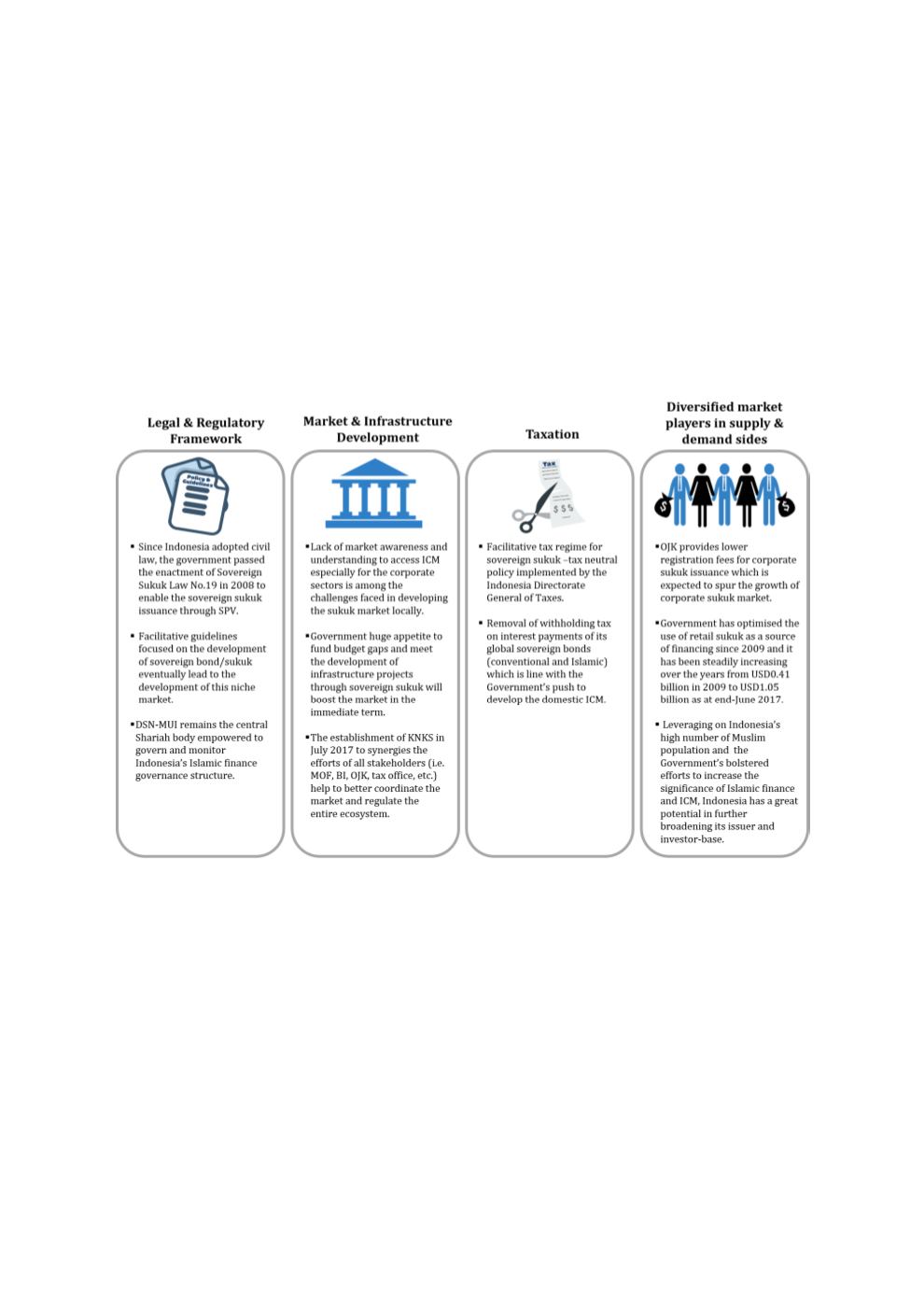

KEY FACTORS UNDERPINNING INDONESIA’S SUKUK MARKET

The development and growth of Indonesia’s sukuk market have been mostly bolstered by

sovereign issuances. On the other hand, the pace of LCY corporate sukuk issuance remains a

challenge which the government and the regulators are trying to address. Therefore, the

government and the regulators are aware of the significance of growing both the sovereign and

corporate bond markets; they have expended the requisite efforts to provide viable stimuli, as

depicted in Figure 4.11. To draw more attention to private sector issuers and boost demand

for sukuk, however, more initiatives and incentives are required.

Figure 4.11: Key Factors Underpinning the Growth of Indonesia’s Sukuk Market

Sources: RAM, ISRA

Indonesia has made strides in developing its sukuk market since Indosat’s (a

telecommunication company) corporate sukuk in 2002. However, Islamic finance in Indonesia

commenced in 1991, with the establishment of Bank Muamalat Indonesia. Figure 4.12

highlights the development phases of Islamic finance in Indonesia, including some insights on

the next stage of advancement.