134

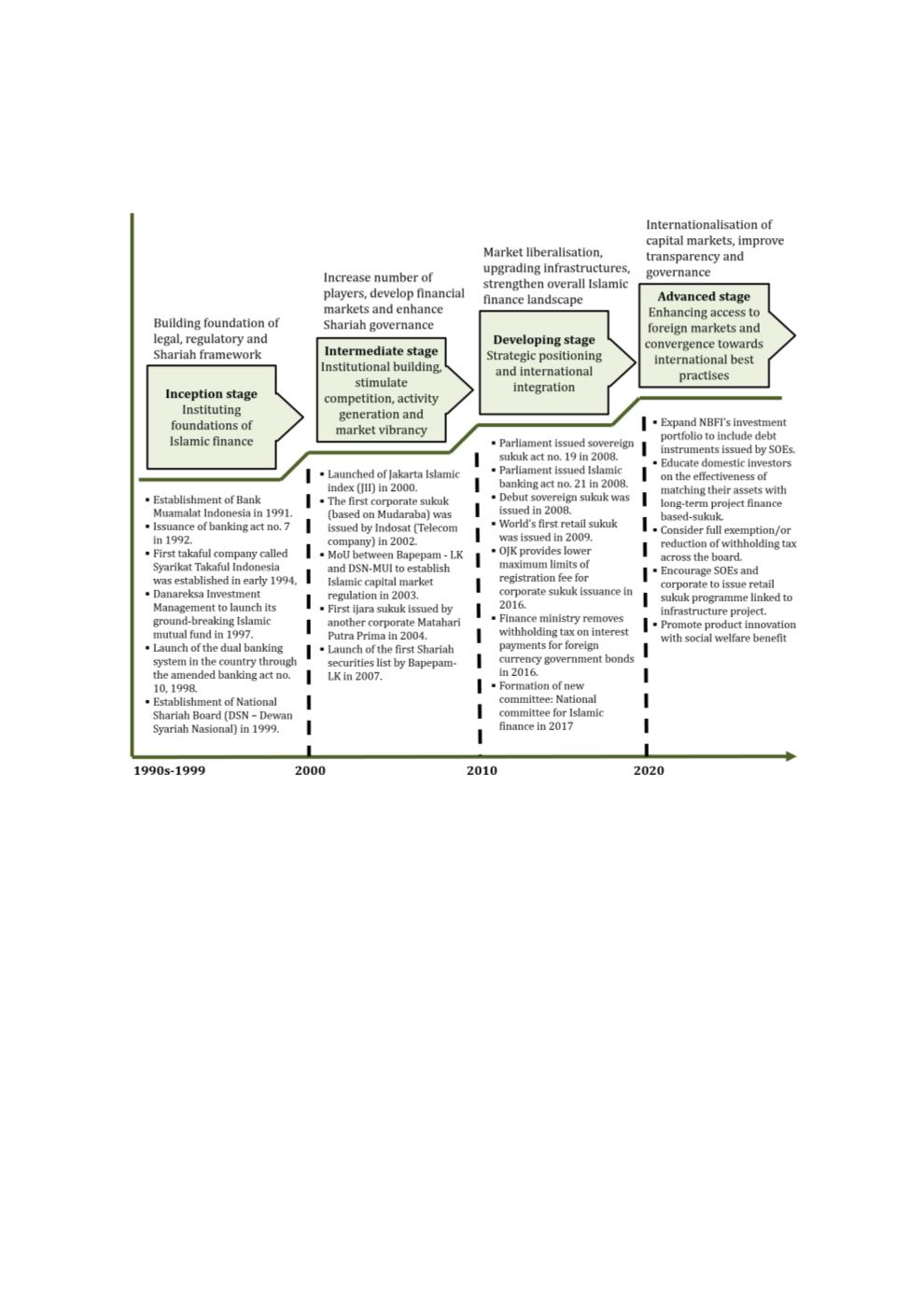

Figure 4.12: Phases of Islamic Finance’s Inclusion in Indonesia’s Financial Landscape

Sources: RAM, ISRA

4.4.5

COUNTRY-SPECIFIC RECOMMENDATIONS

The evolution and improvement of Indonesia’s sukuk market have been driven by several key

factors, as depicted in Chart 4.44. Indonesia has a moderate score in most factors, indicating a

requirement for the further enhancement of each factor in order to boost its sukuk market. In

coming up with the recommendations for Indonesia, we have reviewed the challenges faced by

its sukuk market. Tables 4.16 and 4.17 list the proposals to facilitate the supply of and demand

for sukuk, with a specific focus on the corporate sector.