123

Table 4.13: Indonesia’s Budget Deficits (2014–2017f)

IDR trillion

2014

2015

2016e

2017f

Government revenue

1,550.50

1,508.00

1,555.90

1,750.30

Government expenditure

1,777.20

1,806.50

1,864.30

2,080.50

Budget deficit

(226.70)

(298.50)

(308.40)

(330.20)

Source: MOF

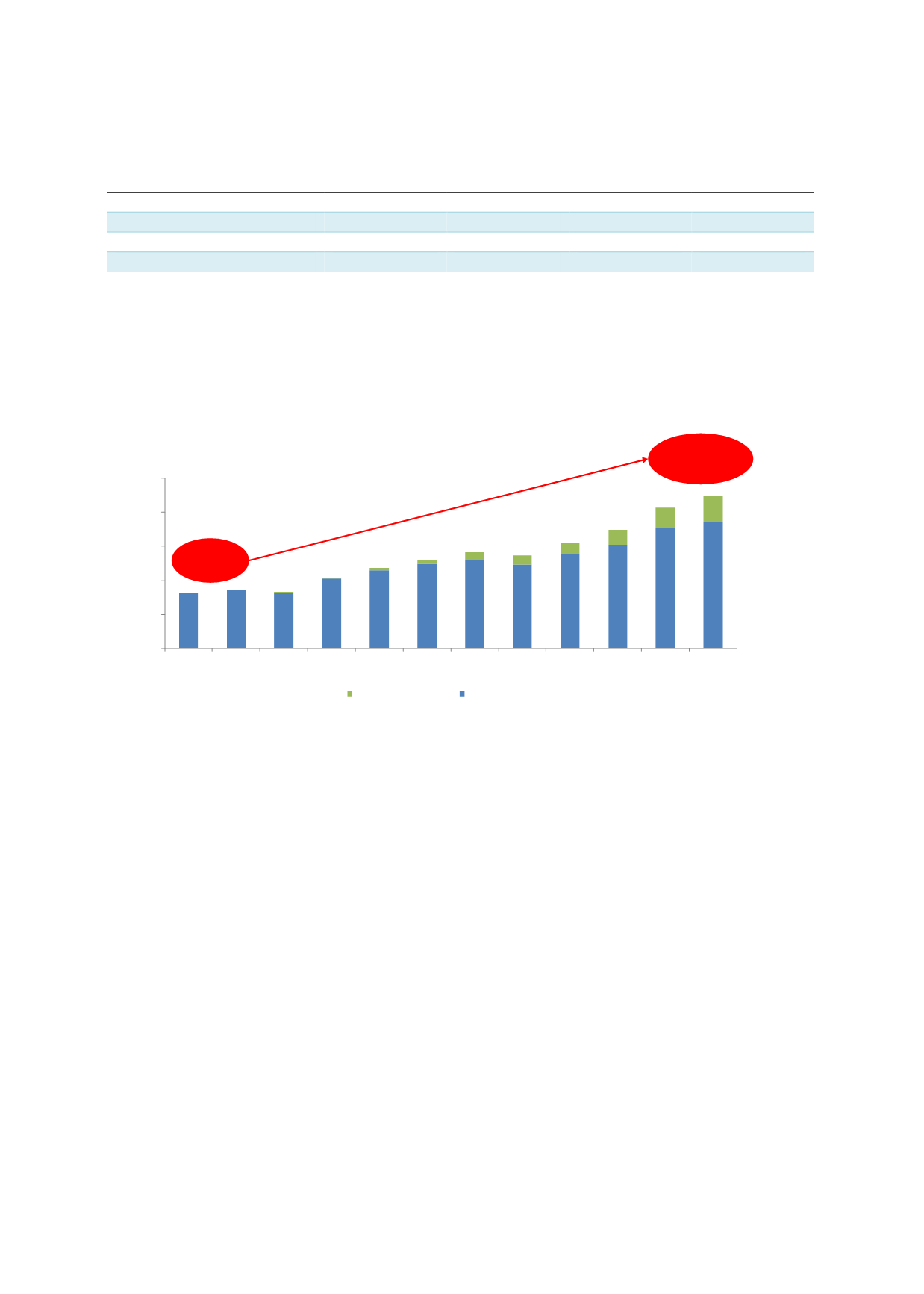

Due to the government’s increasing support for the issuance of Shariah-compliant securities,

the percentage of sovereign sukuk to total public debt had climbed up to 16.8% as at end-June

2017, from 0.4% when it was first launched, as shown in Chart 4.35. This ratio is anticipated to

gradually rise in line with Indonesia’s push to develop its ICM.

Chart 4.35: Indonesia’s Sovereign Sukuk vs Conventional Outstanding (2006-June 2017)

0.00

50.00

100.00

150.00

200.00

250.00

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016 June 2017

USD billion

Sukuk outstanding

Conventional outstanding

USD82.3

billion

USD223.7

billion

0.4

%

16.8

%

Sources: MOF, RAM

Based on our data and analysis, we can conclude that the government is earnestly committed

to increasing sovereign sukuk issuance through the years to finance its medium- and long-term

projects, which will eventually lead to the development of this niche market. Nevertheless,

based on the amount of conventional bond issues by the government, the conventional bond

segment is still far bigger than its sukuk counterpart, which indicates that more effort is

required to ensure that sukuk can reach its full potential as a financing and monetary

instrument in the Indonesian market.

Domestic Market – Private Sector Issuance

Based on historical issuances, the growth of the Indonesian LCY corporate bond market has

lagged behind the LCY sovereign bond market, although there was a pick-up in corporate bond

issuance in 2016. The common reasons cited include the following:

1.

No major difference in terms of cost compared to bank financing, which is faster.

2.

Requirement for issuers to carry investment-grade ratings limits the pool of Indonesian

corporate issuers.